Texas Will

Description

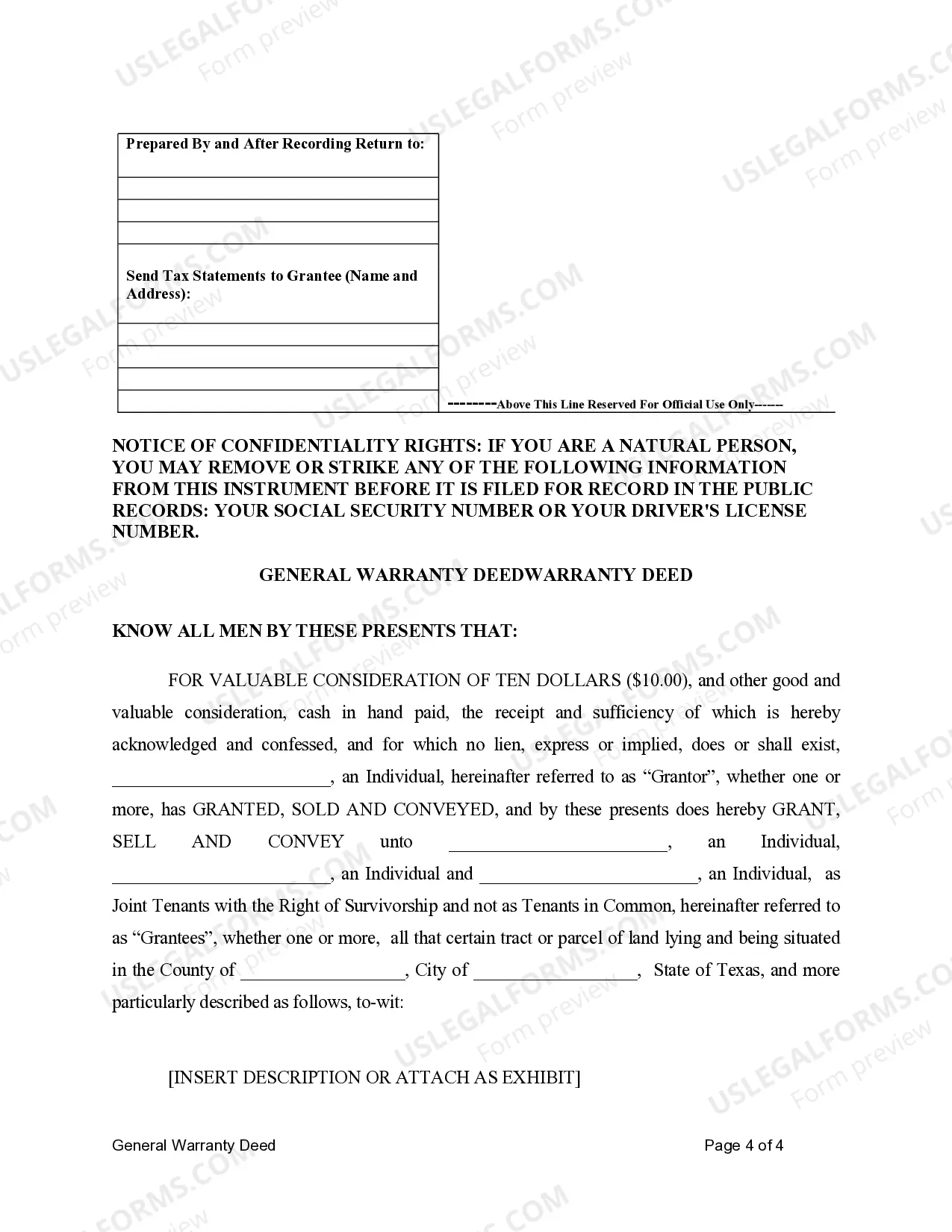

How to fill out Texas General Warranty Deed For Individual To Three (3) Individuals As Joint Tenants With Rights Of Survivorship?

