Affidavit Amend Form For Tax Return In Georgia

Description

Form popularity

FAQ

If you choose to mail Form 1040-X, print the amended return and mail it to the IRS. Attach any required accompanying documents, such as forms created in the return due to the changes made, or any documentation that would support the changes made (corrected Form W-2 Wage and Tax Statement).

When mailing your federal amended return, you will need to send the following: 1040-X. Income documents such as W-2's and 1099 forms if they support the changes on the return. Any forms that have a calculation change from the original return.

If you didn't claim the correct filing status or you need to change your income, deductions, or credits, you should file an amended or corrected return using Form 1040-X, Amended U.S. Individual Income Tax Return.

Be sure to include: A copy of any corrected W-2s, 1099s, etc. Any other substantiating forms, schedules, or documentation supporting the amended return.

What is Form 502X? Maryland Income Tax Form 502X Prior Year is used to amend a previously filed Maryland income tax return for a prior tax year. It is used to report any changes to income, deductions, or credits for the prior tax year.

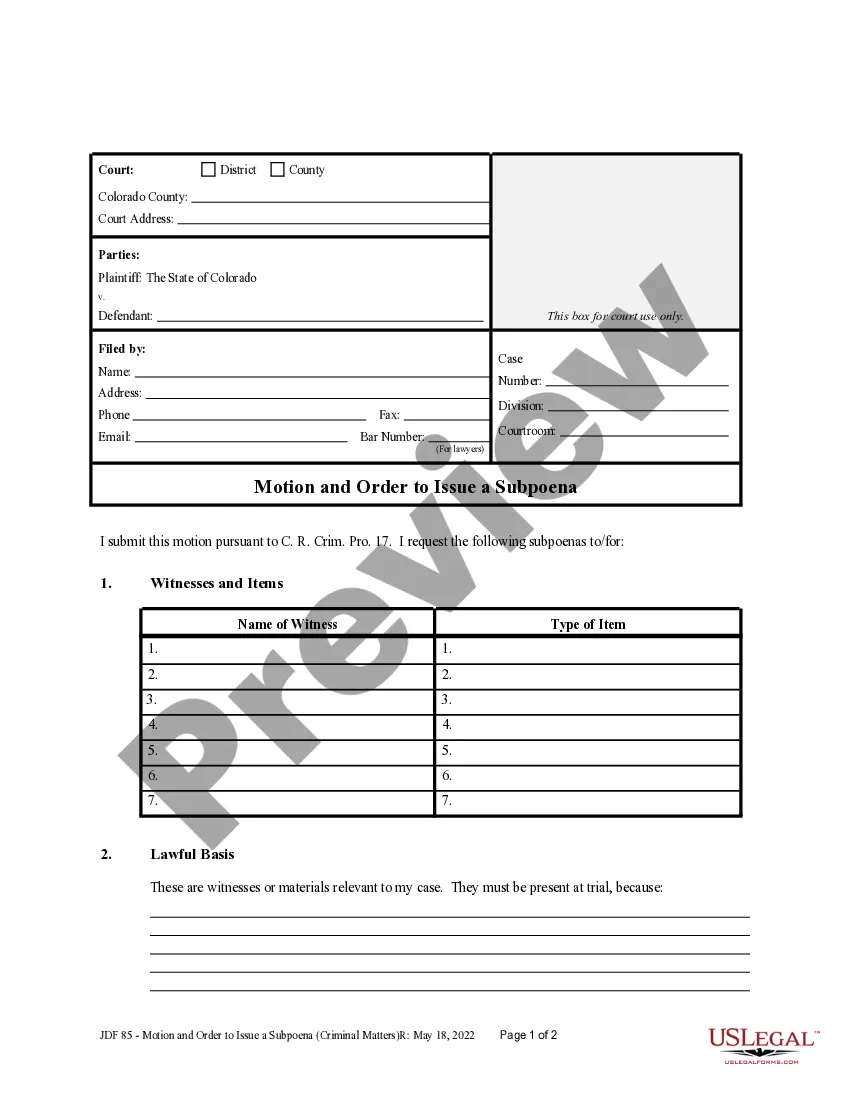

Made a mistake on your Georgia tax return? You can amend it using Form 500X, available for both the current and previous tax years. Simply complete and sign the form, but be aware that you cannot submit it electronically on eFile (unlike the federal Form 1040X).

Taxpayers and electronic return originators (EROs) use this form to send any required paper forms or supporting documentation listed next to the checkboxes on the front of the form. Form 8453 is used solely to transmit the forms listed on the front of the form.

Form 8453, U.S. Individual Income Tax Transmittal for an IRS e-file Return, is used to send required paper document attachments or allowed supporting documentation to the IRS for electronically filed returns.

You must file taxes with the State of Georgia if: You are required to file a federal income tax return. You have income subject to Georgia income tax but not subject to federal income tax. Your income exceeds Georgia's standard deduction and personal exemptions.

If you are an electronic return originator (ERO), you must mail Form 8453 to the IRS within 3 business days after receiving acknowledgement that the IRS has accepted the electronically filed tax return.