Complaint Repossession Document With Lien In California

Description

Form popularity

FAQ

You can also use websites like Carfax, Auto Trader, Buy It Now, eBay and CarsDirect. All these websites provide information about repossessed cars.

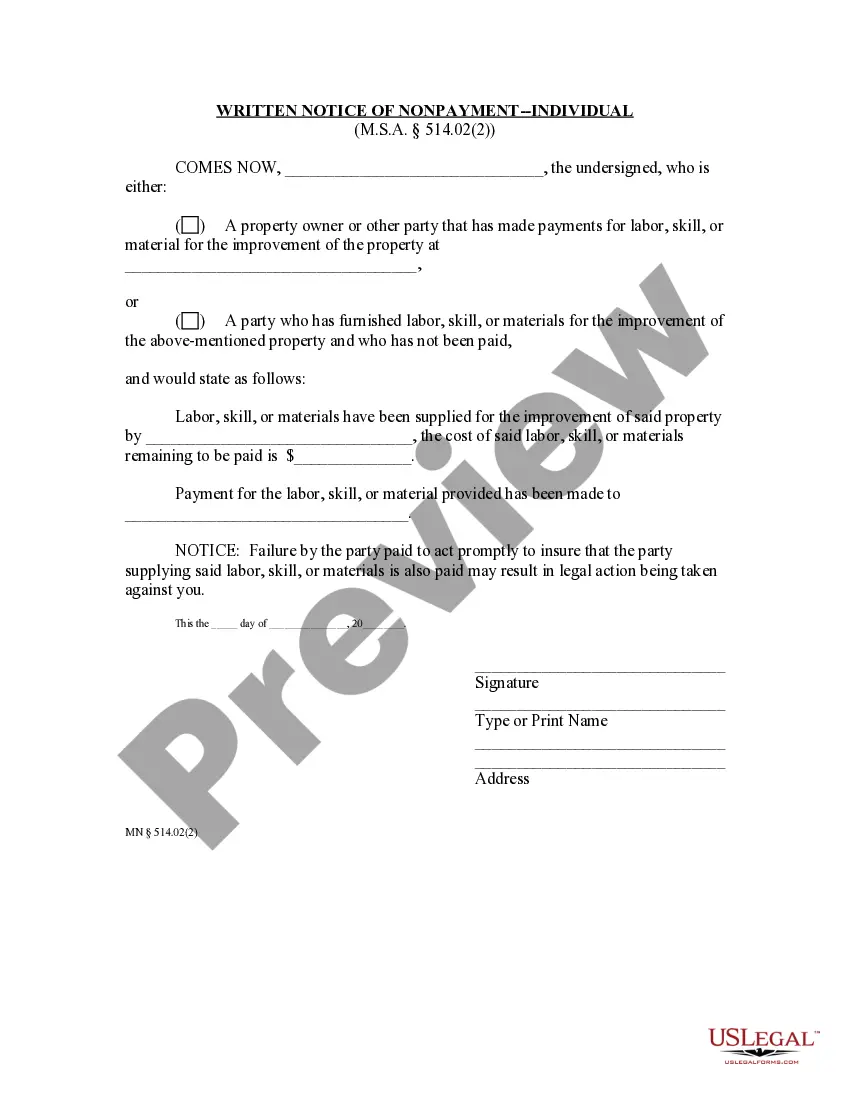

Lien Release: After a lien has been filed, the California claimant can release or cancel the lien by filing a Mechanics Lien Release form with the county recorder's office where the lien was originally recorded.

Look up the vehicle identification number (VIN) with your state's DMV. If there is a lienholder listed on the title, the DMV will be able to tell you. A title search will also give you information on liens. The National Motor Vehicle Title Information System is a good starting point for finding lienholder information.

You have to request lien release documentation from your bank or whoever you had the loan through. You will then take that paperwork to the DMV and they will file it for you and remove the lien.

