Texas Property Code Deed Of Trust

Description

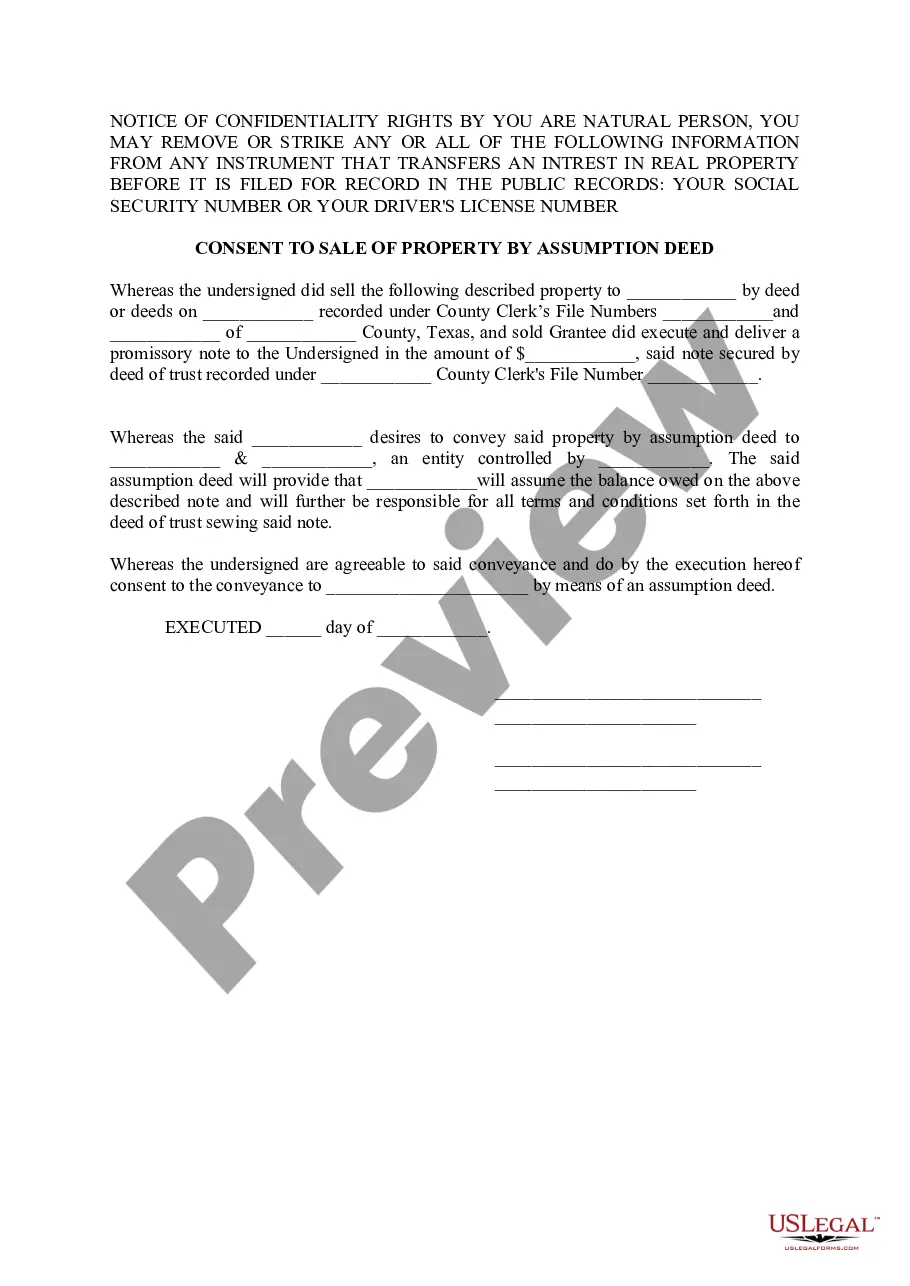

How to fill out Texas Consent To Sale Of Property By Assumption DeedAssumption Deed?

