Affidavit Amend Form With Decimals In Harris

Description

Form popularity

FAQ

You can now file Form 1040-X electronically with tax filing software to amend your Form 1040, 1040-SR, or 1040-NR for the current or two prior tax periods. Paper filing is still an option for Form 1040-X. File Form 1040-X to: Correct Form 1040, 1040-SR, or 1040-NR (or older filings of Form 1040-A or 1040-EZ).

On Form 1040-X, enter your income, deductions, and credits from your return as originally filed or as previously adjusted by either you or the IRS, the changes you are making, and the corrected amounts. Then, figure the tax on the corrected amount of taxable income and the amount you owe or your refund.

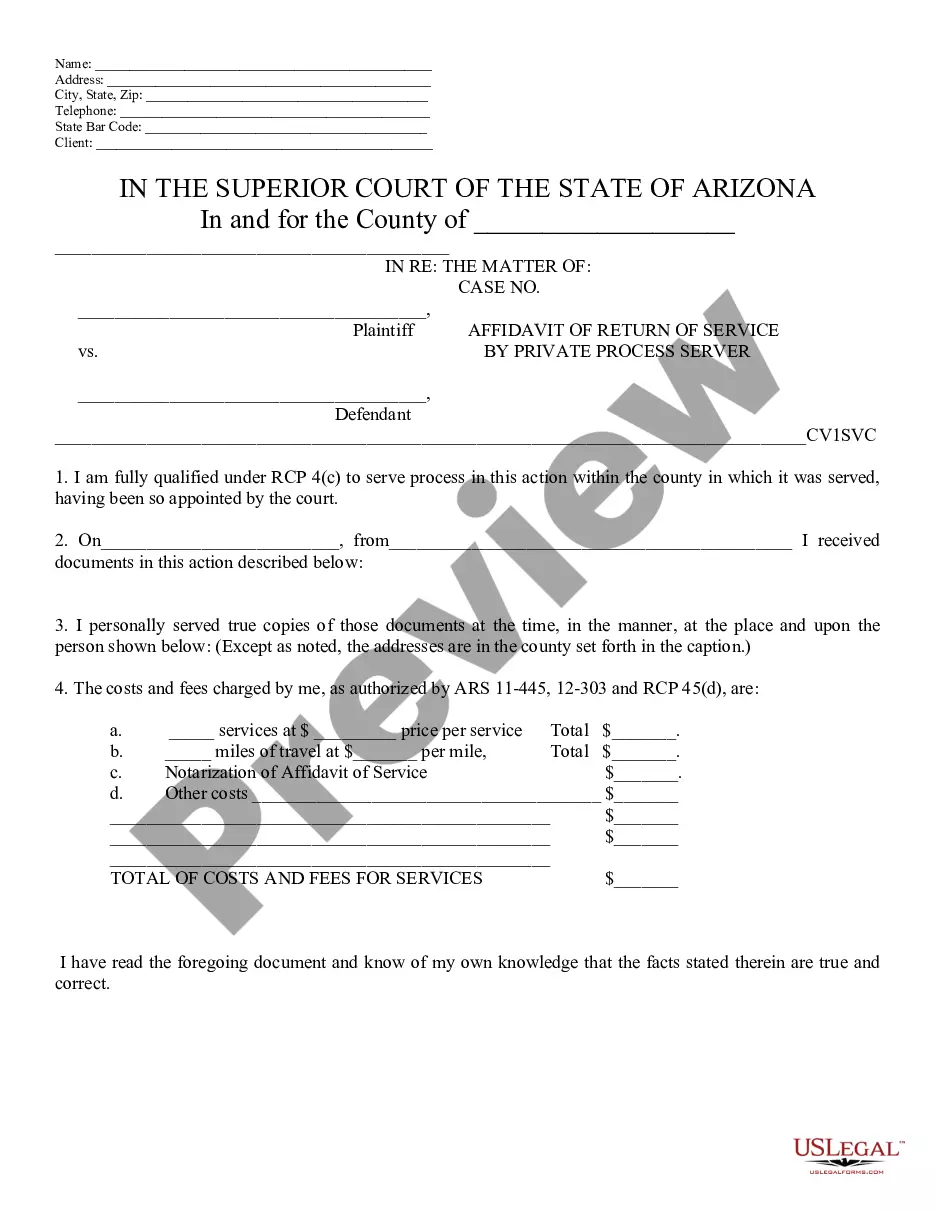

How do I fill this out? Collect accurate vehicle information and documents. Identify errors in the current affidavit that need correction. Fill in the correct details in the specified fields. Review the affidavit for completeness and accuracy. Sign and date the affidavit to validate the corrections.

