Complaint For Declaratory Judgment Insurance Coverage In North Carolina

Description

Form popularity

FAQ

Assistance or File a Complaint The North Carolina Department of Insurance pledges to seek fair treatment of all parties in insurance transactions. We are here to serve you. We can always be reached at 855-408-1212.

Assistance or File a Complaint The North Carolina Department of Insurance pledges to seek fair treatment of all parties in insurance transactions. We are here to serve you. We can always be reached at 855-408-1212.

Commissioner of Insurance Mike Causey Commissioner Mike Causey's goal as commissioner is to fight for more competition in the industry and to combat insurance fraud to drive rates lower for the North Carolina consumer.

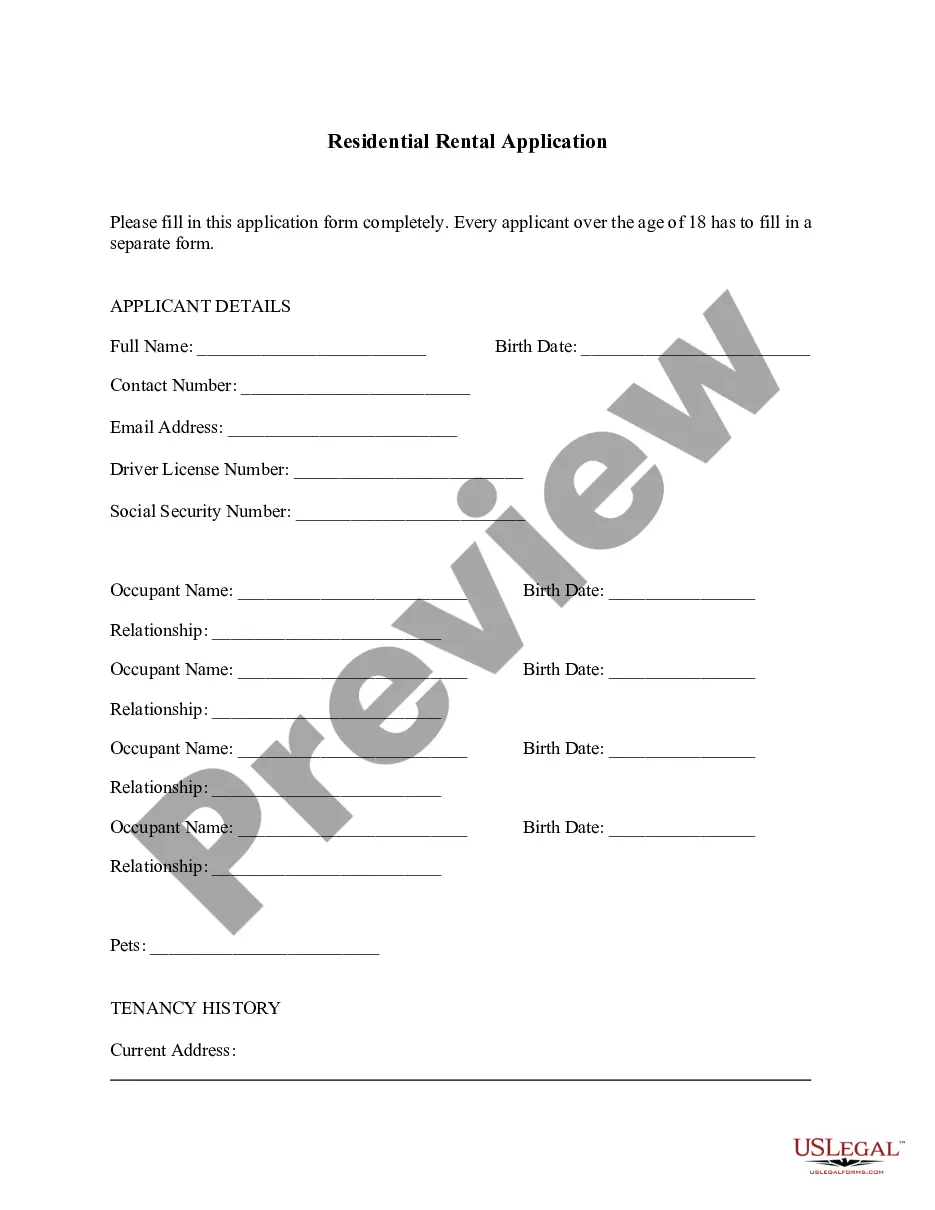

Customers or clients may file a complaint using the NC DSS Civil Rights Complaint Form. Please fill out the form and provide a copy to the local county DSS Title VI Compliance Officer. To protect your rights you must file a complaint within 180 days of the date you believe you or someone else was treated unfairly.

