Replevin Repossession In Contra Costa

Description

Form popularity

FAQ

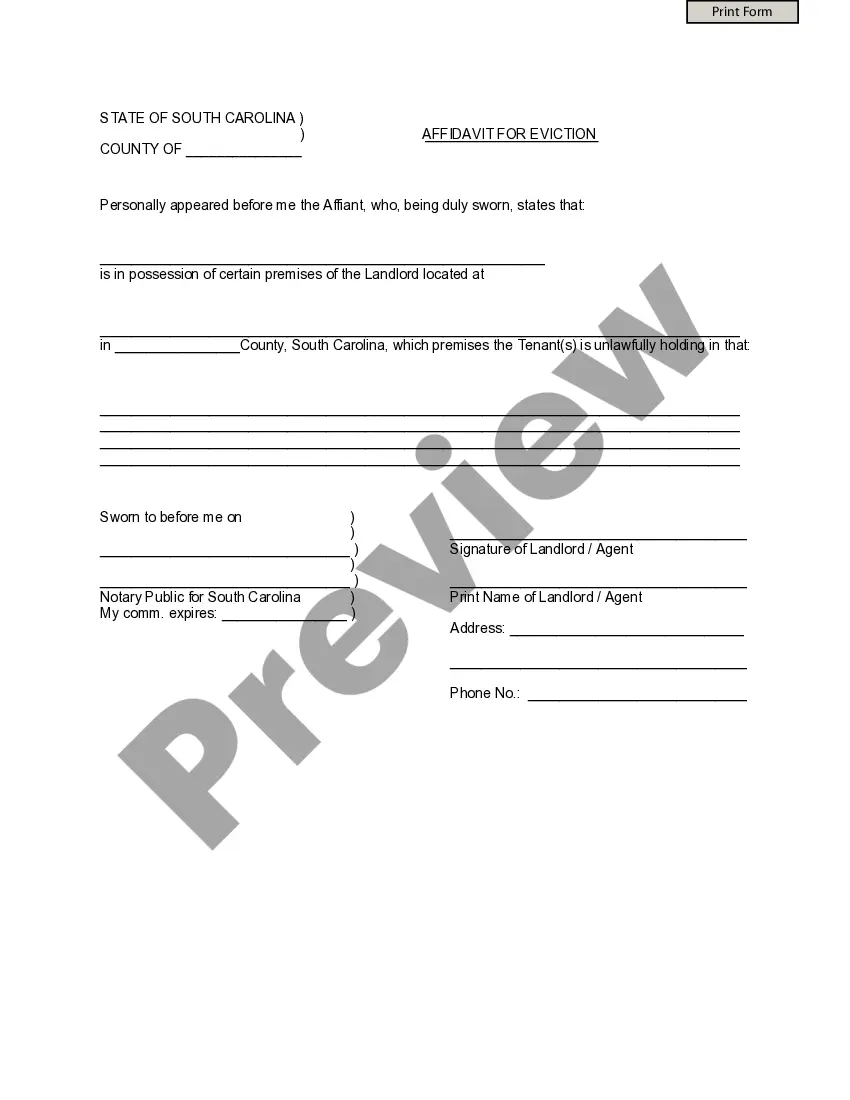

The process of starting a replevin action usually begins with filing a complaint. It also requires filing an affidavit in the county or district court where the property is. The affidavit: States that the plaintiff claims rightful ownership or entitlement to possession of the property.

In its simplest terms, replevin is a procedure whereby seized goods are restored to their owner (creditor) at the beginning of a lawsuit. If you ever find yourself in the unfortunate position of needing to retrieve vehicles, equipment, or any personal property in California, the replevin is a very useful tool.

The process of starting a replevin action usually begins with filing a complaint. It also requires filing an affidavit in the county or district court where the property is. The affidavit: States that the plaintiff claims rightful ownership or entitlement to possession of the property.

A writ of replevin is a prejudgment process ordering the seizure or attachment of alleged illegally taken or wrongfully withheld property to be held in the U.S. Marshal's custody or that of another designated official, under order and supervision of the court, until the court determines otherwise.

The Complaint: The complaint in replevin typically must include: (i) a description of the property to be replevied; (ii) its value; (iii) its location if known; and (iv) the material facts upon which the claim is based – in other words, why the filing party is entitled to seize the property that has been taken.

Banks and loan companies don't want a vehicle to go to repossession - they will take a loss on it if it does. So they want to work with you on payments first. Typically you have to be behind on payments - as In not paying at all - for some time before the unit goes to repo. That depends on a few things though.

That means you are liable for the entire balance, plus interest and late fees. It would be up to the bank whether to reinstate that loan. As part of that process, they are certainly going to ask for information from you that will enable them to learn where you are repossess the car.

If your lender can't locate your vehicle to do a "self-help" repossession, they can still sue you for the vehicle. This will involve a small claims case, where the judge will order you to give the car to the lender. You might even be compelled to Court to provide testimony about the location of the vehicle.

In California, you may have the right to "redeem" or "reinstate" your vehicle, which involves paying off the remaining contract balance, fees, and complying with legal requirements.

This means that: You are stuck with it – if the lender doesn't come to pick up the car. You can't sell it – because the lender still has the lien, and selling it would be committing a theft. You must keep it – you can't junk it or give it away either.