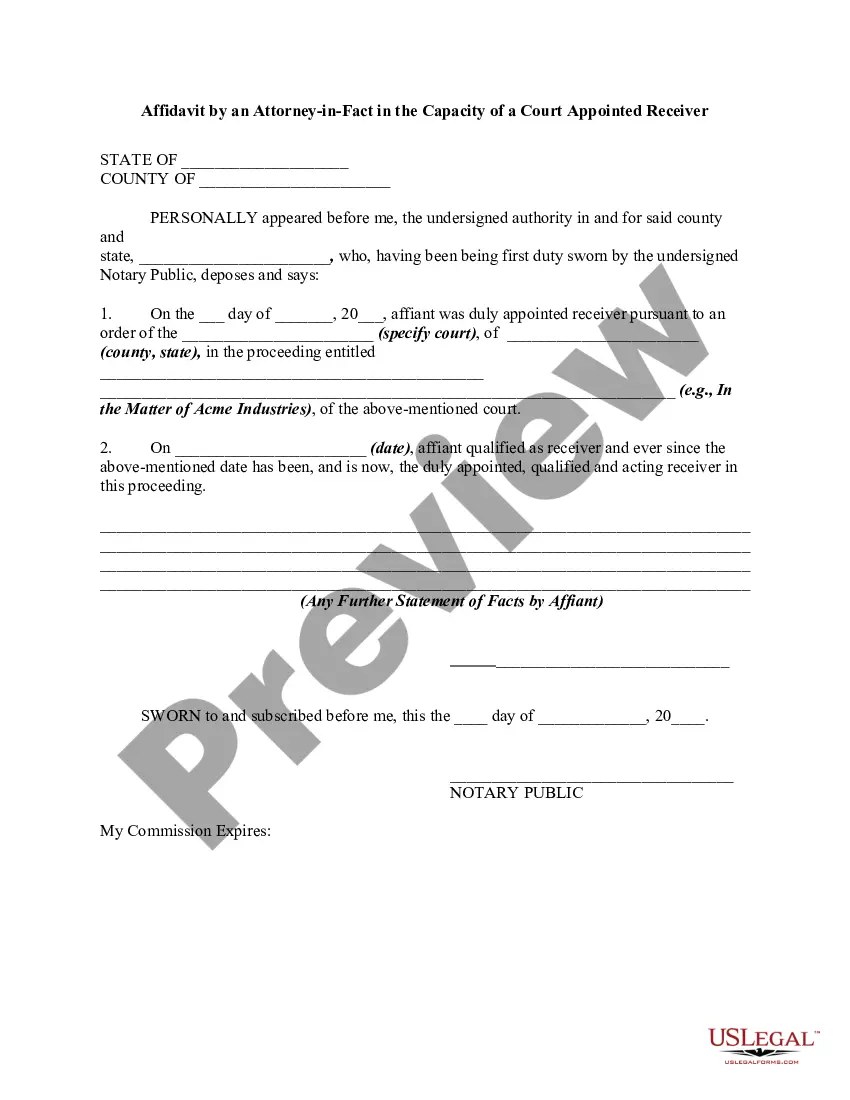

This is a generic Affidavit to accompany a Motion to amend or strike alimony provisions of a divorce decree because of the obligor spouse's changed financial condition. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Examples Of Alimony In Sacramento