Introduction. Insurance is regulated by the states. This system of regulation stems from the McCarran-Ferguson Act of 1945, which describes state regulation and taxation of the industry as being in “the public interest” and clearly gives it preeminence over federal law. Each state has its own set of statutes and rules.

Among its duties, the North Carolina Department of Insurance: Regulates the insurance industry. Handles insurance-related complaints. Licenses insurance agents, adjusters, bail bondsmen and more.

The United States Congress responded almost immediately: in 1945, Congress passed the McCarran-Ferguson Act. The McCarran-Ferguson Act specifically provides that the regulation of the business of insurance by the state governments is in the public interest.

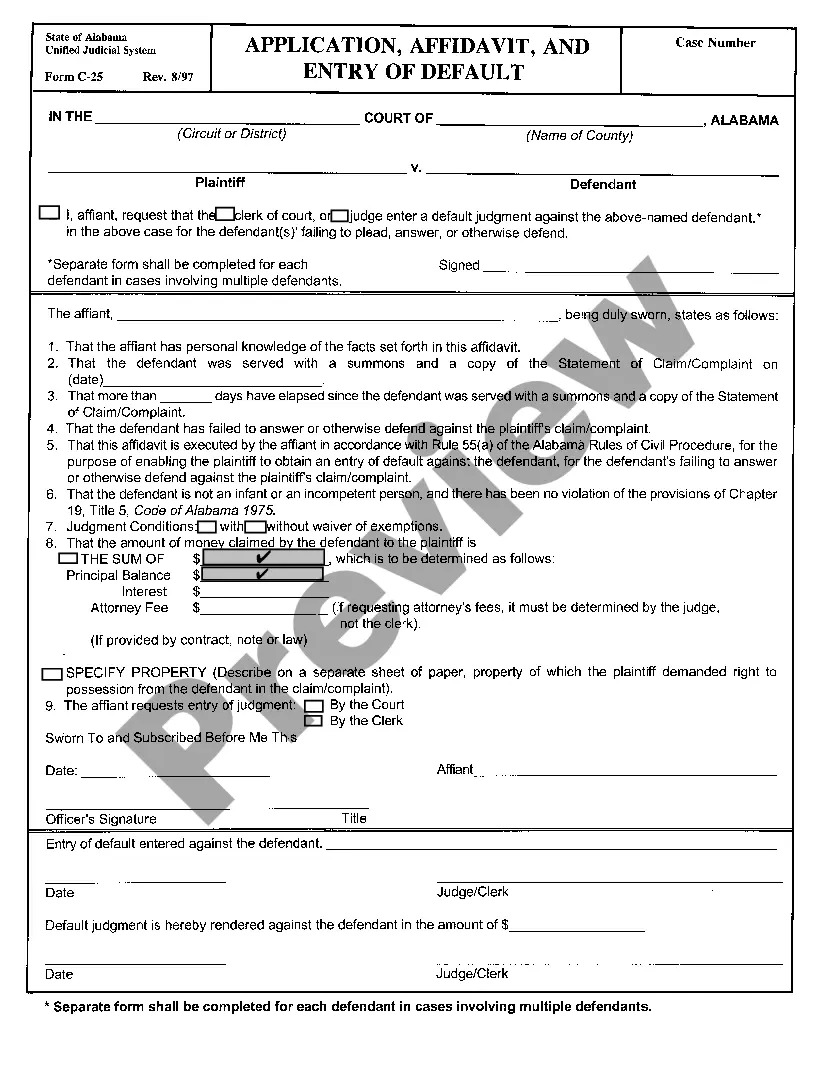

Example of Declaratory Judgment For example, a policyholder believes that their denied claim is unjust. As a result, they inform the insurer that they are considering a lawsuit to recover losses. The insurer seeks a declaratory judgment to clarify its rights and obligations with hopes of preventing the lawsuit.

A declaratory judgment is a ruling of the court to clarify something (usually a contract provision) that is in dispute. A summary judgment is a ruling that a case or portion of a case must be dismissed because there are no triable issues of material fact in dispute.

A declaratory judgment is a binding judgment from a court defining the legal relationship between parties and their rights in a matter before the court. When there is uncertainty as to the legal obligations or rights between two parties, a declaratory judgment offers an immediate means to resolve this uncertainty.