Using Debt To Pay Off Debt In Virginia

Description

Form popularity

FAQ

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Virginia Tax Offset is a program where Virginia Tax keeps your state tax refund to offset other bills you have. The agency can seize state tax refunds to cover unpaid state taxes, IRS back taxes, and debts from several different organizations. There is also a federal refund offset program.

In 1983, the General Assembly enacted legislation authorizing State Agencies to set-off the Virginia income tax refunds due individual taxpayers with past due accounts. In addition, Virginia lottery winnings in excess of $600 are also subject to set-off.

When it comes to credit card debt relief, it's important to dispel a common misconception: There are no government-sponsored programs specifically designed to eliminate credit card debt. So, you should be wary of any offers claiming to represent such government initiatives, as they may be misleading or fraudulent.

Virginia does not have a state-sponsored debt relief program. However, there are accredited organizations and programs available to help residents tackle their debt.

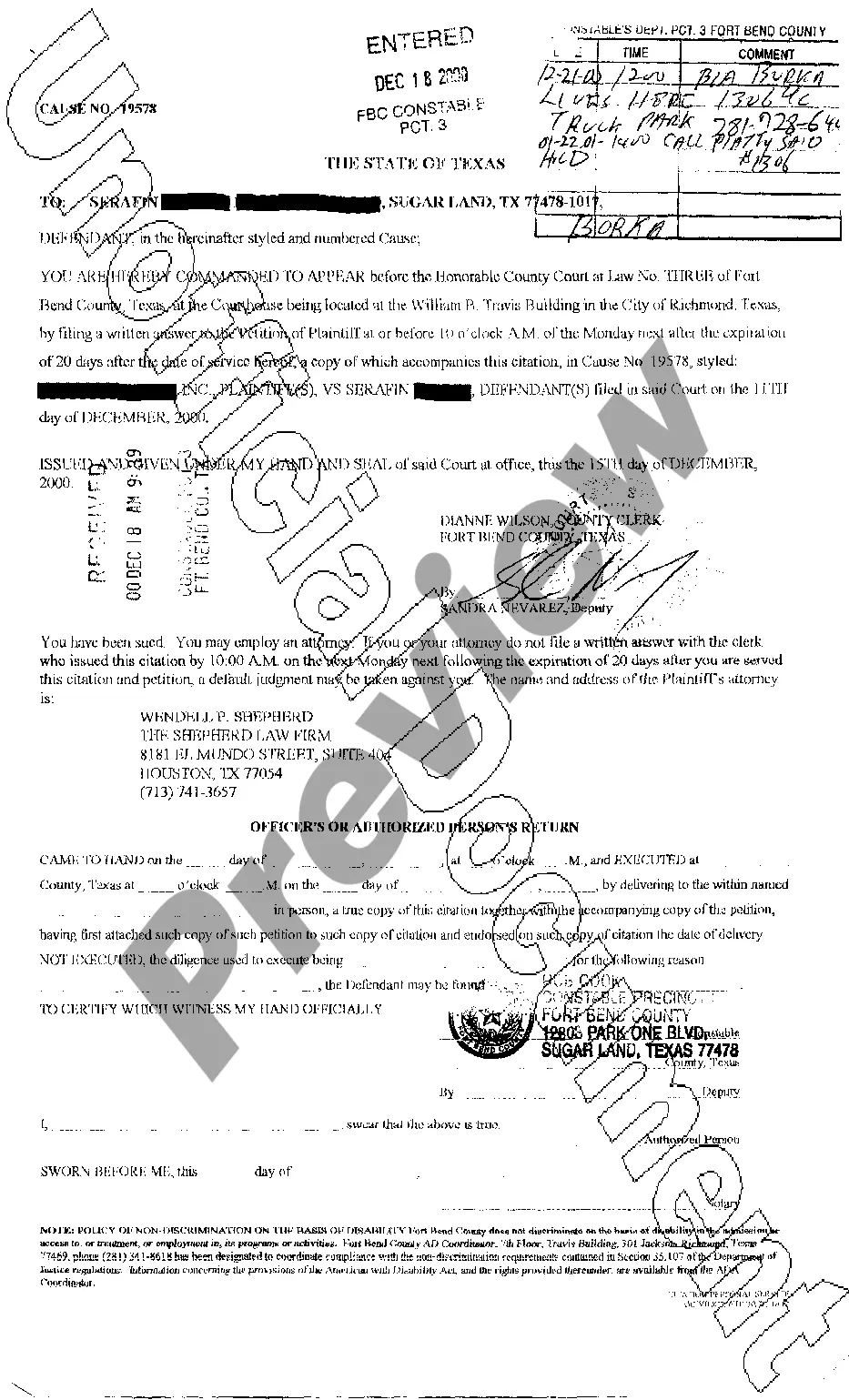

The law of contract governs most consumer-debt claims. Virginia law provides that, in most situations, the statute of limitations for breach of a written contract is five years and of an oral contract, three years.