Closing Real Estate With Services

Description

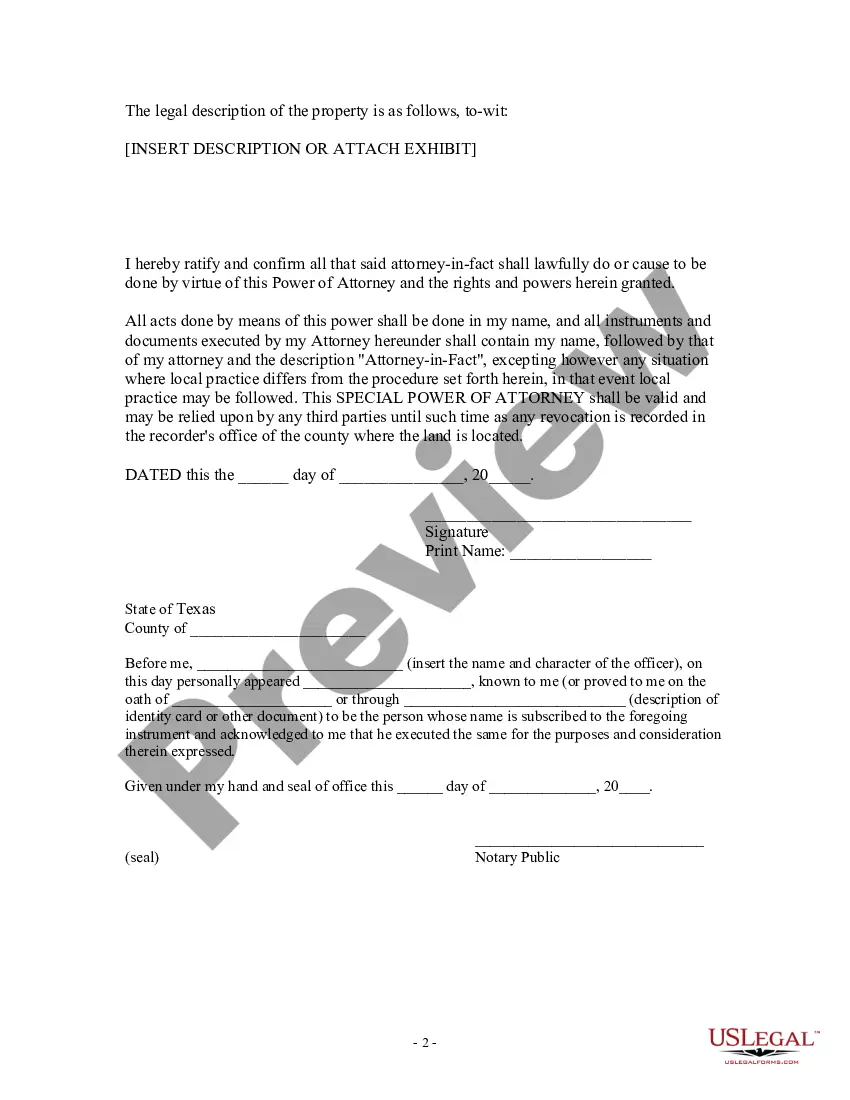

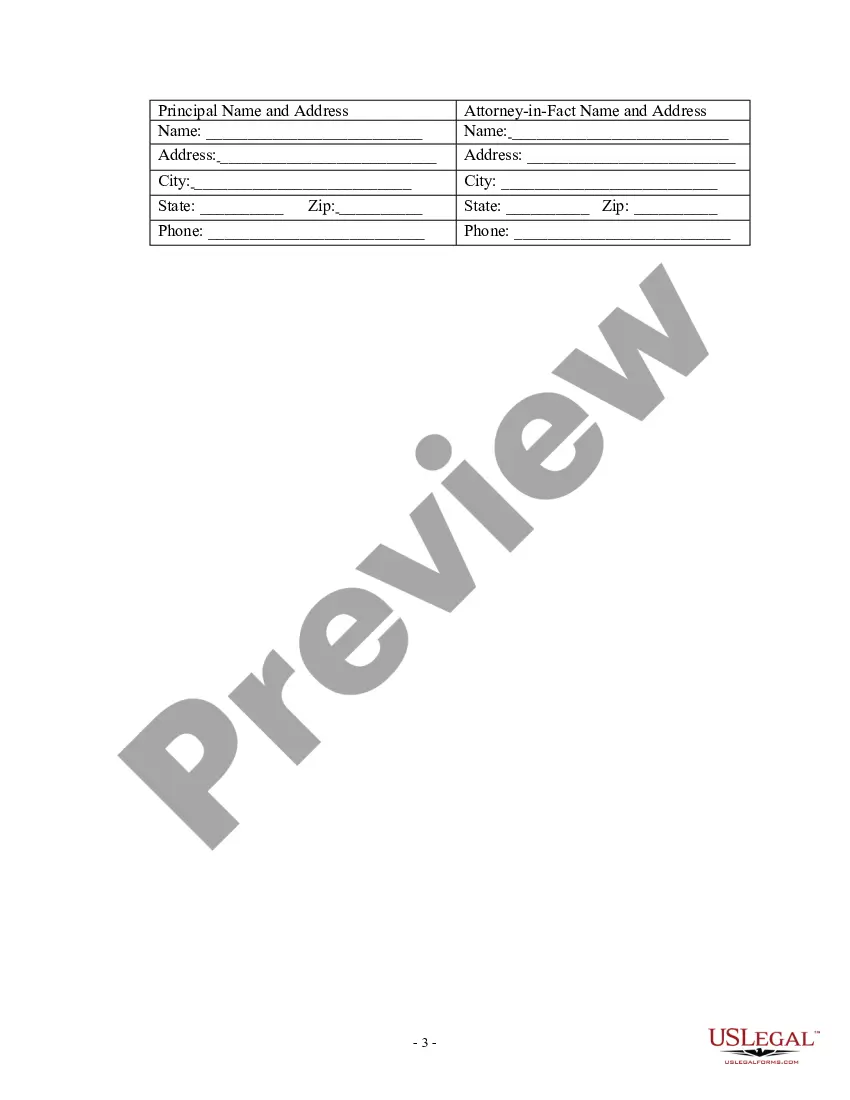

How to fill out Texas Special Or Limited Power Of Attorney For Real Estate Purchase Transaction By Purchaser?

Legal management can be overwhelming, even for the most seasoned professionals.

When you are searching for Closing Real Estate With Services and don't have the time to invest in finding the right and current version, the process can be stressful.

Gain access to a repository of articles, guides, and materials that are particularly pertinent to your circumstances and necessities.

Save time and effort looking for the documents you require, and utilize US Legal Forms’ efficient search and Review feature to obtain Closing Real Estate With Services.

Ensure the template is accepted in your jurisdiction. Select Buy Now when you are ready. Choose a subscription plan. Locate the format you need, and Download, complete, sign, print, and send your documents. Take advantage of the US Legal Forms online catalog, backed by 25 years of experience and reliability. Transform your daily document management into a straightforward and user-friendly process today.

- If you have a monthly membership, Log In to your US Legal Forms account, search for the form, and obtain it.

- Check the My documents tab to view the documents you have already downloaded and to arrange your folders as desired.

- If it is your first experience with US Legal Forms, create an account and gain unlimited access to all the advantages of the library.

- Here are the steps to follow after downloading the necessary form.

- Verify it is the correct document by previewing it and reviewing its description.

- Access state- or county-specific legal and business documents.

- US Legal Forms addresses any needs you may have, from personal to organizational paperwork, all in one location.

- Utilize sophisticated tools to finalize and oversee your Closing Real Estate With Services.

