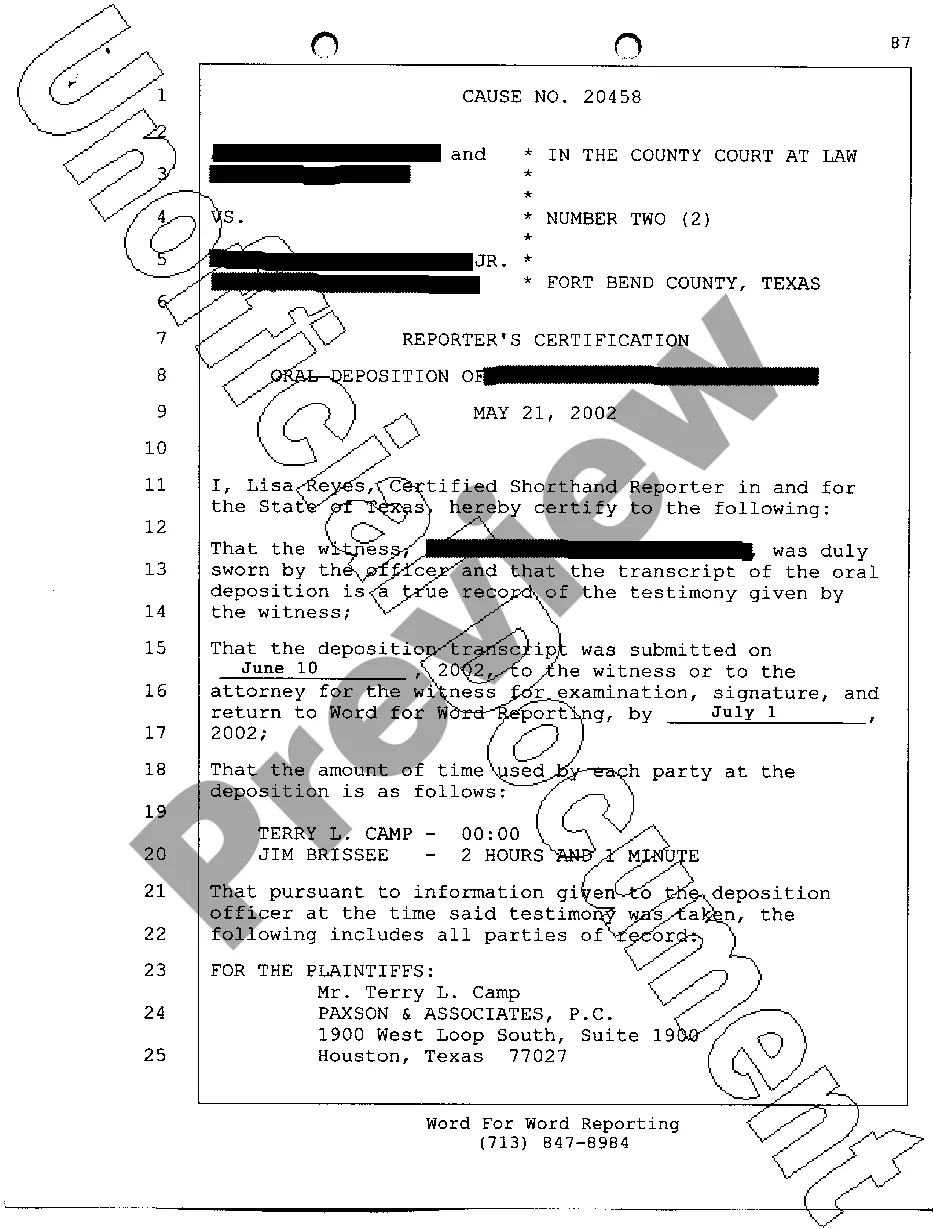

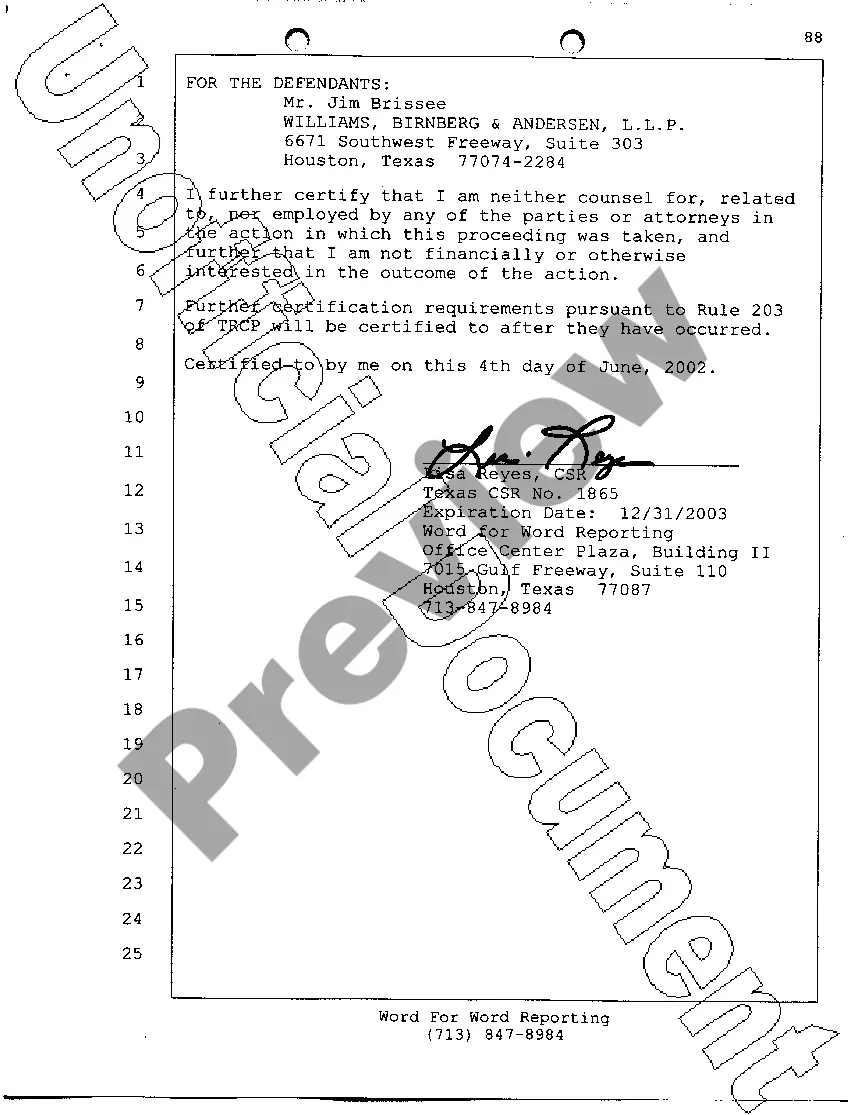

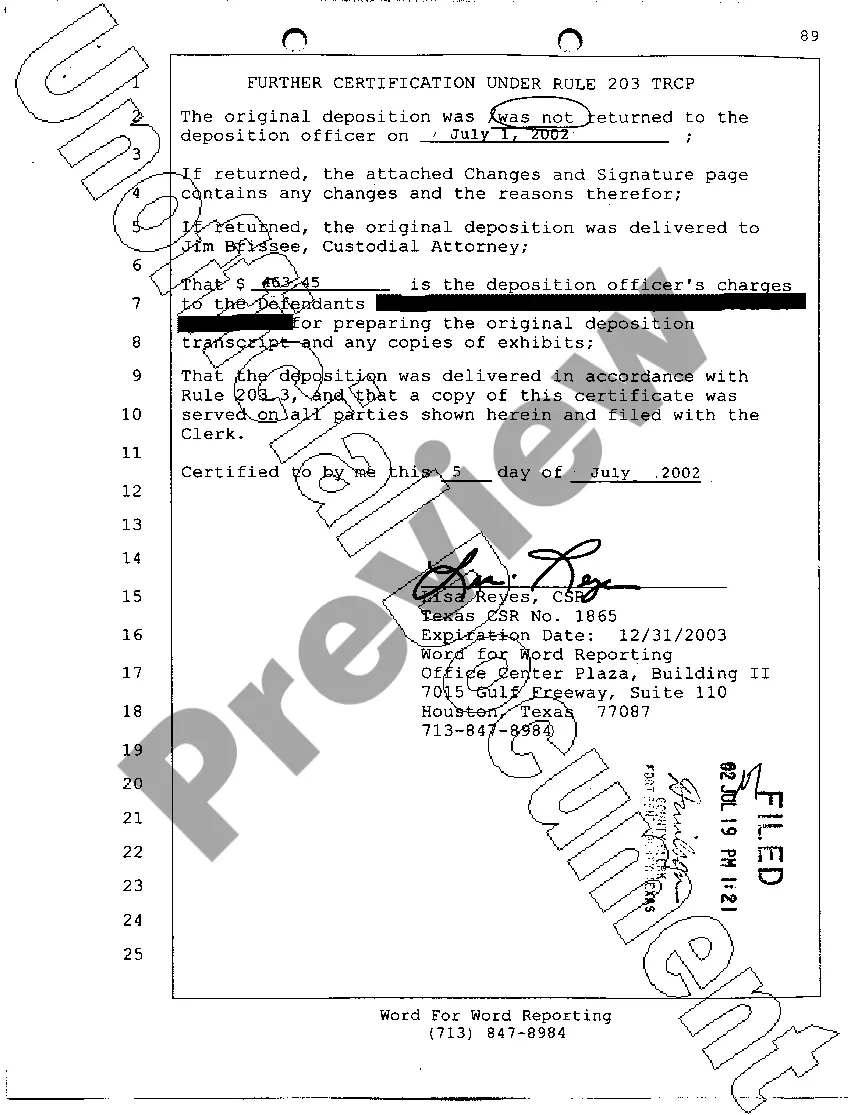

Certificate Of Non Appearance Texas Withholding

Description

How to fill out Texas Court Reporter's Certificate Of Oral Deposition?

Navigating through the red tape of official paperwork and templates can be difficult, particularly when one is not engaged in that field professionally.

Moreover, locating the appropriate template to acquire a Certificate Of Non Appearance Texas Withholding will take a significant amount of time, as it must be accurate and correct down to the last detail.

However, you will need to invest considerably less time locating a suitable template from a resource you can trust.

Obtain the correct form in a few simple steps.

- US Legal Forms serves as a platform that streamlines the process of searching for the correct forms online.

- It is a single destination you need to find the most recent samples of documents, consult their usage, and download these samples to fill them out.

- This is a library containing over 85K forms that apply across various domains.

- When looking for a Certificate Of Non Appearance Texas Withholding, you won’t need to question its legitimacy, as all forms are authenticated.

- Creating an account with US Legal Forms ensures you have all necessary samples at your fingertips.

- Store them in your history or add them to the My documents collection.

- You can access your saved forms from any device by simply clicking Log In on the library site.

- If you do not yet have an account, you can always search for the template you need.

Form popularity

FAQ