- If you're a returning user, simply log in to your account and download the desired form template by clicking the Download button. Ensure your subscription is active; renew it if necessary.

- For first-time users, begin by exploring the Preview mode and reading the form description to select a document that suits your needs and meets your local jurisdiction's requirements.

- If needed, utilize the Search tab to find another template that matches your criteria. If you find what you need, proceed to the next step.

- Purchase the document by clicking the Buy Now button, choosing the subscription plan that suits you best, and creating your account for access to the entire library.

- Complete the transaction by entering your credit card details or opting for a PayPal payment to finalize your subscription.

- Download your form and save it on your device. You can access it anytime through the My Forms section of your profile.

By using US Legal Forms, Texas residents can create legally sound documents with confidence. This platform not only saves time but also ensures that users can rely on a robust collection of forms, far greater than that of competitors.

Ready to streamline your legal documentation process? Explore US Legal Forms today and make your legal tasks simpler!

Form popularity

FAQ

You do not need an attorney to file a will in Texas, but having one is often beneficial. An attorney can help navigate the complexities of estate laws and ensure your Texas will meets all legal standards. If you prefer to handle it yourself, platforms like USLegalForms provide resources and templates to guide you through the process smoothly.

To create a Texas will, you must meet specific legal requirements. First, you need to be at least 18 years old and of sound mind. The will must be in writing and signed by you or by someone else at your direction. Additionally, having two witnesses sign the document can strengthen its validity, ensuring your intentions are clearly documented.

Absolutely, you can write your own will in Texas as long as you adhere to the necessary legal requirements. The will must be in writing, signed by you, and either witnessed by two individuals or notarized as part of a self-proving will. While creating your own will can save costs, it is important to ensure that it meets Texas laws to avoid complications later. Consider using USLegalForms to guide you through the process and secure a valid Texas will.

Yes, you can write your own will in Texas and have it notarized, but it is essential to follow the required legal guidelines for it to be valid. Ensure your will is signed by you and at least two witnesses, or create a self-proved will that includes a notarized affidavit. Having a notarized will can help speed up the probate process and reduce the risk of legal challenges. For assistance in drafting your Texas will, look into the services offered by USLegalForms.

In Texas, a will does not have to be notarized to be valid, but doing so can provide extra security. If you opt for a self-proved will, a notary will be necessary to notarize the self-proving affidavit. This added verification can help streamline the probate process, as it makes the will easier to validate in court. Consider consulting USLegalForms to create a notarized Texas will that meets all requirements.

To be classified as a self-proved will in Texas, the document must be signed by the testator and two witnesses. Furthermore, the will should include a self-proving affidavit, which is a sworn statement affirming the validity of the will's execution. This type of will can simplify the probate process, as it eliminates the need for witnesses to appear in court. Utilizing a reliable platform like USLegalForms can help you craft a self-proved Texas will efficiently.

A Texas will can be deemed invalid if it does not meet specific legal requirements. For example, if it is not signed by the testator or witnessed by at least two individuals, it may not hold up in court. Additionally, any signs of fraud, lack of capacity, or undue influence can also invalidate a Texas will. Therefore, it is crucial to understand these requirements and ensure that your will complies with them.

In Texas, various professionals, such as licensed notaries, can notarize a will. Many banks and law offices offer notary services, making it convenient to find someone. You may also find notary services at public libraries or community centers. To simplify this process, consider using USLegalForms, which can guide you on how to arrange notarization for your Texas will.

In Texas, a will does not need to be notarized to be valid, but notarization can make the probate process smoother. If you choose a self-proving will, notarization allows you to avoid questions about the will's authenticity later. Therefore, while it's not a legal requirement, notarization can enhance your Texas will's effectiveness.

To obtain a copy of a will in Texas, you can visit the county clerk's office where the will is filed. Most wills become public records after they are probated. If you require a copy that is not publicly available, you may need to request it from the executor or the person who created the Texas will.