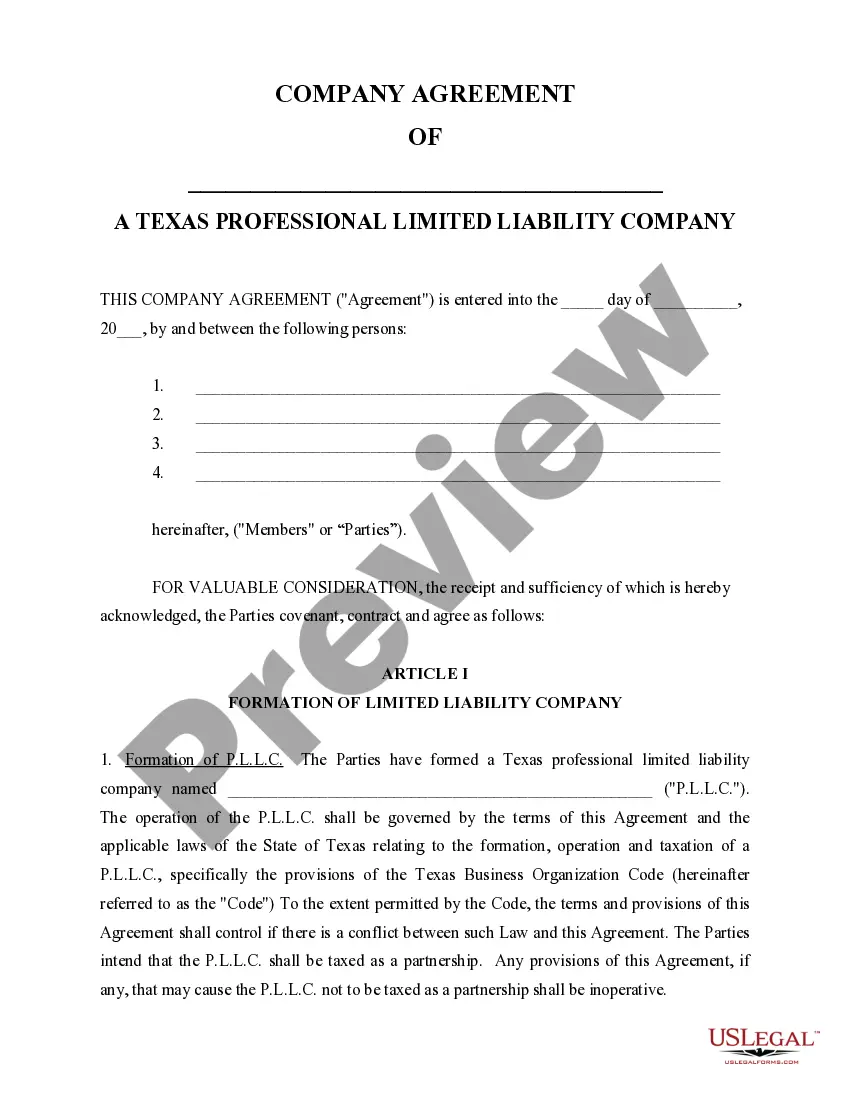

Pllc Texas Formation

Description

How to fill out Texas Sample Operating Agreement For Professional Limited Liability Company PLLC?

The Pllc Texas Formation you see on this page is a reusable legal template drafted by professional lawyers in accordance with federal and state laws. For more than 25 years, US Legal Forms has provided individuals, businesses, and attorneys with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the quickest, easiest and most trustworthy way to obtain the documents you need, as the service guarantees bank-level data security and anti-malware protection.

Getting this Pllc Texas Formation will take you just a few simple steps:

- Look for the document you need and check it. Look through the sample you searched and preview it or review the form description to verify it suits your needs. If it does not, use the search option to get the correct one. Click Buy Now when you have located the template you need.

- Sign up and log in. Select the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to proceed.