Whether you handle documentation often or occasionally need to submit a formal document, it is crucial to have a resource of information where all the examples are pertinent and current.

The first step you need to take with a Texas Property Code Deed Of Trust is to ensure that it is indeed its most recent version, as it determines whether it can be submitted.

If you aim to simplify your search for the most recent document samples, look for them on US Legal Forms.

Forget about the confusion associated with legal documents. All your templates will be organized and verified with an account at US Legal Forms.

- US Legal Forms is a repository of legal documents that includes nearly every example you might seek.

- Look for the required templates, review their relevance immediately, and learn more about their application.

- With US Legal Forms, you gain access to around 85,000 document templates across a wide range of fields.

- Find the Texas Property Code Deed Of Trust samples within just a few clicks and save them anytime in your account.

- A US Legal Forms account will allow you to access all the samples you need with greater ease and less frustration.

- Simply click Log In in the website header and navigate to the My documents section with all the forms you require readily available, so you won’t need to spend time searching for the appropriate template or assessing its relevance.

- To acquire a form without an account, follow these steps.

Form popularity

FAQ

The Texas property code 92.0161 addresses the rules surrounding the disclosure of certain information by landlords to prospective tenants. This code mandates that landlords inform tenants about specific issues, like the presence of mold in a rental unit, which can directly impact the tenant's safety. Understanding this requirement within the framework of the Texas property code deed of trust is essential for maintaining transparency in rental agreements.

Yes, Texas law typically requires a deed of trust for securing loans against real property. This legal instrument serves as a way to protect the lender's interests while outlining the terms under which the property may be sold in the event of default. Knowing how the Texas property code deed of trust operates can be highly beneficial for both borrowers and lenders in real estate transactions.

Texas property code 209.003 outlines the powers and duties of property owners' associations, particularly relating to the management of common areas and enforcement of community rules. This code ensures that property owners maintain compliance with community standards. Familiarity with the Texas property code deed of trust can help you navigate property association rules effectively.

The Texas property code 113.083 deals with property owners' rights concerning deeds of trust and certificates of sale. It specifies how property transactions should be conducted and the obligations of the parties involved. Understanding this code is important, particularly in the context of the Texas property code deed of trust, to ensure smooth transactions and compliance with the law.

In Texas, a foreclosure generally extinguishes junior liens, meaning lower-priority claims against the property are removed. However, senior liens, such as those tied to senior mortgages, remain in effect even after foreclosure. It’s essential to understand how the Texas property code deed of trust influences lien status during foreclosure proceedings to protect your interests properly.

Texas property code 51.016 addresses the requirements for notifying homeowners about the potential sale of their property due to unpaid debts. This code ensures that homeowners receive timely notifications to allow them to address any financial issues before facing foreclosure. Understanding this aspect of the Texas property code deed of trust is crucial for homeowners looking to protect their investments.

The Texas property code provides a comprehensive framework that governs real estate transactions, rental agreements, and property rights in the state. It outlines the regulations that protect both landlords and tenants, while also specifying the processes for buying, selling, or leasing property. By familiarizing yourself with the Texas property code deed of trust, you can ensure compliance and safeguard your rights in real estate matters.

The Texas property code 92.056 relates to rental agreements and emphasizes the obligations of landlords regarding the maintenance of rental properties. Under this code, landlords must ensure that their properties meet certain health and safety standards. This code serves to protect tenants' rights and ensures a safe living environment. Understanding the Texas property code deed of trust can help you navigate these regulations effectively.

Proving ownership of a property in Texas generally requires presenting your property deed, which outlines your interest in the land. A Deed of Trust may also be relevant as it provides details about the financing agreement associated with property ownership. Additionally, keeping all related documents organized can be beneficial. For comprehensive assistance, you might turn to US Legal Forms, which can provide templates and guidance regarding property ownership documentation.

To obtain a copy of your property survey in Texas, you should first check with your title company or real estate agent who may have received it during the closing process. If that's not available, consider reaching out to a professional surveyor or your local county clerk's office. They may also retain copies of surveys submitted alongside the Texas property code deed of trust associated with your property.