Affidavit Amend Form With Pf Withdrawal In North Carolina

Description

Form popularity

FAQ

Some customers are exempt from paying sales tax under North Carolina law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

– Debt management plans are offered by nonprofit credit counseling agencies, who work with creditors to reduce interest rates and monthly payments to a manageable level. The program covers unsecured debts, like credit cards, but not secured debts, like houses or cars.

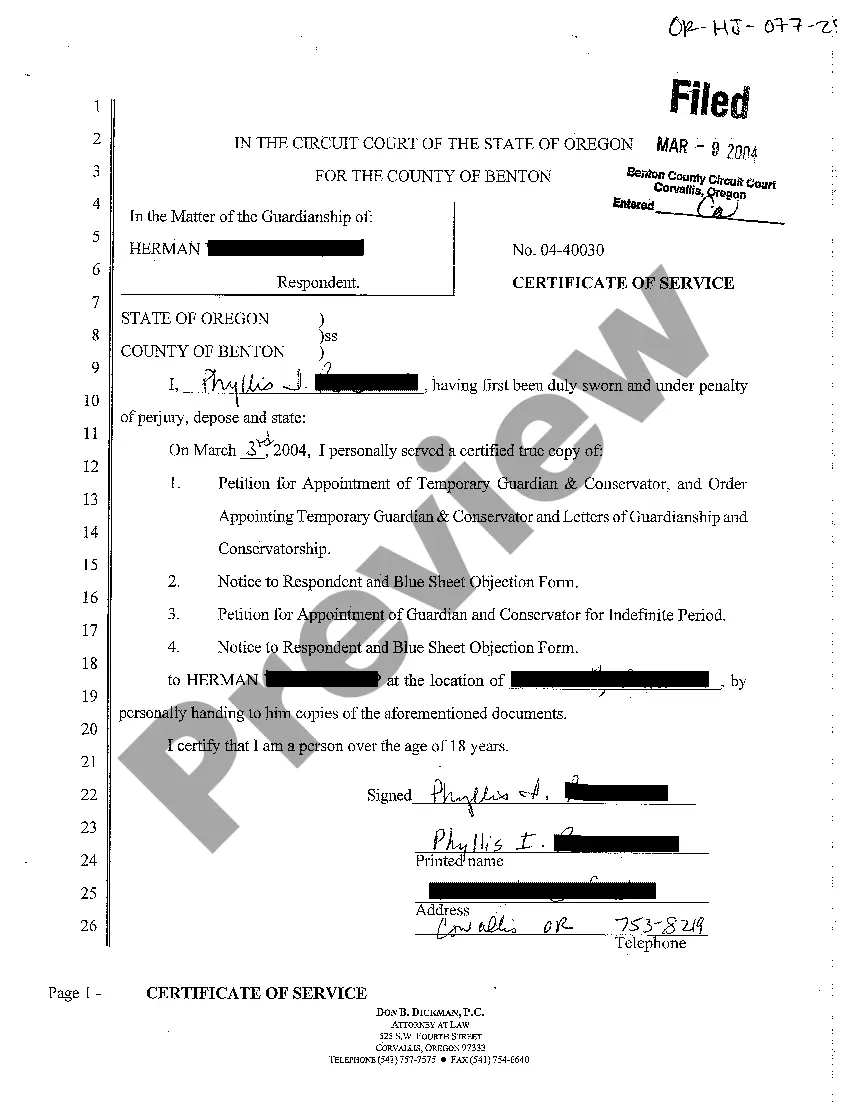

If this Affidavit is provided in a case already pending in the courts, include the file number and county in which the case is pending above and the name of the defendant below. An affidavit is a statement given under oath that its contents are true and accurate.

Form E-589CI, Affidavit of Capital Improvement, may be used to substantiate that a contract, or a portion of work to be performed to fulfill a contract, is to be taxed for sales and use tax purposes, as a real property contract for a capital improvement to real property.

A North Carolina small estate affidavit is a document that allows an individual to petition for all or a portion of a deceased person's estate. The petitioner, or affiant, can only use this affidavit if they have a lawful claim to the estate.

If you have received a Notice of Individual Income Tax Assessment, you have been assessed for income taxes due. You may have also previously received a "Notice to File a Return" and failed to respond to that notice within 30 days.

A capital improvement is one or more of the following: New construction, reconstruction, or remodeling.

What is The Affidavit for Collection of Personal Property? ing to the North Carolina statute § 28A-25-1, a heir can settle a deceased person's estate without going through probate by applying for the Affidavit for Collection of Personal Property of the Decedent (form AOC-E-203B).

Once the Executor has met all legal requirements, they will receive copies of form AOC-E-403, Known as Letters Testamentary or Letters of Administration. You will receive 5 copies of this form. With the provided form, you can act on behalf of the decedent and access their accounts.

You'll have to file a request in the county where the deceased person lived at the time of their death. The paperwork will ask for you to be officially acknowledged as the legal executor representing the estate. In addition to the petition, you'll need to file a valid will, if one exists, and the death certificate.