This is one of the official workers' compensation forms for the state of Texas.

Texas Workers Compensation Forms For Independent Contractor

Description

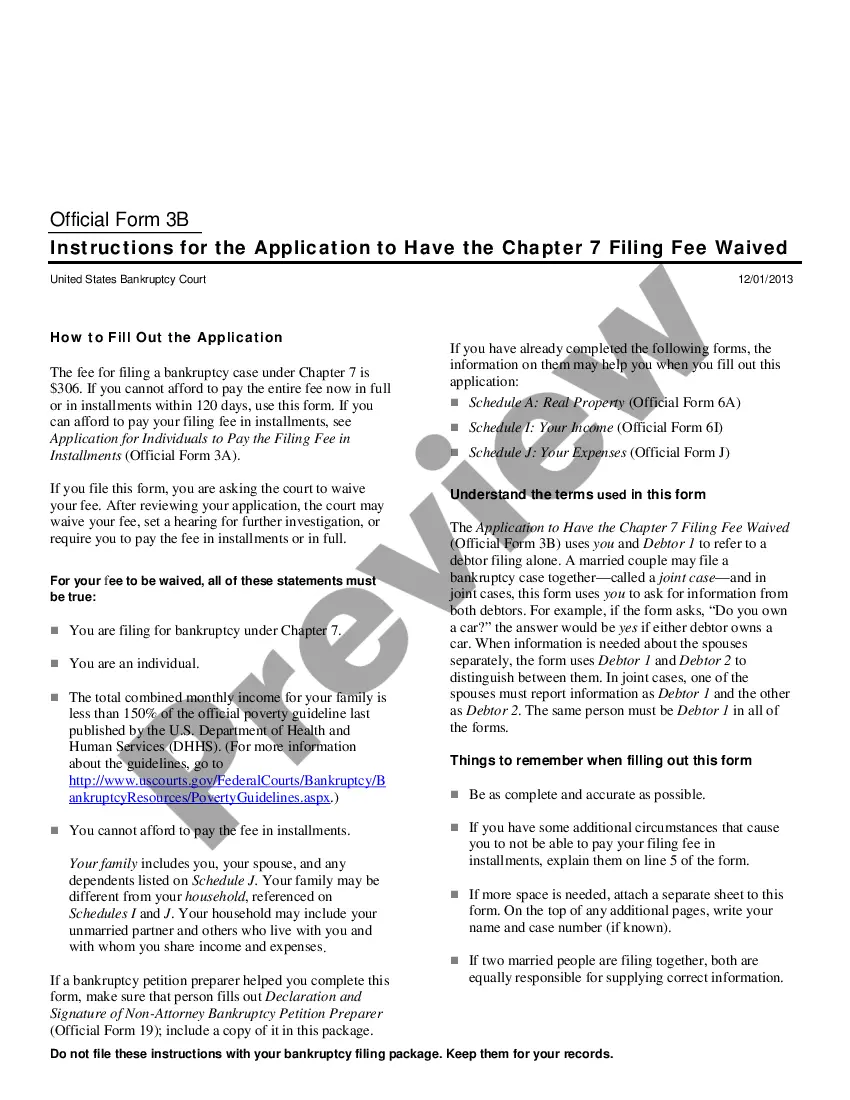

How to fill out Texas Application For Attorneys Fees?

Properly crafted official documentation is one of the vital assurances for preventing issues and legal disputes, but obtaining it without an attorney's assistance may require time.

Whether you need to swiftly locate the latest Texas Workers Compensation Forms For Independent Contractor or any other forms related to employment, family, or business matters, US Legal Forms is always ready to assist.

The process is even easier for existing users of the US Legal Forms library. If your subscription is active, simply Log In to your account and click the Download button next to the desired document. Furthermore, you can access the Texas Workers Compensation Forms For Independent Contractor at any time, as all documentation obtained from the platform is stored within the My documents section of your profile. Save time and finances on preparing official documents. Explore US Legal Forms today!

- Ensure that the form is appropriate for your situation and locality by reviewing the description and preview.

- Search for another sample (if necessary) using the Search bar at the top of the page.

- Hit Buy Now when you discover the relevant template.

- Choose the pricing plan, sign in to your account or create a new one.

- Select your preferred payment method to acquire the subscription plan (using a credit card or PayPal).

- Choose PDF or DOCX file format for your Texas Workers Compensation Forms For Independent Contractor.

- Press Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

Though it's not required by law, sole proprietors, independent contractors, and other self-employed individuals may elect to buy workers' comp insurance for themselves. Their clients might also require them to carry this coverage.

Generally, independent contractors are not employees of a company, so they are not covered by their workers' compensation insurance policy.

Independent contractors are not eligible for workers' compensation coverage; employers are not required by state law to purchase coverage for independent contractors. However, some employers misclassify employees as independent contractors to avoid paying payroll taxes and workers' comp premiums for them.

1099 vs W2 Employee for Workers Comp Insurance. The general rule is that employers do not have to carry workers' compensation insurance for workers who qualify as 1099 Independent Contractors.