Land Trust Formation

Description

How to fill out Texas Land Trust Agreement?

Legal documents handling can be perplexing, even for seasoned professionals.

When you seek a Land Trust Formation and lack the opportunity to invest in finding the accurate and current version, the processes may become burdensome.

Gain access to a valuable repository of articles, guides, tutorials, and materials related to your situation and needs.

Save effort and time searching for the documents you require, and use US Legal Forms’ superior search and Review feature to locate Land Trust Formation and retrieve it.

Enjoy the US Legal Forms online library, backed by 25 years of expertise and reliability. Transform your everyday document management into a straightforward and intuitive process today.

- If you possess a membership, Log In to your US Legal Forms account, search for the form, and download it.

- Check your My documents tab to examine the documents you have previously saved and manage your folders as needed.

- If this is your first experience with US Legal Forms, create an account to obtain unlimited access to all platform benefits.

- Here are the steps to follow after downloading the desired form.

- Ensure it is the correct form by previewing it and reviewing its details.

- Access regional or municipal-specific legal and organizational documents.

- US Legal Forms encompasses all requirements you may have, from personal to business paperwork, all consolidated in one location.

- Utilize advanced tools to complete and manage your Land Trust Formation.

Form popularity

FAQ

The price for setting up a trust varies based on its type and complexity. An essential living trust (revocable trust) could range from $1,000 to $3,000, while more complex trusts such as special needs, charitable remainder, or QTIP trusts could cost upwards of $5,000.

To create a living trust in Washington, prepare a written trust document and sign it before a notary public. To finalize the trust and make it effective, you must transfer ownership of your assets into it. A living trust is an effective tool that can provide you with the flexibility and privacy you seek.

Summary of Registration Requirements Within four months of its inception, a charitable trust must file the Application for Registration as a Charitable Trust, a copy of the trust instrument, and a $25 dollar filing fee made payable to the Secretary of State.

The price for setting up a trust varies based on its type and complexity. An essential living trust (revocable trust) could range from $1,000 to $3,000, while more complex trusts such as special needs, charitable remainder, or QTIP trusts could cost upwards of $5,000.

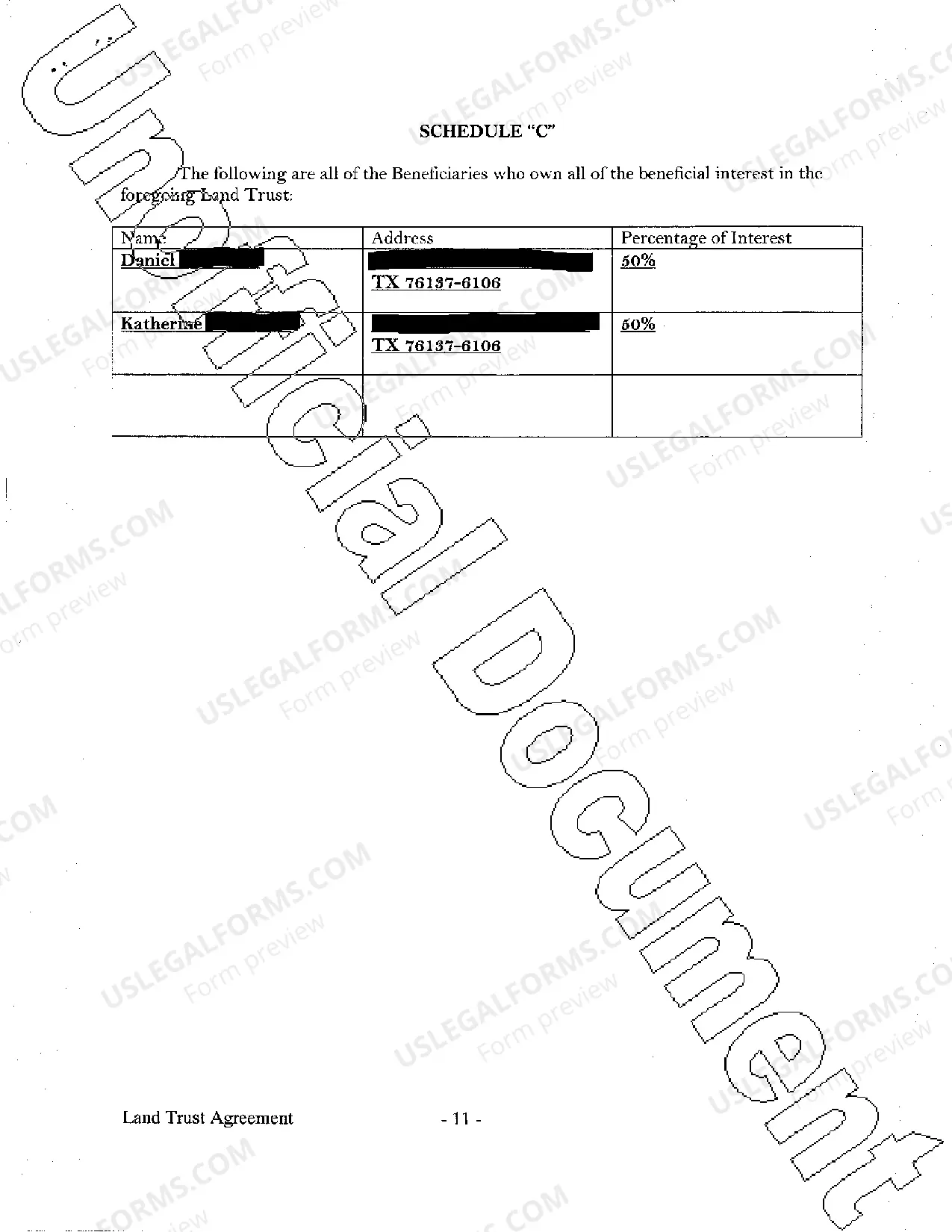

Certain elements are necessary to create a legal trust. The basic elements include a trustor, a trustee, one or more beneficiaries, trust property, and generally a written trust agreement. The person who creates a trust is called a trustor. This person may also be referred to as the ?grantor? or ?settlor?.

The trustee must register the trust by filing with the clerk of the court in any county where venue lies for the trust under RCW 11.96A.

Within four months of its inception, a charitable trust must file the Application for Registration as a Charitable Trust, a copy of the trust instrument, and a $25 dollar filing fee made payable to the Secretary of State.

In Washington, you can make a living trust to avoid probate for virtually any asset you own -- real estate, bank accounts, vehicles, and so on.