- Obtain the fillable template. Pick the format you want for your Pllc Texas Formation (PDF, Word, RTF) and download the sample on your device.

- Fill out and sign the document. Print out the template to complete it manually. Alternatively, utilize an online multi-functional PDF editor to rapidly and precisely fill out and sign your form with a valid.

- Download your paperwork one more time. Use the same document once again anytime needed. Open the My Forms tab in your profile to redownload any previously downloaded forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s scenarios at your disposal.

Form popularity

FAQ

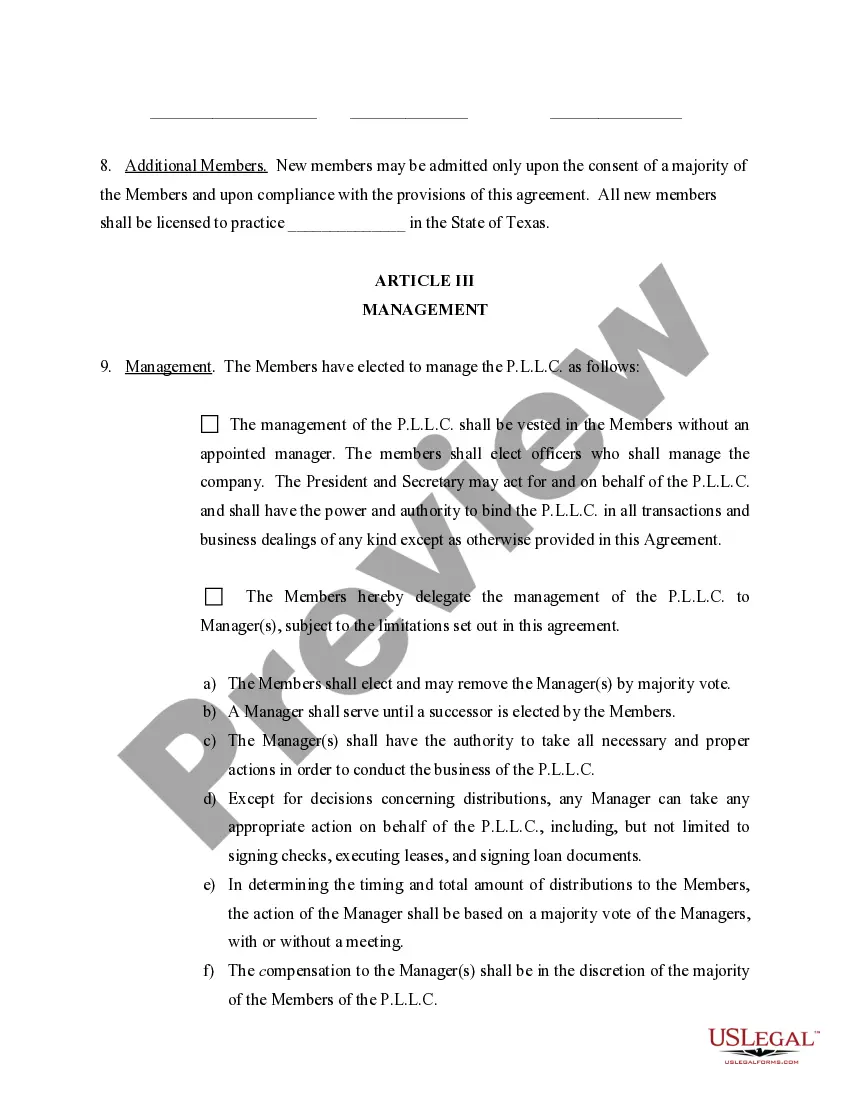

Advantages. Members of a PLLC aren't personally liable for the malpractice of any other member. This is a big advantage over a general partnership or sole proprietorship. PLLC members are not personally liable for business debts and lawsuits, such as unpaid office rent.