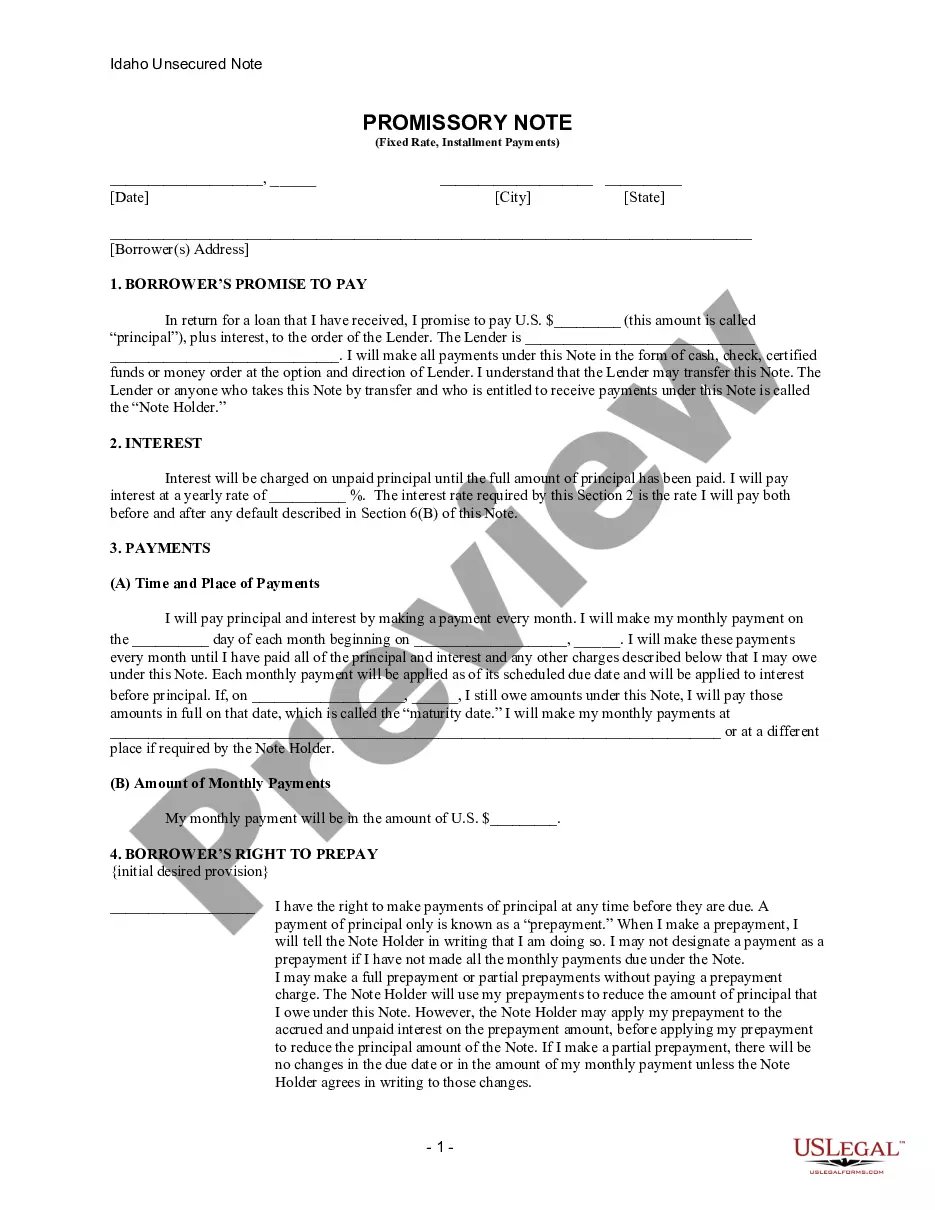

Written contracts on auto loans have a four-year limitation in California, but only if the lender attempts to sue you in court. Actual repossession of a vehicle, which doesn't require a lawsuit to begin with, can happen at any time during which you have an active lien on the account.