Form popularity

FAQ

The closing process consists of multiple important steps. Initially, you will meet with your attorney or closing agent to go over the closing documents, which include the deed, mortgage, and settlement statement. After reviewing and signing, you will transfer the necessary funds and receive the keys to your new property. This ensures that you fully understand and feel confident about the closing real estate with services.

The steps leading up to the closing date include: Purchase agreement acceptance. Optional buyer home inspection. Loan origination. Lender home appraisal and credit underwriting. Loan Approval. Homeowner and title insurance. Closing disclosures.

In New Mexico, the customary practice is to hand over keys to the buyer upon RECORDING and FUNDING. Closing occurs when both parties sign. The Buyer and Seller will close separately, with separate closing appointments. For the Buyer the paperwork for the loan is signed as well as required disclosures and tax documents.

Action steps Submit documents and answer requests from the lender. Schedule a home inspection. Shop for homeowner's insurance. Look out for revised Loan Estimates. Shop for title insurance and other closing services. Review documents before closing. Close the deal. Save and file your documents.

The closing agent collects all the documents, funds, and instructions for closing and checks them off the closing checklist. The closing agent makes all the necessary adjustments and prorations on the closing statement. The deed and loan documents are signed. The instruments to be recorded are prepared and signed.

The closing process involves four steps to make that happen. Close revenue accounts to Income Summary. Income Summary is a temporary account used during the closing process. ... Close expense accounts to Income Summary. ... Close Income Summary to Retained Earnings. ... Close dividends to Retained Earnings.