Closing Real Estate Forecast

Description

How to fill out Texas Special Or Limited Power Of Attorney For Real Estate Purchase Transaction By Purchaser?

It’s well-known that you cannot become a legal expert instantly, nor can you comprehend how to swiftly create a Closing Real Estate Forecast without having a specific expertise.

Drafting legal paperwork is an extensive process that demands certain education and abilities. So why not let the experts handle the preparation of the Closing Real Estate Forecast.

With US Legal Forms, one of the largest collections of legal templates, you can locate anything from court documents to in-office communication templates.

At any moment, you can regain access to your documents from the My documents section. If you are a current customer, you can just Log In and locate and download the template from that same section.

No matter the intention of your documents—whether they are for financial, legal, or personal use—our website has you covered. Experience US Legal Forms today!

- Search for the document you need using the search feature at the top of the page.

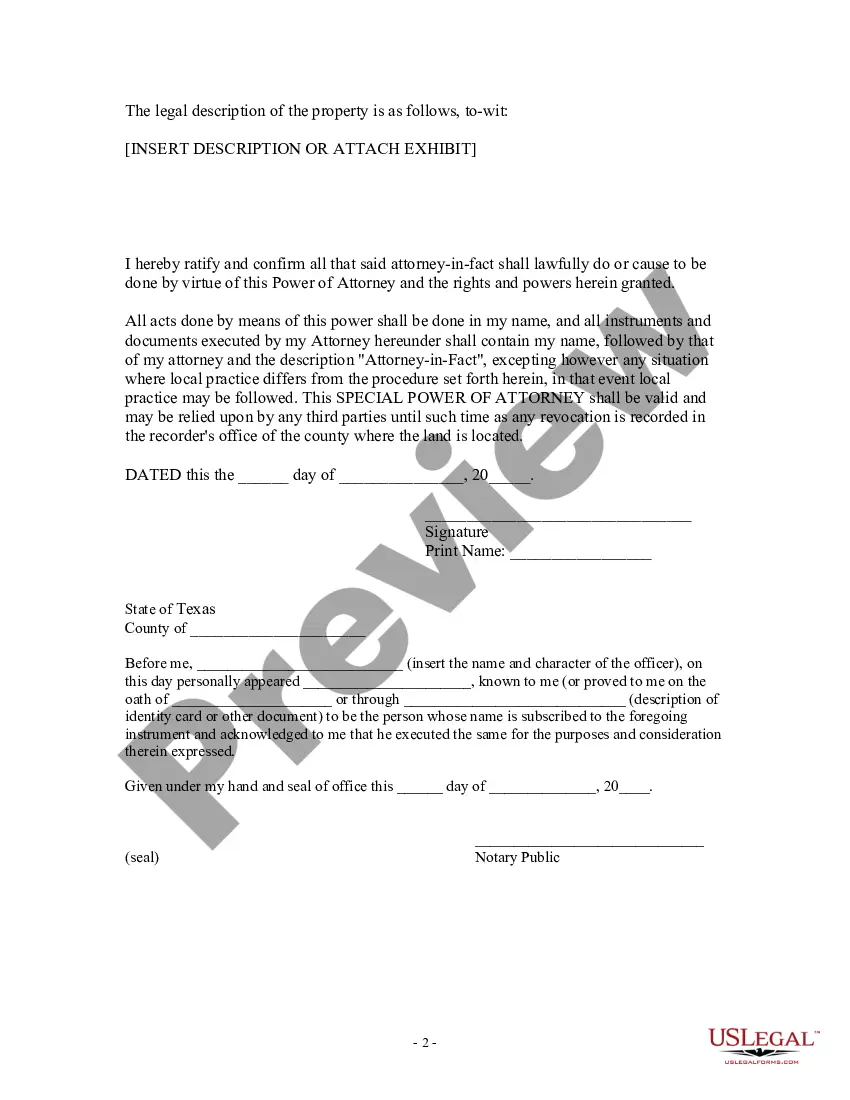

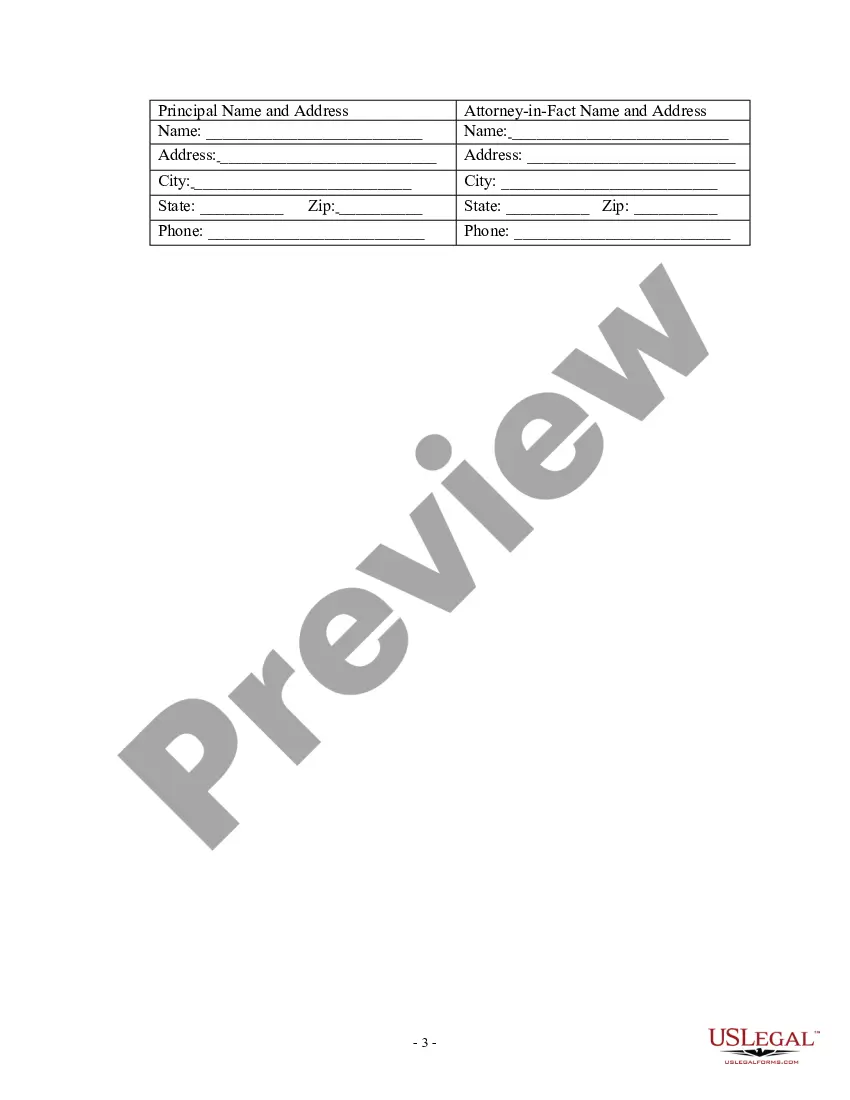

- Preview it (if this option is available) and review the accompanying description to determine if the Closing Real Estate Forecast is what you require.

- If you need another form, restart your search.

- Create a free account and choose a subscription plan to buy the template.

- Click Buy now. Once your payment is finalized, you can obtain the Closing Real Estate Forecast, complete it, print it, and send or mail it to the appropriate individuals or organizations.

Form popularity

FAQ

Subtract any seller or loan credits. Example: With a $300,000 purchase price and 20% down payment ($60,000), plus $9,500 total closing costs, the estimated cash to close would be $69,500.

The Estimated Settlement Statement lists all of the costs and credits associated with the purchase of a home showing the buyer their total costs to close the transaction and showing sellers their net profit (or loss).

Step 1: Understanding Your Documents. Taking inventory of your closing documents will ensure you and your lender have everything that's required for closing. ... Step 2: Selecting A Homeowners Insurance Plan. ... Step 3: Preparing Your Finances For Closing Day. ... Step 4: Planning What To Bring To The Table.

A Closing Disclosure is a five-page form that provides final details about the mortgage loan you have selected. It includes the loan terms, your projected monthly payments, and how much you will pay in fees and other costs to get your mortgage (closing costs).

Cash to close includes the total closing costs minus any fees that are rolled into the loan amount. It also includes your down payment, and subtracts the earnest money deposit you might have made when your offer was accepted, plus any seller credits.