Owelty Lien Form Texas Withholding

Description

How to fill out Texas Owelty Deed?

Dealing with legal documentation and processes can be a lengthy addition to your day.

Owelty Lien Form Texas Withholding and similar forms frequently necessitate that you locate them and comprehend the optimal method to fill them out correctly.

Consequently, whether you are managing financial, legal, or personal issues, utilizing a comprehensive and accessible online directory of forms at your fingertips will significantly help.

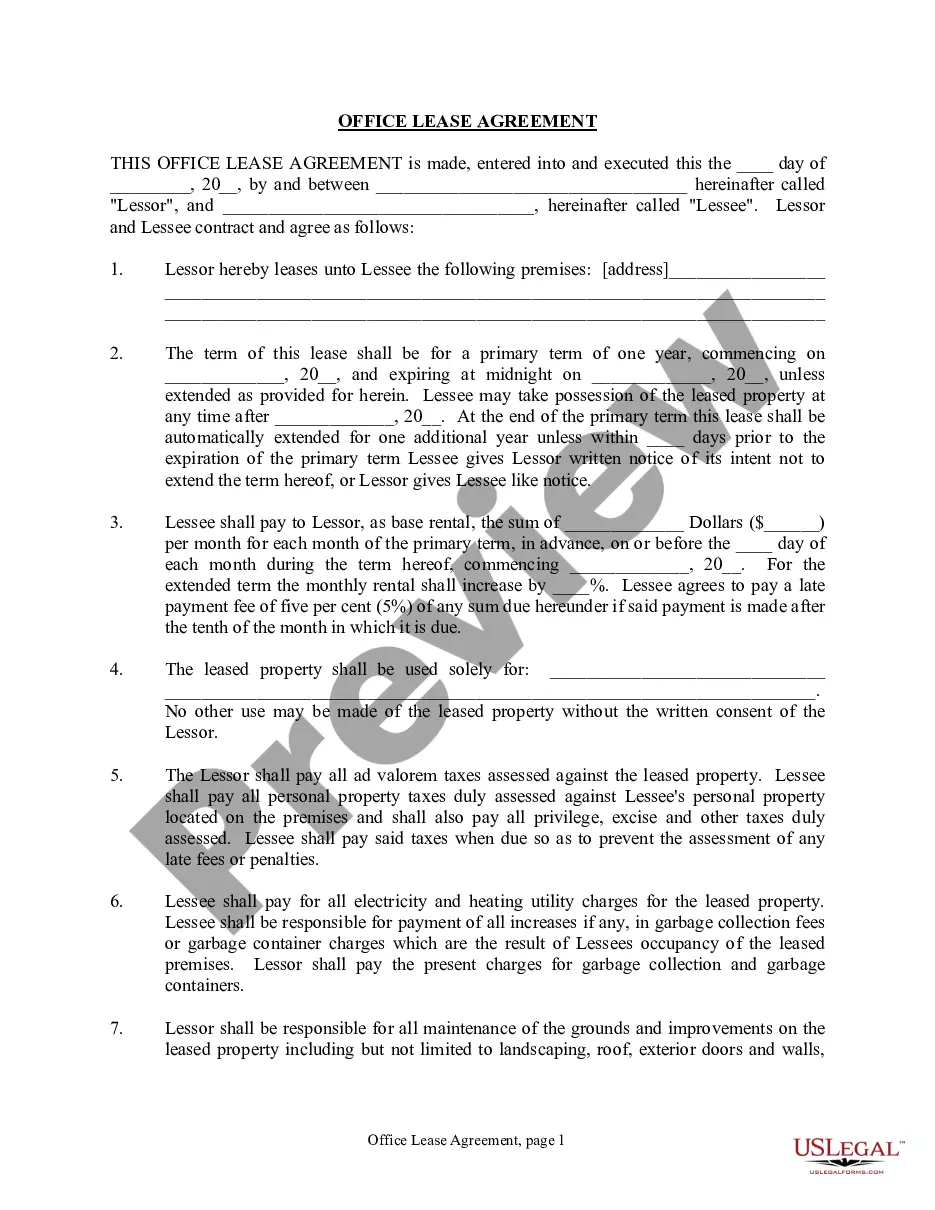

US Legal Forms is the top online service for legal templates, boasting over 85,000 state-specific documents and a range of resources to help you complete your paperwork effortlessly.

