Promissory Note Template Texas For Employee Loan

Description

How to fill out Texas Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Utilizing legal forms that comply with federal and local regulations is essential, and the web presents numerous choices to select from.

However, what is the purpose of wasting your time searching for the appropriate Promissory Note Template Texas For Employee Loan example online when the US Legal Forms online library already has such documents gathered in one location.

US Legal Forms is the largest digital legal repository with over 85,000 customizable templates prepared by lawyers for any commercial and personal situation.

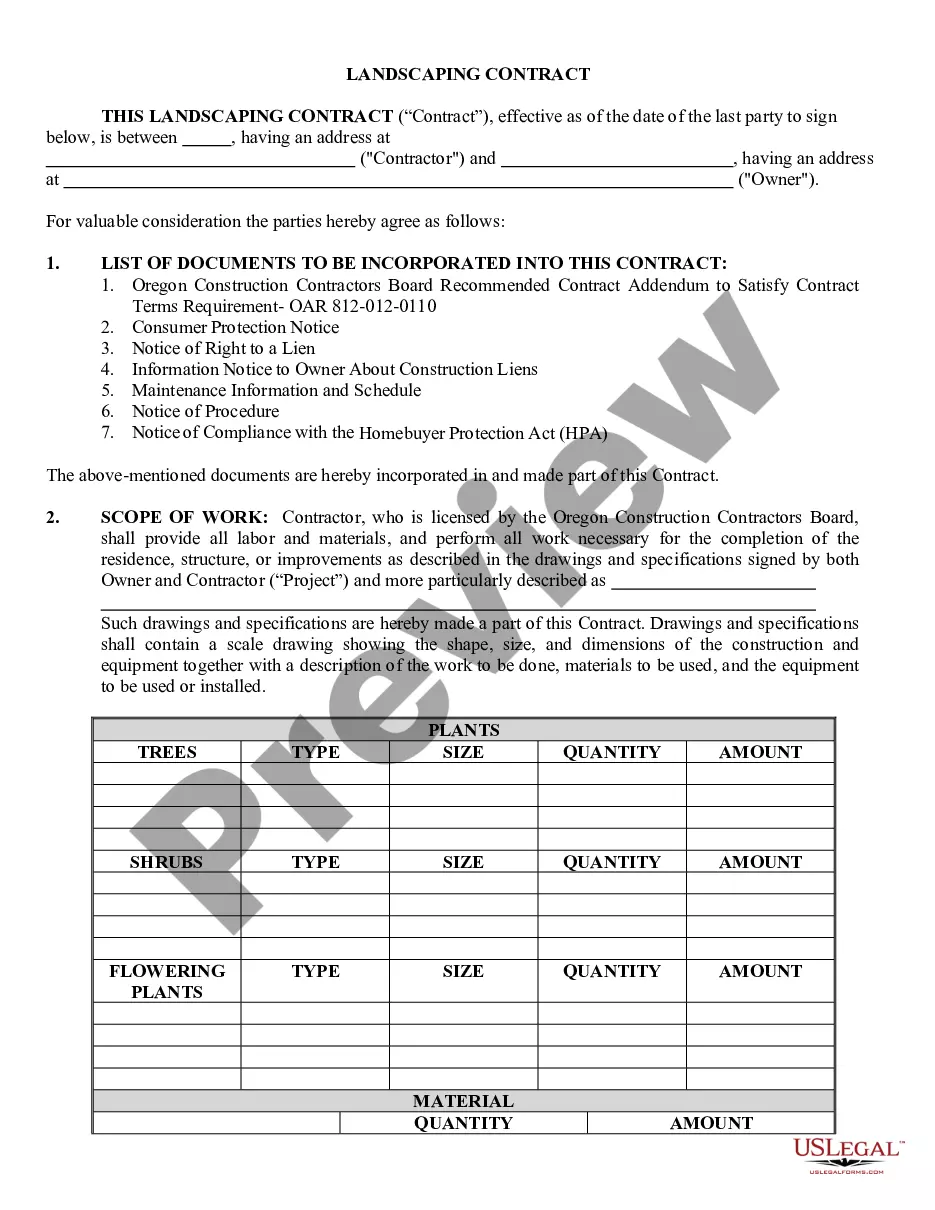

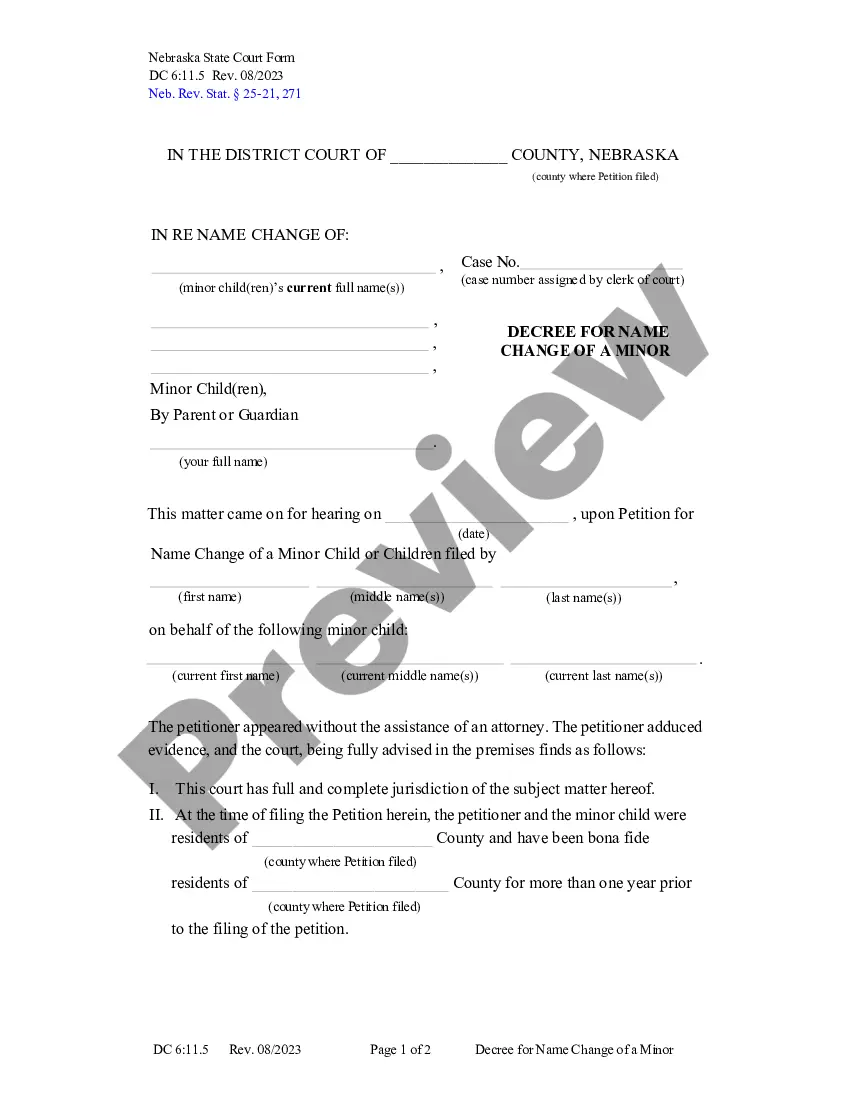

Explore the template using the Preview feature or via the text outline to ensure it meets your requirements.

- They are straightforward to navigate as all files are organized by state and intended usage.

- Our specialists keep track of legislative changes, so you can always trust that your form is current and compliant when obtaining a Promissory Note Template Texas For Employee Loan from our platform.

- Acquiring a Promissory Note Template Texas For Employee Loan is quick and simple for both existing and new clients.

- If you already have an account with an active subscription, Log In and retrieve the document sample you need in your desired format.

- If you are new to our website, follow the steps below.

Form popularity

FAQ

Filling out a promissory note template Texas for employee loan is straightforward. First, include the names and addresses of both the borrower and lender. Next, specify the loan amount, interest rate, and repayment schedule. Finally, ensure you both sign and date the document to create a binding agreement that protects everyone's interests.

Yes, a promissory note can hold up in court if it meets specific legal requirements in Texas, such as being in writing and signed by the borrower. A well-structured promissory note template Texas for employee loan can provide clear terms, which strengthens its enforceability. If disputes arise, having a properly drafted note can make a significant difference in legal proceedings. To ensure your document is solid, consider using trusted resources like US Legal Forms to craft your promissory note.

A promissory note may be deemed invalid in Texas if it lacks essential elements, such as proper signatures or clear repayment terms. Other factors like duress, fraud, or lack of consideration can also render a note unenforceable. To avoid these pitfalls, utilizing a reliable promissory note template for employee loans can ensure all legal requirements are satisfied. Make sure every detail is correct to protect your interests.