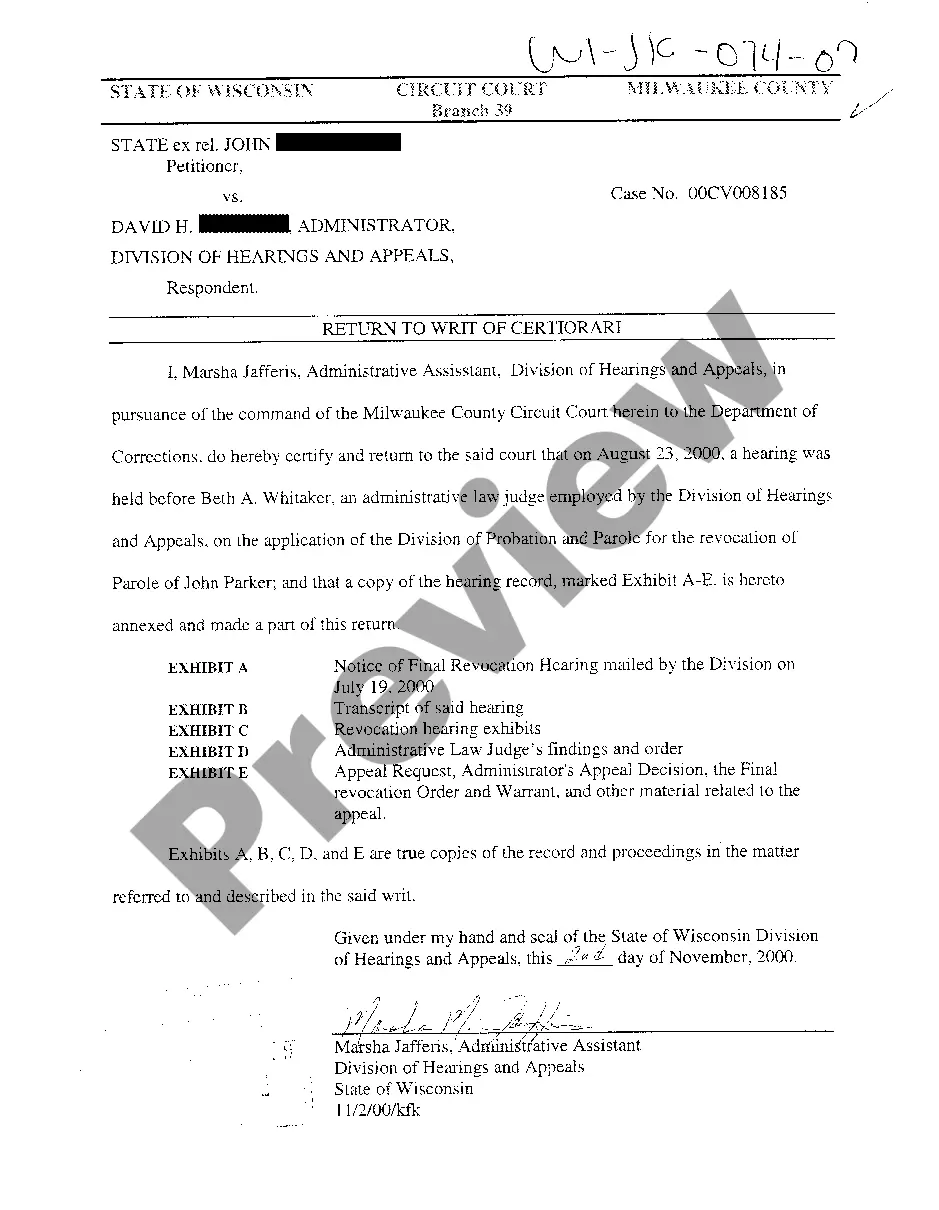

An Affidavit of Correction is a legal document that you can use to fix inaccurate information on an official record. If you have made an error on an official court or government document, you can use an Affidavit of Correction to address it.