Is this your first time utilizing US Legal Forms? Sign up and create your account in mere minutes to gain access to the form directory and Owelty Lien Form Texas Withholding. Then, follow the subsequent steps to fill out your form.

- Explore the collection of pertinent documents available with just one click.

- US Legal Forms provides you with state- and county-specific documents available for download at any time.

- Safeguard your document management processes with a premium service that enables you to prepare any form in just a few minutes without any extra or concealed costs.

- Simply Log In to your account, search for Owelty Lien Form Texas Withholding, and obtain it immediately from the My documents section.

- You can also retrieve previously saved forms.

Form popularity

FAQ

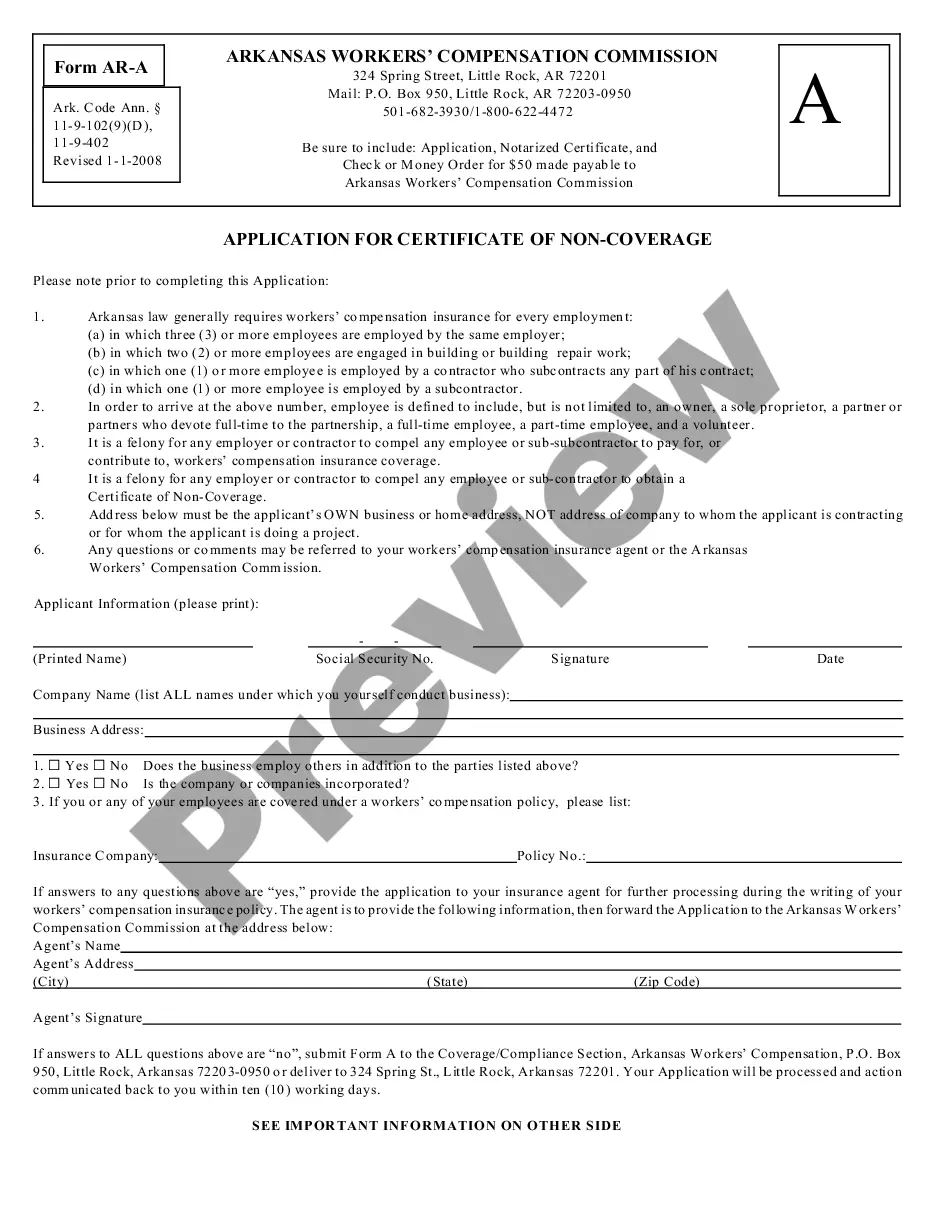

To file a lien in Texas, you need to complete the Owelty lien form; this process involves providing specific information about the property and the parties involved. It is crucial to include details such as the property description and the nature of the claim to ensure compliance with Texas law. Additionally, you must submit the completed form to the appropriate county clerk office where the property is located. Utilizing a reliable platform like USLegalForms can simplify this process by providing templates and guidance tailored to the Owelty lien form Texas withholding.

Filing an owelty lien in Texas involves completing the appropriate forms and submitting them to the county clerk's office. You will need to provide specific details about the property and the parties involved, making accuracy paramount. Using an Owelty lien form in Texas withholding can help ensure you follow all requirements and streamline the process.

In Texas, the statute of limitations on a state tax lien typically lasts for 20 years from the date of the lien's creation. After this period, the lien may no longer be enforceable, allowing property owners some relief. It's important to stay informed on tax obligations and any liens that may affect your property.

The owelty lien statute in Texas governs the creation and enforcement of owelty liens. It specifies the process for establishing a lien when property is divided during divorce or other legal proceedings. For accurate applications of this statute, utilizing an owelty lien form in Texas withholding is highly recommended to ensure compliance and protect your interests.

