Angel Investment Form With Ai In Los Angeles

Description

Form popularity

FAQ

You can start by exploring online investor directories like AngelList and EquityNet. They provide comprehensive lists of all the accredited investors in the area.

To be an angel, you need to qualify as an accredited investor, defined by the SEC as $1 million of net worth or annual income over $200,000. (I'm simplifying – the real definition is a bit more complex – but it gives you the idea.) You don't have to own a professional sports team, or pass an exam.

Yes- angel investing is a risky asset class. Individual angel investors are advised to invest no more that five to eight percent of their entire net worth into this asset class. On average, over fifty percent of all start-ups fail to return capital.

The tax laws that govern non-profits (such as pension funds) that often invest in VC funds make it difficult for those funds to invest in LLCs. Professional investors also generally want to see you giving stock options to employees which is much easier to do with a C-corporation (more about that below).

Start an investment firm A step by step guide Why Start an Investment Firm? Step One Determine the Type of Investment Firm You Want to Start. Step Two Choose Your Business Structure. Step Three Develop Your Investment Philosophy. Step Four Create Your Business Plan. Step Five Raise Capital.

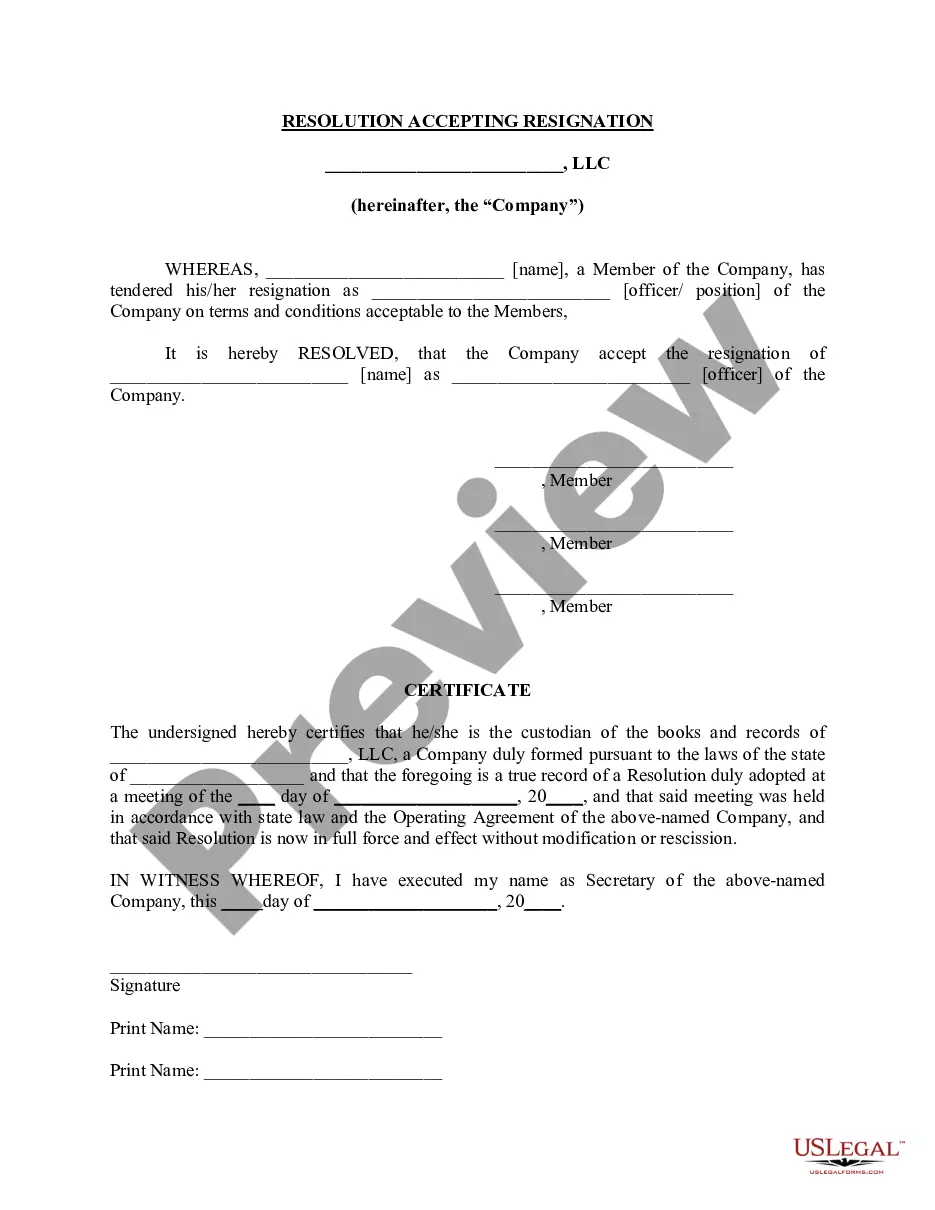

Some angel investors choose to invest through LLCs rather than as individuals. Generally, passively investing through an LLC rather than as an individual offers no tax advantages.

Different LLCs can have very different fundraising needs, and there are many different options and types of investors for raising capital that an LLC's members can consider. You can consult with a legal or financial advisor for more context on what types of funding might be most appropriate for your LLC.

Money you invest as an angel investor is not tax deductible like a charitable gift. It's more complicated. However, since we wrote this piece in late 2021, there have been several states that have come out with “angel tax credits” - which means that there may be state level tax opportunities.

Some angel investors choose to invest through LLCs rather than as individuals. Generally, passively investing through an LLC rather than as an individual offers no tax advantages.