Affidavit Of Surviving Spouse/dependency With Undertaking Sss Death Benefit In Broward

Description

Form popularity

FAQ

Only about a third of all states have laws specifying that assets owned by the deceased are automatically inherited by the surviving spouse. In the remaining states, the surviving spouse may inherit between one-third and one-half of the assets, with the remainder divided among surviving children, if applicable.

How to fill out the Affidavit of Next of Kin for Medical Records? Review the affidavit carefully before starting. Fill in the decedent's name and details including date of death. Specify your relationship to the decedent. Sign and date the affidavit before a notary public. Submit the completed affidavit as required.

Box indicating your relationship to the decedent. You may select executor administration heir orMoreBox indicating your relationship to the decedent. You may select executor administration heir or survivor. Next enter the full name of the decedent. On this portion mark the appropriate.

Spouses and ex-spouses Payments start at 71.5% of your spouse's benefit and increase the longer you wait to apply. For example, you might get: Over 75% at age 61.

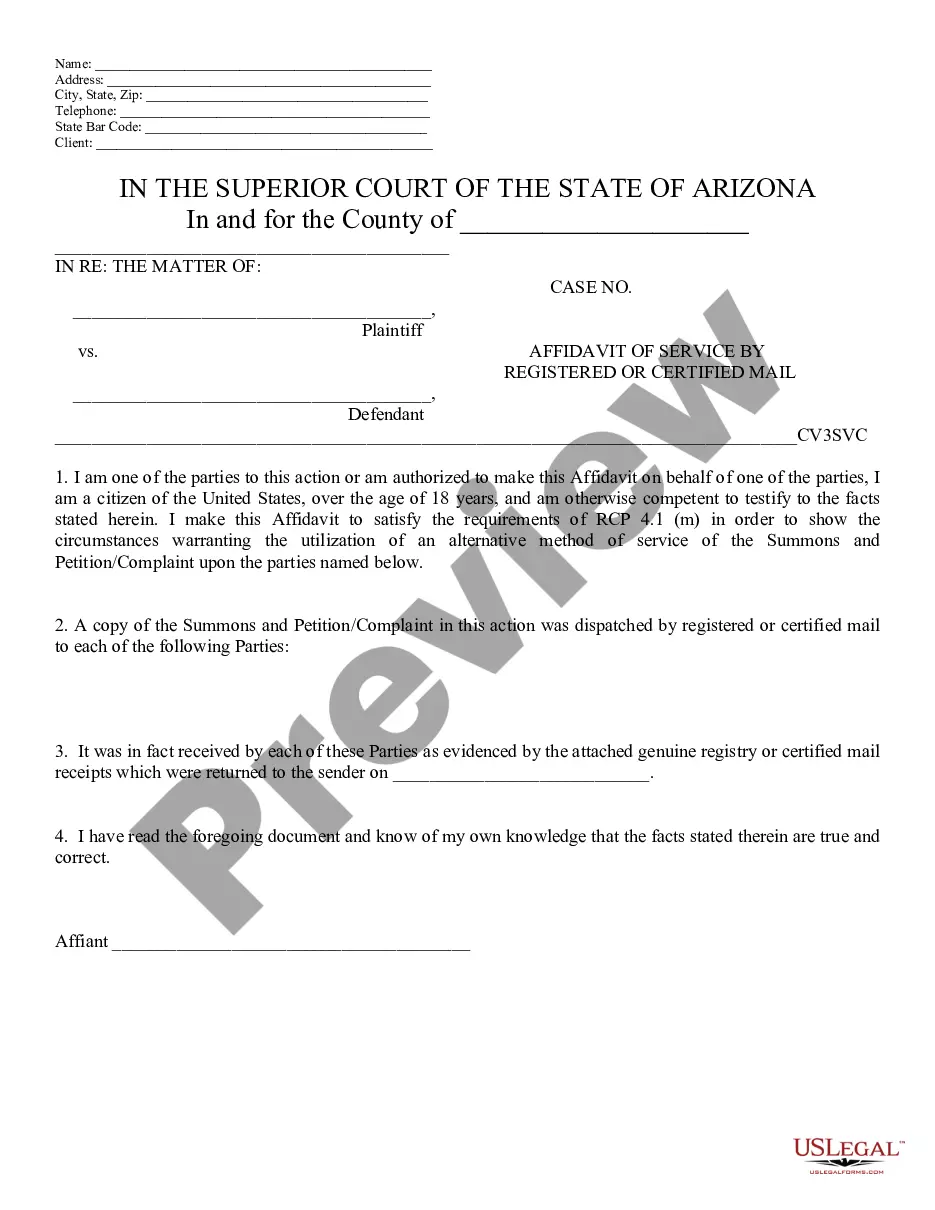

The following are six critical sections that must be included: Title. This is either your name (“Affidavit of Jane Doe”) or the specific case information. Statement of identity. The next paragraph tells the court about yourself. Statement of truth. Statement of facts. Closing statement of truth. Sign and notarize.

Box indicating your relationship to the decedent. You may select executor administration heir orMoreBox indicating your relationship to the decedent. You may select executor administration heir or survivor. Next enter the full name of the decedent. On this portion mark the appropriate.

Proof of death — either from a funeral home or a death certificate. Your SSN, and the deceased worker's SSN. Your birth certificate. Your marriage certificate if you're a surviving spouse.

NAME OF. DECEDENT: DATE OF. DEATH. Name of Former Spouse Date of Death Date of Divorce Place of Death or Place of Divorce If deceased, were they married to Decedent at time of death? Name of Child. Date of. Birth. Name of Adopted Child. Date of. Adoption. Name of Relative. Relationship. Age. Relative(s) Name. Relationship. Age.

Usually, you can't get surviving spouse's benefits if you remarry before age 60 (or age 50 if you have a disability). But remarriage after age 60 (or age 50 if you have a disability) won't prevent you from getting benefit payments based on your former spouse's work.

Military duty status at time of death is not a factor in determining eligibility. $255 has not changed since its inception and is not indexed for inflation. Application is made by calling 1-800-772-1213. (TTY 1-800-325-0778) or by visiting your local Social Security office.