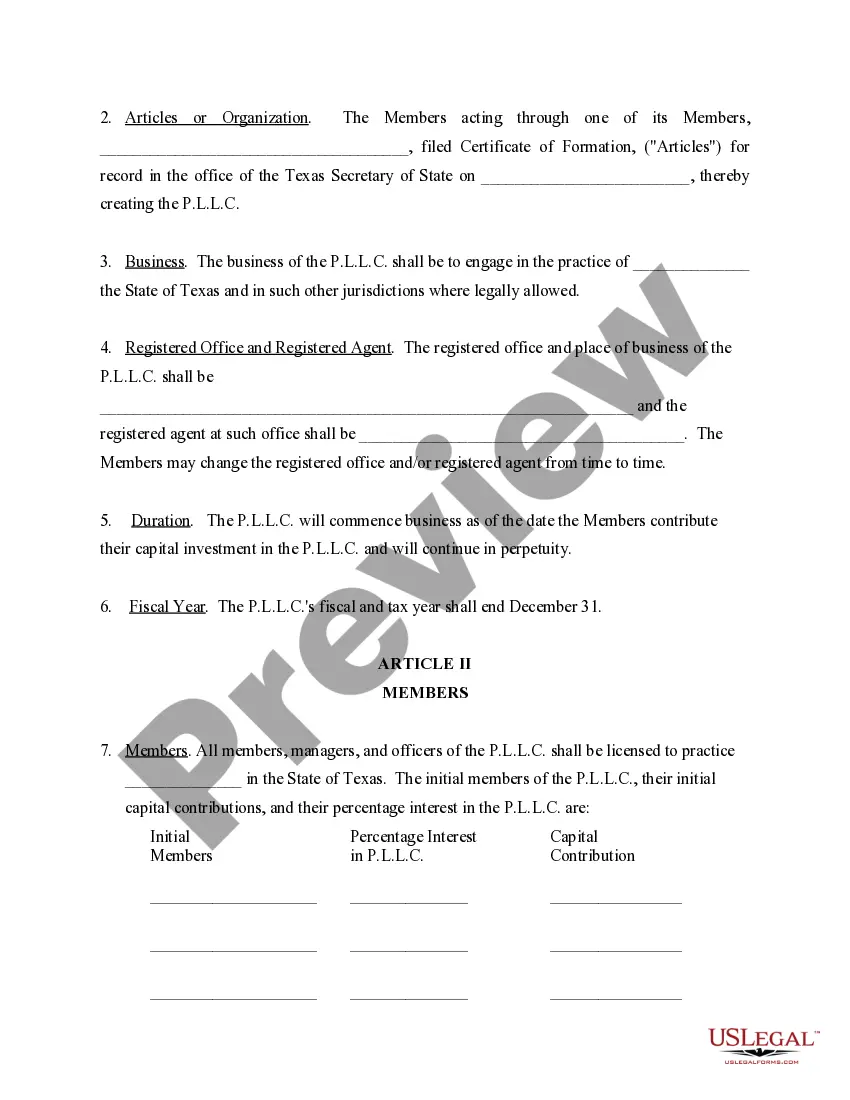

The Purpose of a Texas PLLC For a PLLC in Texas, the Purpose must be the providing of some specific professional service such as legal advice, medical services, or architectural planning, to name a few. This is why, if you are converting to a PLLC from an LLC, it is not just a simple name change.

A business entity that is formed for the purpose of providing a "professional service" (i.e., a service that requires a Texas license) may need to be a professional entity like a professional corporation (PC) or professional LLC (PLLC).

PLLCs pay taxes in the same manner as LLCs. The PLLC itself does not pay taxes. The net income and losses of the PLLC passes to each member. Each member then claims their share of the net income and losses as part of their tax return.

A Texas PLLC can be owned by a professionally licensed individual, or by association whose members are licensed professionals. Some common professions that require licensing include medicine, law, accounting and architecture.