Repossession Letter Sample With Notice Period In Cook

Description

Form popularity

FAQ

Identify yourself and your vehicle. Be sure to include an account number so that your lender can match your letter to your records. Explain that you're unable to make payments and intend to surrender the car. Provide contact information so that your lender can reach you.

If the repo company can't repossess the car without breaching the peace, then the lender can go to court and go through the replevin process. The lender is basically taking you to court to make you hand over the car. If you lose the court case, then you have to return the car by the scheduled date.

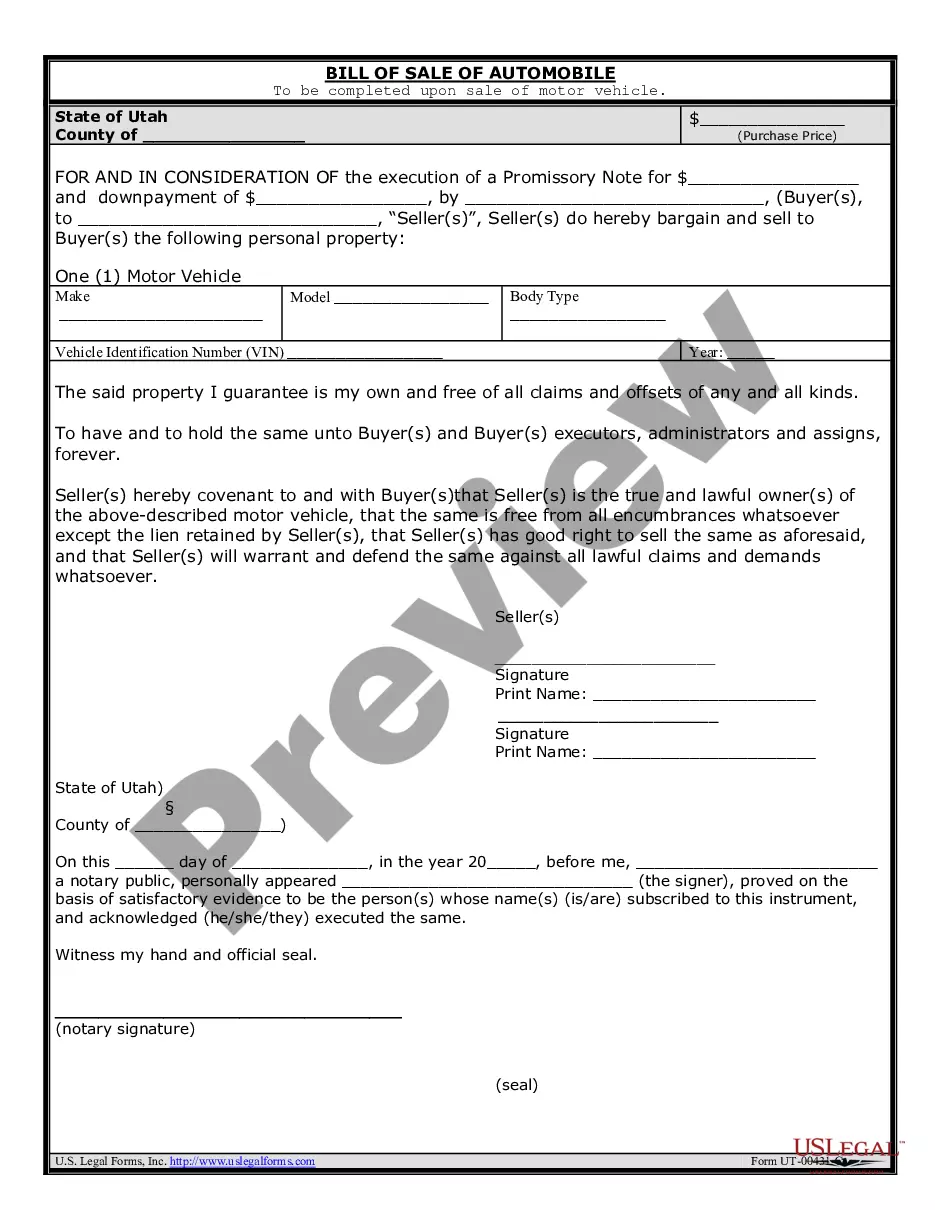

You are hereby notified that your description of motor vehicle, year, make, model and VIN #, was lawfully repossessed on Date because you defaulted on your loan with Credit Union Name. The vehicle is being held at location address of vehicle. be sold at public sale. A sale could include a lease or license.

More Definitions of Repossession Notice Repossession Notice means a written warning notice identifying your default. If this default is not remedied within 15 days of the notice, we will have the right to reposes the Goods from you.

Dear Borrower Name: You are hereby notified that your description of motor vehicle, year, make, model and VIN #, was lawfully repossessed on Date because you defaulted on your loan with Credit Union Name. The vehicle is being held at location address of vehicle. be sold at public sale.

Know the Repo Laws of Your State. The first thing to know about how to repo a car is you need to be aware of how repo laws stand within the jurisdictions where you will conduct business. Make Sure the Debtor Is in Default. Locate and Verify the Car. Choose the Method to Repossess. Do Not Breach the Peace.

You can also use websites like Carfax, Auto Trader, Buy It Now, eBay and CarsDirect. All these websites provide information about repossessed cars.

Repossession happens when a lender takes back a car because the borrower has fallen behind on payments. Repo agents use personal details, social media, and tools like GPS trackers and license plate scanners to find vehicles.

Although court judgments no longer appear on credit reports or factor into credit scores, they're still part of the public record. If a lender looks up your public records, this could make it harder to qualify for future loans.

Start the letter by identifying yourself and the property. The lender will need to identify your loan, so include an account number. Give them your name, address and contact information. Tell the lender that you are voluntarily giving the item back because you can no longer make the payments.