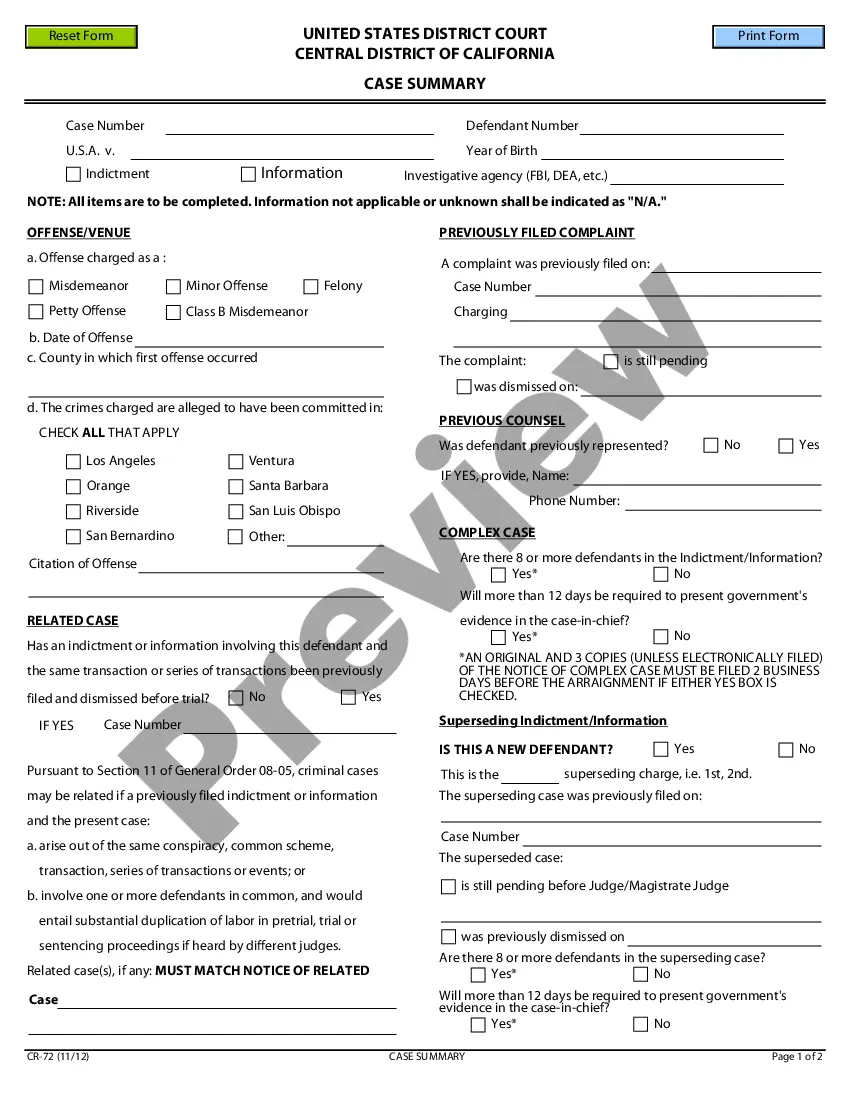

Evidence Can Prove a Wrongful Repossession Case From detailed written statements to visual documentation of property damage, illegal access, and proof of timely payments, the types of evidence required may vary depending on the circumstances.

You are hereby notified that your description of motor vehicle, year, make, model and VIN #, was lawfully repossessed on Date because you defaulted on your loan with Credit Union Name. The vehicle is being held at location address of vehicle. be sold at public sale. A sale could include a lease or license.

Dispute Inaccurate Information Initiate a formal dispute with all necessary credit reporting agencies (CRAs) that issued the report containing the repossession. You can dispute a repossession online with all three credit reporting agencies, and this is the most efficient way to pursue removal: Experian. Equifax.

Wrongful repossession can have long-lasting effects on your reputation and creditworthiness. A repossession record on your credit report can negatively impact your credit score, making it difficult to secure loans, obtain favorable interest rates, or even find suitable housing in the future.