The enforceability of a promissory note depends on its compliance with legal formalities and the clarity of its terms. In Texas, notes with clear obligations and proper signatures generally hold up in court if a dispute arises. By using a promissory note template for an employee loan, you can enhance enforceability through precise language and structure. Always keep a signed copy accessible for reference.

Yes, various templates for promissory notes are available online, specifically designed for different scenarios, including employee loans in Texas. These templates streamline the process, ensuring you include all necessary legal components and terms. Utilizing a promissory note template for an employee loan can help you create a clear agreement that protects both parties. It is essential to customize the template to fit your specific needs.

Yes, promissory notes are legally binding in Texas, provided they contain essential elements like an offer, acceptance, consideration, and a mutual understanding of terms. When executed properly, they hold both parties accountable for repayment. It is advisable to use a reliable promissory note template for employee loans to ensure compliance with Texas laws. A well-drafted note safeguards your interests.

To enforce a promissory note in Texas, you must first ensure it meets the legal requirements set forth by state law. This includes having clear terms regarding repayment, interest, and signatures from both parties. If you encounter non-payment, you can pursue legal action, seeking a judgment through the court. A promissory note template for employee loans can provide a strong foundation for enforceability.

While you can express a desire to cancel a promissory note, backing out may not be straightforward. In Texas, once both parties sign the promissory note, it becomes a legally binding document. Carefully consider the implications before attempting to withdraw, as doing so could lead to legal complications. Using a promissory note template for an employee loan can clarify obligations and responsibilities.

Many banks do accept promissory notes, but acceptance may depend on the specific terms and context of the loan. Banks often look for clarity in terms, interest rates, and repayment schedules. If you're planning to present a promissory note for an employee loan, using a promissory note template Texas for employee loan can give you a solid foundation. A well-documented note can enhance your credibility when discussing terms with a financial institution.

Yes, promissory notes are legal in Texas as long as they fulfill specific criteria set by state law. These notes must include essential components such as the loan amount, interest rate, and repayment terms. If you are drafting a promissory note for an employee loan, a promissory note template Texas for employee loan can help ensure your document is valid and enforceable. This way, you can protect your rights as a lender and create a clear record of the loan agreement.