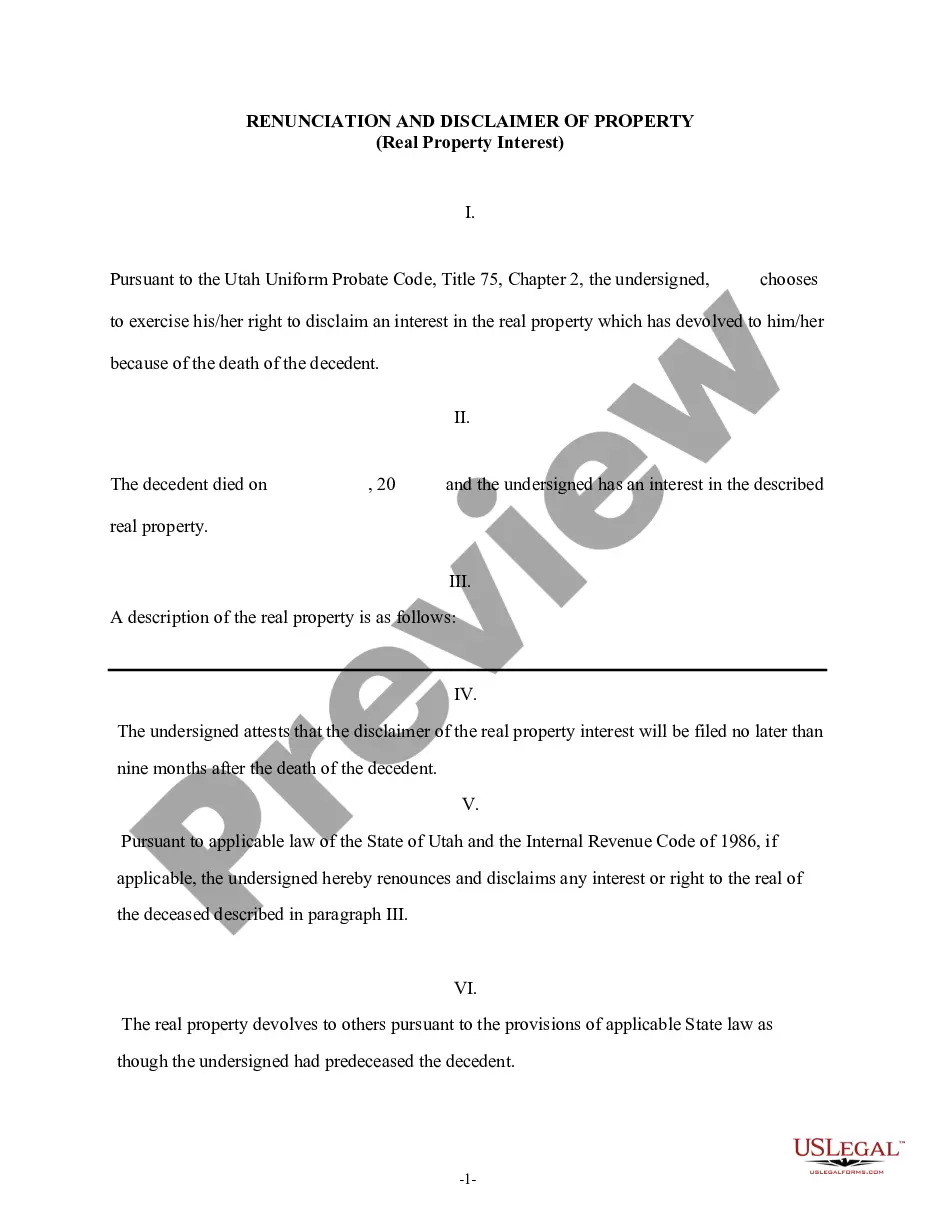

The affidavit of heirship is used when the decedent had no unpaid debts and there was no other requirement that probate be filed. It is often used when there is a third party who requires the affidavit before transacting business with the heir as owner of the property.

In this situation, an heir can simply file what is called an affidavit of heirship with the court. You may find this form on your state court website or through the court clerk's office, or you may need to have an attorney or legal services firm create one for you.

Good to know: An Affidavit of Heirship establishes a clean chain of title. It ensures that the title records of the Heir Property title changes legally to the heirs of the deceased.

Unlike the affidavit of heirship, the small estate affidavit only transfers the title of the decedent's homestead. Only a surviving spouse or minor child can inherit property through this affidavit type. The other types of the deceased person's real property cannot be transferred by submitting a small estate affidavit.

The form must include: The witnesses' names and addresses. Relationships to the decedent. Decedent's date of death. Decedent's marital history. Decedent's family history (children, grandchildren, parents, siblings, nieces/nephews)