The constitutional lien statute in Texas refers to the legal framework that allows property owners to secure debts against their property without the need for a formal contract. This statute aims to protect lenders and ensures that they can claim a lien in multiple circumstances. Understanding this statute is vital for anyone dealing with property disputes or loans.

An owelty lien in Texas is a legal claim against property that ensures payment for a debt, typically arising from a divorce or a partition of property. It allows one party to receive compensation for their share of the property, making it crucial during property settlements. Proper documentation is essential, and using an Owelty lien form in Texas withholding can simplify this process.

An owelty lien typically comes into play when a couple divides property during a divorce. For instance, if one spouse retains the family home, they may owe the other spouse a specified amount, secured by an owelty lien. This ensures that the spouse who gave up ownership gets compensated fairly over time. Utilizing an Owelty lien form Texas withholding can help ensure the process is handled correctly and efficiently.

A statutory lien arises from laws that provide a legal claim against a property for certain debts. Common examples include tax liens and mechanics liens, which secure payment for services or unpaid taxes. Knowing about statutory liens is important, especially when dealing with property transactions. For those in Texas, the Owelty lien form Texas withholding may also be categorized under similar legal frameworks.

In Texas, an owelty lien secures the payment owed by one party to another as part of a property division. Essentially, it functions like a financial claim against the property until the agreed compensation is satisfied. This lien ensures that the receiving party gets their fair share. For those involved in property disputes, using the Owelty lien form Texas withholding can simplify the documentation and enforcement of such liens.

Owelty refers to a legal term in property division, particularly during a divorce or property settlement. It involves the court assigning a monetary value to one party's interest in a property, allowing the other party to compensate them accordingly. Understanding Owelty is crucial for anyone navigating complex property disputes. Utilizing resources like the Owelty lien form Texas withholding can help streamline this process.