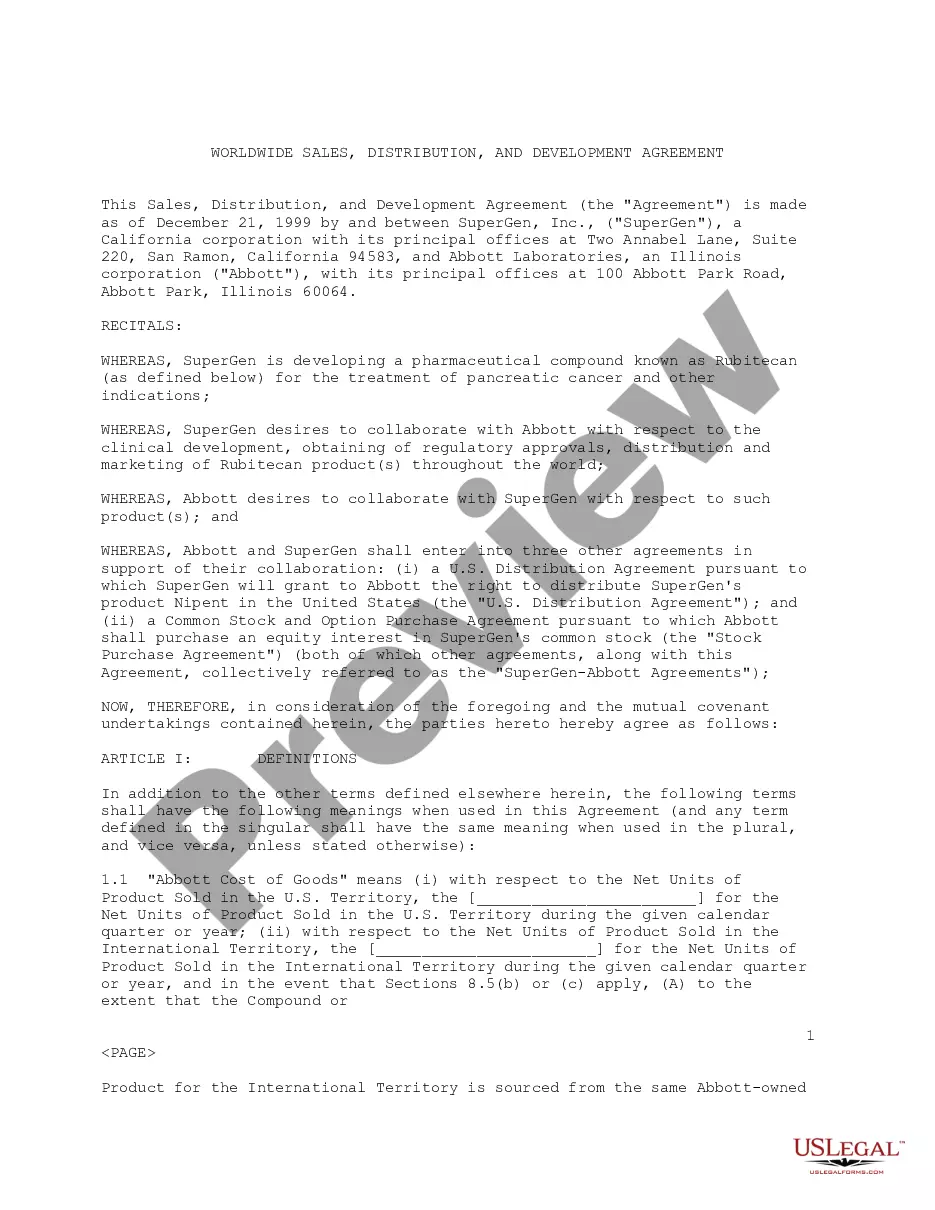

Description

Form popularity

FAQ

40% of the high earner's net monthly income minus 50% of the low earner's net monthly income. For instance, if Spouse A earns $5,000 per month and Spouse B earns $2,500 per month, temporary spousal support might be calculated as follows: 40% of $5,000 = $2,000. 50% of $2,500 = $1,250.

The person asking for alimony must show the court that he or she needs financial support, and that the other spouse has the ability to provide financial support.

Generally, the courts in California award spousal support based on the length of the marriage. In California, spousal support typically lasts half the length of the marriage. If the couple was married for six years, for example, a judge would make a spousal support obligation last for three years.

Misconduct: Certain behaviors can also lead to the disqualification of alimony. For instance, if a spouse is found to have engaged in financial misconduct, such as hiding assets or failing to disclose financial information during the divorce proceedings, this can result in disqualification.

The courts in many California counties use a formula as a guideline for calculating the amount of temporary spousal support. These guidelines vary, but one common formula for the monthly amount of support is 40% of the high earner's net monthly income minus 50% of the low earner's net monthly income.

Since the goal is to protect mutual standards of living, if your ex remarries or finds themselves once again in a steady double-income household, you may no longer be required to maintain or begin alimony payments.

The key factors analyzed in an alimony decision are each spouse's income, ability to earn and standards of living established during the marriage. If there is a history of violence, abuse or certain criminal convictions, however, this could bar a spouse from receiving alimony payments under California law.

There are many considered factors, but the primary factors used to determine spousal support is income and earning capacity. The Court looks at the present income as well as separate property available to the supported party.

40% of the high earner's net monthly income minus 50% of the low earner's net monthly income. For instance, if Spouse A earns $5,000 per month and Spouse B earns $2,500 per month, temporary spousal support might be calculated as follows: 40% of $5,000 = $2,000. 50% of $2,500 = $1,250.

40% of the high earner's net monthly income minus 50% of the low earner's net monthly income. For instance, if Spouse A earns $5,000 per month and Spouse B earns $2,500 per month, temporary spousal support might be calculated as follows: 40% of $5,000 = $2,000. 50% of $2,500 = $1,250.