Texas Beneficiaries Without Will

Description

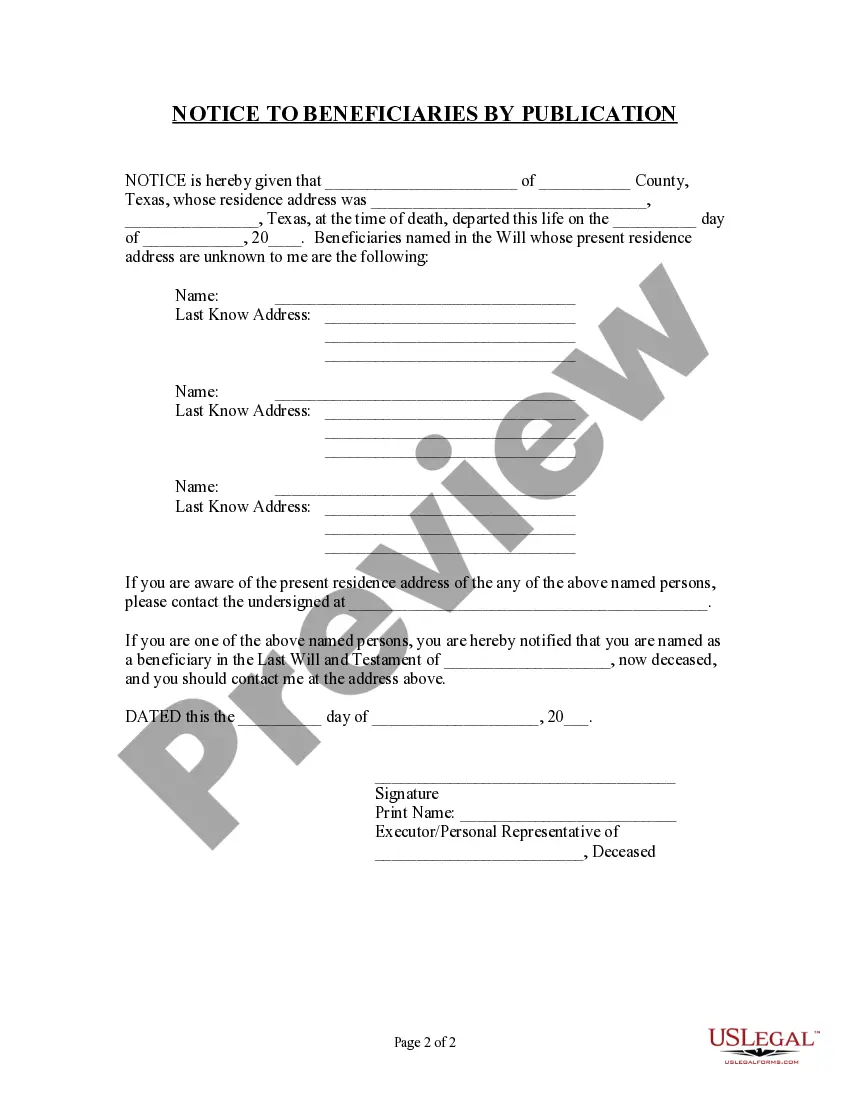

How to fill out Texas Notice To Beneficiaries Of Being Named In Will?

Creating legal documents from the ground up can occasionally be overwhelming. Some situations may require extensive research and significant financial investment.

If you're looking for a more straightforward and economical method of preparing Texas Beneficiaries Without Will or any other documents without unnecessary complications, US Legal Forms is readily available.

Our digital library containing over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal affairs. With just a few clicks, you can swiftly access compliant forms tailored for your needs by our legal experts.

Utilize our platform whenever you require a dependable and trustworthy service to quickly find and download the Texas Beneficiaries Without Will. If you are familiar with our site and have previously registered, simply Log In to your account, locate the template, and download it or re-download it at any time from the My documents section.

US Legal Forms is known for its excellent reputation and over 25 years of experience. Join us today and make document processing straightforward and efficient!

- Check the document preview and descriptions to confirm you have located the form you need.

- Ensure the template you select adheres to the specifications of your state and county.

- Choose the most appropriate subscription plan to acquire the Texas Beneficiaries Without Will.

- Download the document. Then complete, sign, and print it.

Form popularity

FAQ

When you die, your property interest passes to the person you named in the Transfer on Death Deed (the ?beneficiary?) without any probate action. You can name more than one beneficiary, and you can change the beneficiary at any time by cancelling the Transfer on Death Deed or making a new one.

If you have no spouse or children, your property will be split among your parents and/or siblings, depending on who survives you: If both parents are still living, ½ goes to Mother and ½ goes to Father. If one parent and siblings (or siblings' descendants) are still living, ½ goes to surviving parent and ½ to siblings.

There are several different ways to settle an estate without a will in Texas. Affidavit of Heirship. Small Estate Affidavit. Independent Administration. Dependent Administration.

How Do You Settle an Estate Without a Will In Texas? An intestate estate is settled by going into probate court. Once someone is pronounced dead and it is realized that they do not have a will, their estate enters into the probate process. This can unfortunately take a long time, as long as a year or more to complete.

Procedure ? An affidavit of heirship is prepared that details the decedent's heirship facts and the assets of the estate. The affidavit is then signed before a notary public by two disinterested witnesses. The affidavit is then filed in the real property records on file with the county clerk's office.