Spouse Applying For Social Security

Description

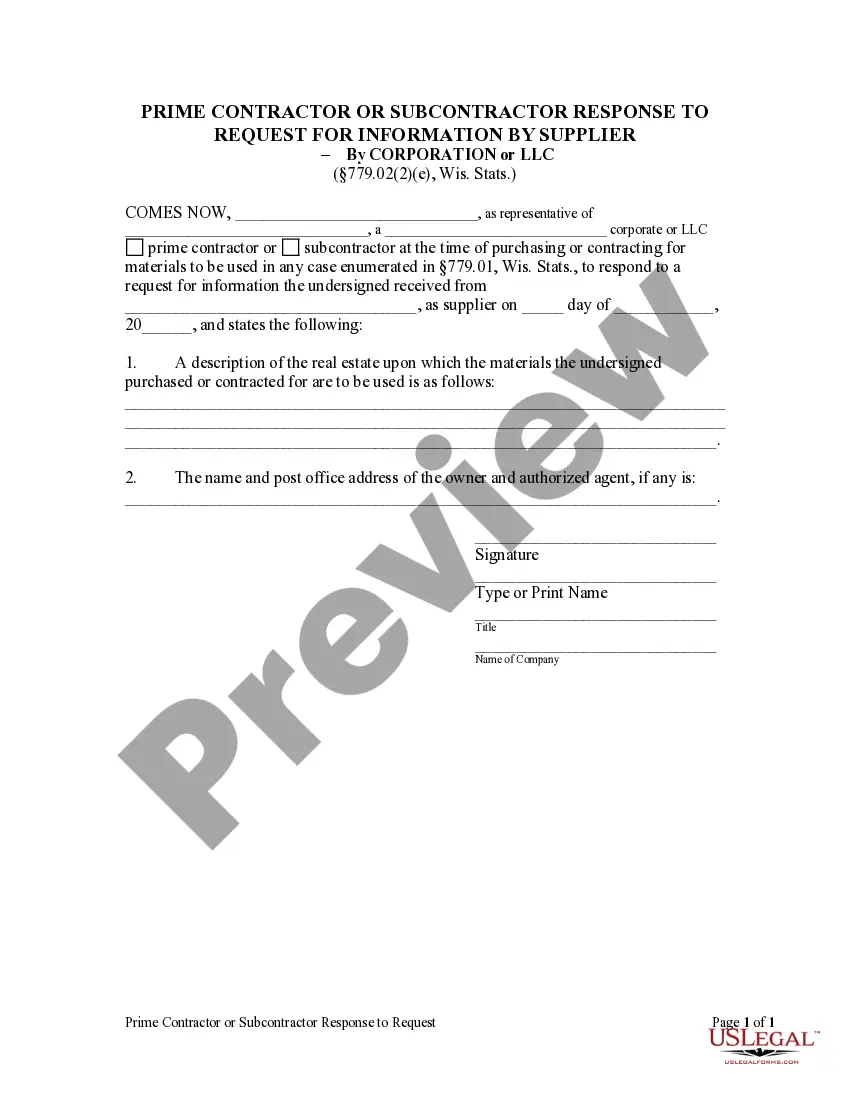

How to fill out Affidavit By Obligor Spouse On Application To Modify Order For Alimony?

The Spouse Applying For Social Security you see on this page is a reusable formal template drafted by professional lawyers in line with federal and regional laws and regulations. For more than 25 years, US Legal Forms has provided people, organizations, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal occasion. It’s the fastest, most straightforward and most reliable way to obtain the paperwork you need, as the service guarantees bank-level data security and anti-malware protection.

Acquiring this Spouse Applying For Social Security will take you just a few simple steps:

- Browse for the document you need and check it. Look through the file you searched and preview it or check the form description to confirm it suits your needs. If it does not, use the search bar to get the appropriate one. Click Buy Now once you have found the template you need.

- Sign up and log in. Opt for the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to continue.

- Get the fillable template. Pick the format you want for your Spouse Applying For Social Security (PDF, DOCX, RTF) and save the sample on your device.

- Fill out and sign the document. Print out the template to complete it manually. Alternatively, use an online multi-functional PDF editor to rapidly and accurately fill out and sign your form with a valid.

- Download your paperwork again. Use the same document again whenever needed. Open the My Forms tab in your profile to redownload any previously downloaded forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

Claiming Benefits From an Ex-Spouse Although the spousal benefit might fly a bit under the radar, a true ?loophole? that is easy to overlook is that even ex-spouses may qualify. That's right, even if you're divorced, you may be able to receive a benefit based on your ex-spouse's work record.

Benefits For Your Spouse Even if they have never worked under Social Security, your spouse may be eligible for benefits if they are at least 62 years of age and you are receiving retirement or disability benefits. Your spouse can also qualify for Medicare at age 65.

For a spouse who is not entitled to benefits on his or her own earnings record, this reduction factor is applied to the base spousal benefit, which is 50 percent of the worker's primary insurance amount.

If you qualify for your own retirement benefit and a spouse's benefit, we always pay your own benefit first. You cannot receive spouse's benefits unless your spouse is receiving his or her retirement benefits (except for divorced spouses).

If your spouse is not receiving any retirement benefits yet, then you could technically take your regular Social Security benefit as early as age 62. When your spouse files for their benefit later you could switch to spousal benefits.