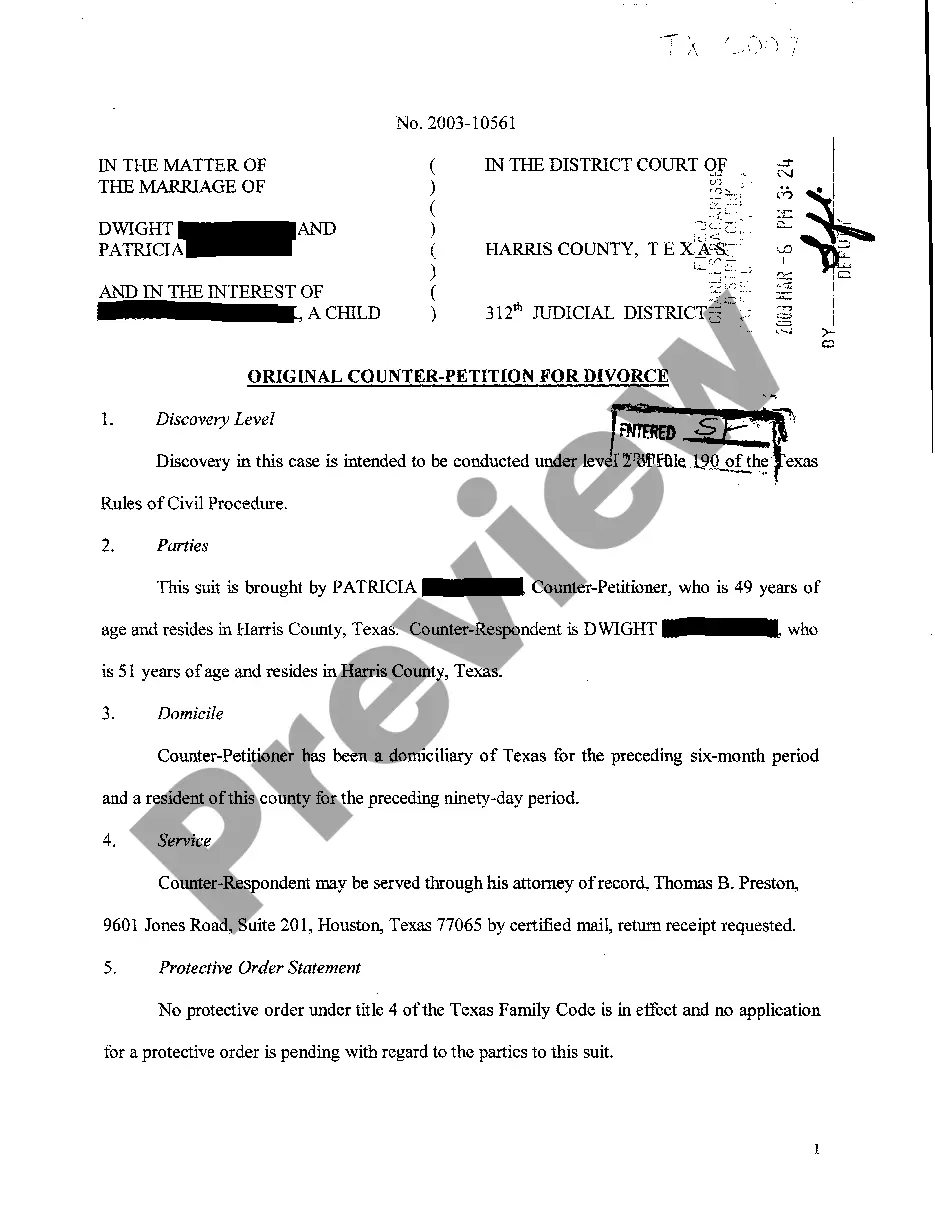

This is a generic Affidavit to accompany a Motion to amend or strike alimony provisions of a divorce decree on the remarriage of the plaintiff former spouse. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Alimony Spouse Support Formula In Santa Clara

Description

Form popularity

FAQ

While a divorce action is pending, one common method is what is referred to as the County of Santa Clara formula, which generally states that temporary spousal support is computed by taking 40% of the net income of the payor, minus 50% of the net income of the payee.

40% of the high earner's net monthly income minus 50% of the low earner's net monthly income. For instance, if Spouse A earns $5,000 per month and Spouse B earns $2,500 per month, temporary spousal support might be calculated as follows: 40% of $5,000 = $2,000. 50% of $2,500 = $1,250.

There are a few basic steps that you can take to help avoid paying alimony after divorce in California. These include: Spousal support is not automatic: One of the most important things to understand about spousal support is that it is not automatic.

California doesn't use a "calculator" for determining the amount of long-term spousal support. Instead, judges must decide how much to award after they've considered all of the following circumstances: each spouse's needs, based on the standard of living they had during the marriage.

Generally, the courts in California award spousal support based on the length of the marriage. In California, spousal support typically lasts half the length of the marriage. If the couple was married for six years, for example, a judge would make a spousal support obligation last for three years.

40% of the high earner's net monthly income minus 50% of the low earner's net monthly income. For instance, if Spouse A earns $5,000 per month and Spouse B earns $2,500 per month, temporary spousal support might be calculated as follows: 40% of $5,000 = $2,000. 50% of $2,500 = $1,250.