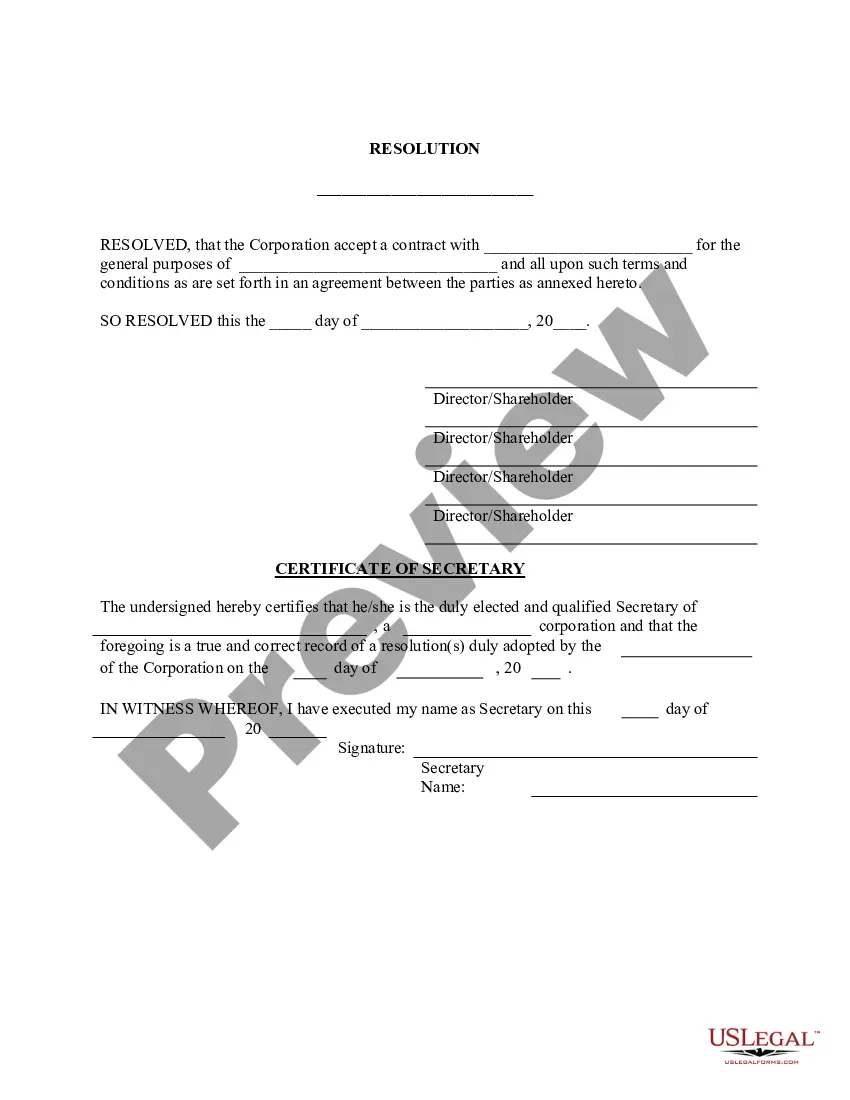

Appointment Resolutions Form In Virginia

Description

Form popularity

FAQ

SALES AND USE TAX CERTIFICATE OF EXEMPTION In order to be deemed a “farmer,” a person must be engaged in the business of producing agricultural products for market. Va. Code § 58.1-609.2 provides that the Virginia retail sales and use tax shall not apply to (check appropriate box):

Applications for real estate tax exemption are taken in the office of the Commissioner of the Revenue, Municipal Center, Building 1, by appointment only from Feb. 1 through June 30. To qualify, individuals must meet income and net worth limitations. The percentage of tax exemption varies based on income level.

A request for a continuance must be made in person on your court date before the judge. If you are unable to appear on the court date, you may file a request for a continuance, in writing, no less than two business days prior to the court date.

How Do I Get My Virginia Contractor License? #1: Get your Virginia contractor business set up. #2: Decide on your Virginia contractor license type. #3: Complete your Virginia contractor pre-license education course. #4: Pass the Virginia contractor exam. #5: Submit your completed application to the DPOR.

How to fill out a Virginia ST-10. Date the form at the top. Name of dealer should be your registered business name. Virginia Account Number should be your registered business number in Virginia. Address should be the registered address of your company.

Every corporation that is incorporated under Virginia law, or that has registered with the State Corporation Commission for the privilege of conducting business in Virginia, or that receives income from Virginia sources, must file a Virginia corporation income tax return (Form 500).

Entities that do not elect the PTET must file Form 502. Each electing PTE must obtain consent from its owners. The election is binding on all the owners once the election is made. An owner does not have the option to opt out of an entity's election.

Publication 502 explains the itemized deduction for medical and dental expenses that you claim on Schedule A (Form 1040), including: What expenses, and whose expenses, you can and cannot include in figuring the deduction. How to treat reimbursements and how to figure the deduction.