Promissory Note Template Texas With Personal Guarantee

Description

How to fill out Texas Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

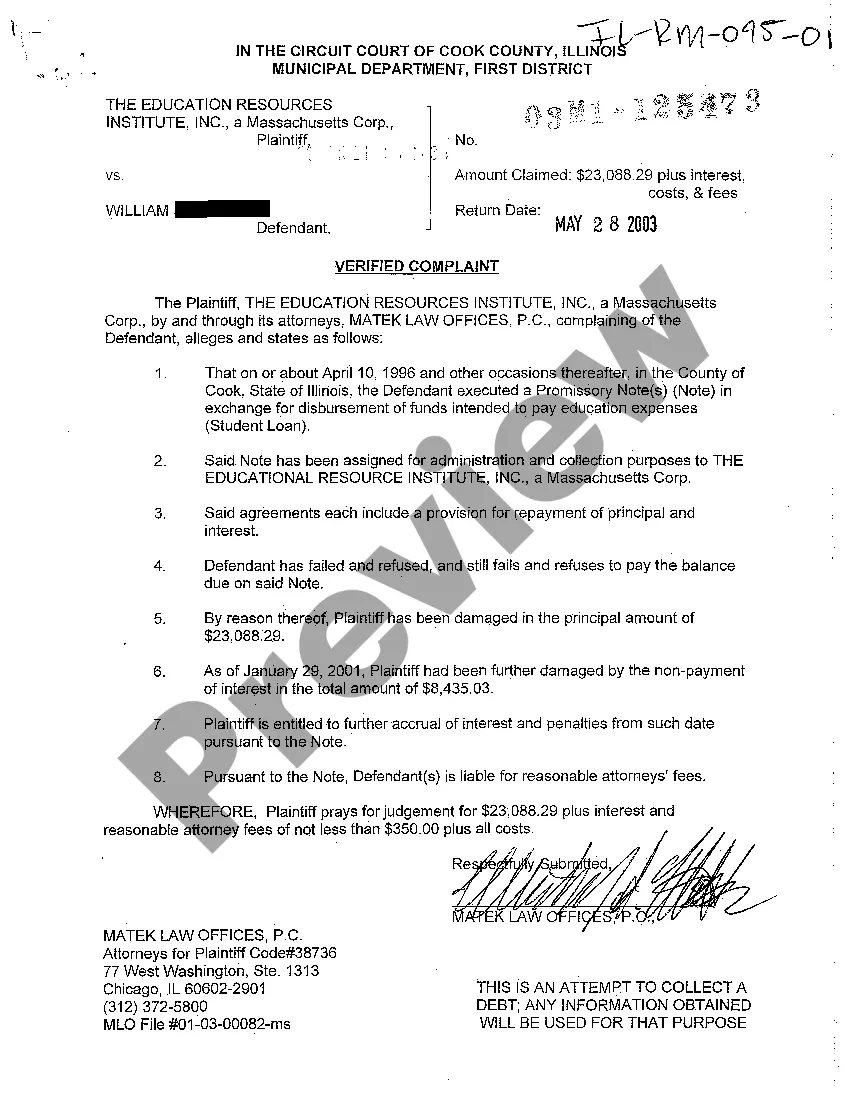

The Promissory Note Template for Texas with Personal Guarantee shown on this page is a versatile legal document created by experienced attorneys in accordance with federal and state laws and regulations.

For over 25 years, US Legal Forms has supplied individuals, organizations, and legal practitioners with more than 85,000 validated, state-specific documents for any business and personal necessity. It’s the quickest, easiest, and most dependable method to obtain the forms you require, as the service ensures bank-grade data protection and anti-malware safeguards.

Subscribe to US Legal Forms to have reliable legal templates for all of life's circumstances accessible at your convenience.

- Search for the document you require and evaluate it.

- Browse the sample you located and preview it or review the form description to ensure it meets your needs. If it doesn't, use the search function to find the correct one. Click 'Buy Now' once you have found the template you need.

- Register and sign in.

- Choose the pricing option that fits you and set up an account. Use PayPal or a credit card for a quick payment. If you already possess an account, Log In and verify your subscription to proceed.

- Obtain the editable template.

- Select the format you desire for your Promissory Note Template for Texas with Personal Guarantee (PDF, Word, RTF) and save the document on your device.

- Complete and sign the documentation.

- Print the template to fill it out manually. Alternatively, use an online multifunctional PDF editor to quickly and accurately fill out and sign your form electronically.

- Redownload your documents as needed.

- Reutilize the same document whenever necessary. Access the 'My documents' section in your profile to redownload any forms previously purchased.

Form popularity

FAQ

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Promissory notes are legally binding documents that all lenders require. You can't obtain a loan without signing a promissory note. Lenders, on the other hand, may or may not require a personal guarantee. Most lenders don't require a personal guarantee for secured business loans.

Texas Secured Promissory Note The date of inception of the note. The names and addresses of all the parties involved as well as the information of the witness that gives the document validity. The loan amount and the details of how and when payment will occur.

When a personal guarantee is accompanied with a promissory note, a personal guarantee acts like collateral. The asset (promissory note) is protected by the collateral (the guarantor's promise to pay, and the ability to sue the guarantor personally for noncompliance with the terms of the promissory note).