Investor Term Sheet Template For Lease In Clark

Description

Form popularity

FAQ

Whereas the term sheet is the starting point, the investment agreement is sort of the final step. The investment agreement is the document that sets out the investment details. It includes the actions required to close the investment and the structure of the investment itself.

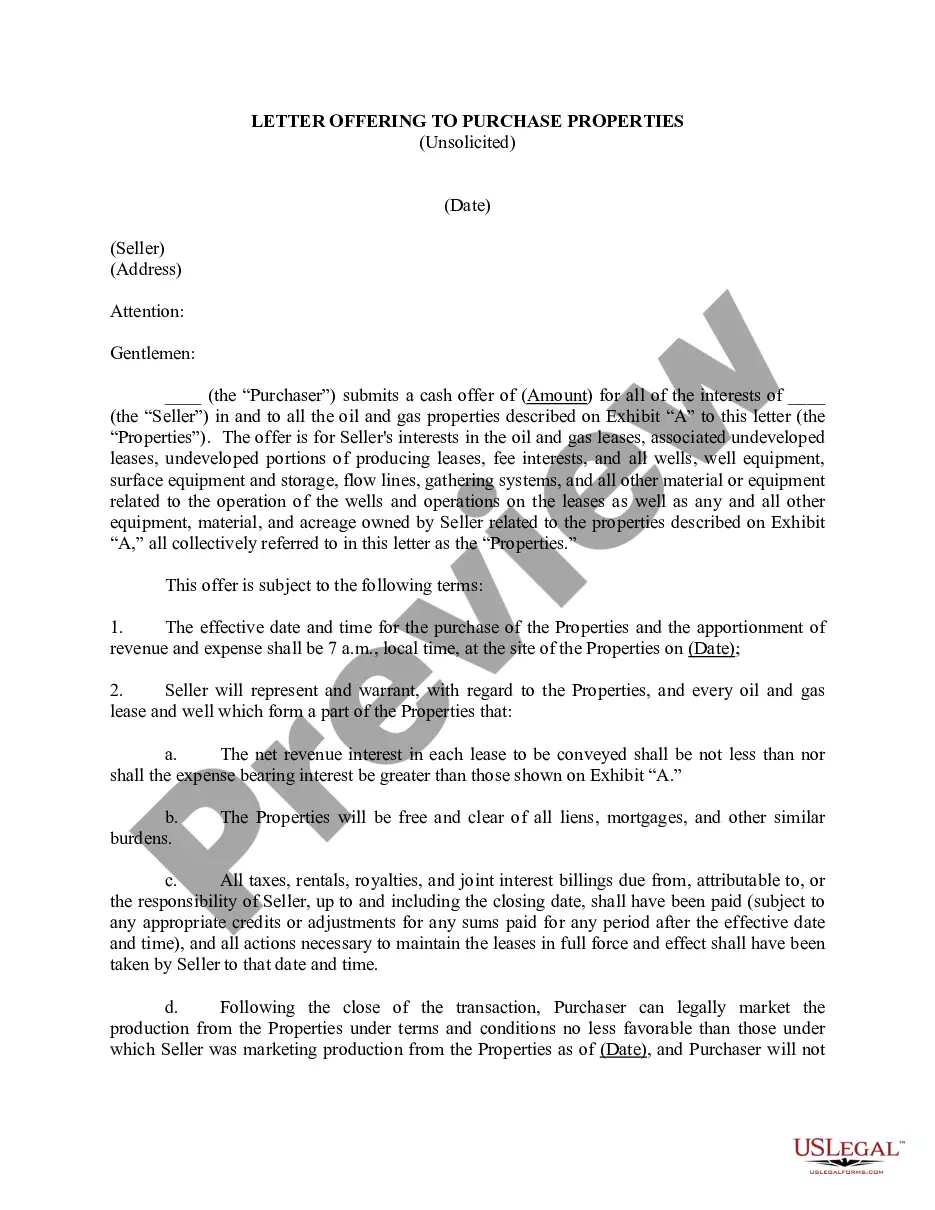

“Term sheets”, “letters of intent”, “memoranda of understanding” and “agreements in principle” may constitute an enforceable agreement if the writing includes all the essential terms of an agreement. This is so even if “the parties intended to negotiate a 'fuller agreement'”.

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

The lease term is the non-cancellable period for which the lessee has agreed to lease the asset from the lessor, together with periods covered by options to extend the lease that the lessee is reasonably certain to exercise, and periods covered by options to terminate the lease that the lessee is reasonably certain not ...

Also known as a letter of intent or memorandum of understanding. A term sheet is a document which sets out certain terms of a transaction agreed in principle between parties, and is typically negotiated and signed at the beginning of a transaction.

In simple terms, a term sheet is a non-binding agreement that outlines the basic terms and conditions of a potential business deal. An agreement, on the other hand, is a legally binding contract that both parties have agreed upon. The purpose of a term sheet is to establish a framework for negotiations.

In as little as 500 words, a VC's term sheet lays out the financial terms of the investment, how much your startup will be worth, who will control it and who will profit the most if the company is sold or goes public. The term sheet is akin to a letter of intent.