This is a generic Affidavit to accompany a Motion to amend or strike alimony provisions of a divorce decree because of cohabitation by dependent spouse. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Affidavit Amend Form With Decimals In Utah

Description

Form popularity

FAQ

Report Utah withholding tax from the following forms: Federal form W-2, Wage and Tax Statement. Federal form 1099 (with Utah withholding), including 1099-R, 1099-MISC, 1099-G, etc.

A nonresident is required to file a Colorado income tax return if they: are required to file a federal income tax return, and. had taxable Colorado-sourced income.

File your Utah taxes at tap.utah. If filing on paper, mail your return to the address on page 1. TC-40 page 3, TC-40A, TC-40B, TC-40S, and TC-40W (all that apply). An explanation for any equitable adjustment entered on TC-40A, Part 2, code 79.

Amended Returns - Utah supports electronic filing for Amended Returns. There is no separate form for an amended return. The Taxpayer should check in the header of Form TC-40 that the return is an Amended Return. After marking the return as an amended return, be sure to select one of the reason codes for the amendment.

Use TC-40B to calculate the Utah tax for a nonresident or a part-year resident.

A taxpayer who files their income tax return and has a balance due of $1,000 or more may be assessed a penalty for underpayment of estimated tax. The penalty is computed by multiplying the current interest rate for underpayments by the amount of underpaid tax.

File your Utah taxes at tap.utah. If filing on paper, mail your return to the address on page 1. TC-40 page 3, TC-40A, TC-40B, TC-40S, and TC-40W (all that apply). An explanation for any equitable adjustment entered on TC-40A, Part 2, code 79.

To submit the Utah Corporation Franchise Tax Return, you can send it by mail to the Utah State Tax Commission at 210 North 1950 West, Salt Lake City, UT 84134-2000. You may also submit the tax return electronically through approved e-filing services.

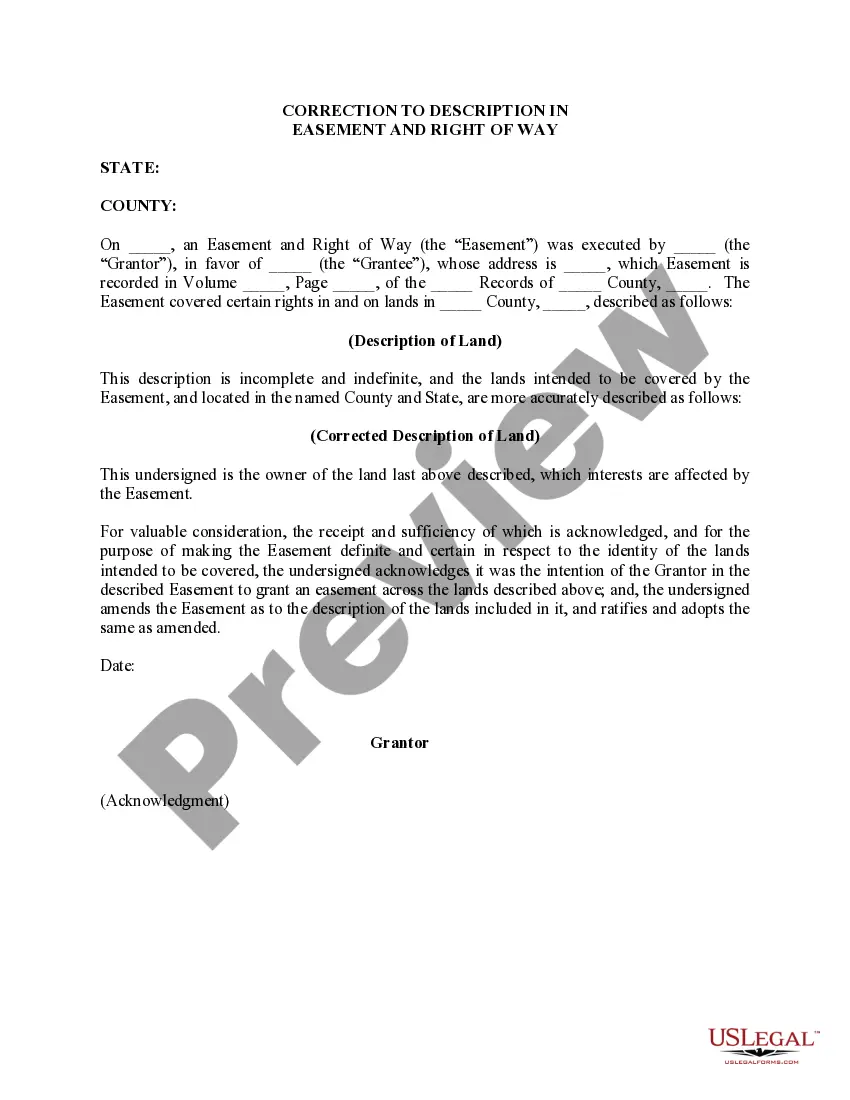

An Affidavit of Correction is a legal document that you can use to fix inaccurate information on an official record. If you have made an error on an official court or government document, you can use an Affidavit of Correction to address it.