Rule 176 governs the issuance of subpoenas in Texas. It stipulates the requirements for serving subpoenas, which can compel attendance at a trial or to produce documents. This rule can be particularly relevant for those seeking a Certificate of non appearance Texas withholding, ensuring proper procedures are followed for legal documents.

Rule 199 outlines the procedures for depositions in Texas. It specifies how and when depositions can be taken and the requirements for notifying parties involved. Familiarity with these rules can aid in situations where documentation, such as a Certificate of non appearance Texas withholding, becomes necessary to present in court.

Rule 174 allows parties in a civil case to contest or agree to their jurisdictional limitations. This is important in determining where a case can be heard. Understanding Rule 174 includes knowing how it can relate to issues like the Certificate of non appearance Texas withholding, ensuring proper legal protocol is followed.

Yes, in Texas, you can be served legal documents on a Sunday. The law does not prohibit service of process on weekends or holidays. This is crucial for those who are involved in legal matters and may require documentation relating to a Certificate of non appearance Texas withholding.

The new initial disclosure rule in Texas requires parties to disclose to each other important information at the start of a lawsuit. This includes basic details about witnesses, documents, and any potential claims or defenses. This transparency aims to streamline the legal process and can be particularly important when addressing matters like a Certificate of non appearance Texas withholding.

A Certificate of Account Status to terminate Texas registration is a document needed when dissolving or terminating a business entity. This certificate confirms that all obligations have been met, and there are no outstanding taxes owed to the state. Obtaining this certificate ensures compliance and helps prevent any future liabilities. Platforms like U.S. Legal Forms can provide guidance in acquiring this document efficiently.

If someone fails to show up to a deposition, it can complicate the legal process. The court may issue sanctions or a subpoena to compel their appearance. Additionally, the absence can affect the outcome of the case, as their testimony may be considered crucial. You should consult with a legal professional to determine the best course of action in such situations.

Getting a Texas Certificate of Account Status involves submitting a request to the Texas Comptroller online or through a written request. You’ll need to provide relevant information about your business and ensure all tax obligations are met. This certificate is essential for various business activities, ensuring that your business is compliant with state requirements, including the aspect of Certificate of Non Appearance Texas Withholding.

Proof of active status with the Texas Comptroller is a document that verifies a business is legally recognized and in good standing. This typically includes the Certificate of Account Status, which shows that your business is registered and current on all taxes and obligations. Ensuring you have this proof can be vital for securing contracts or financing.

To obtain a Certificate of Account Status in Texas, you need to request it through the Texas Comptroller’s office. You can do this online or by submitting a form by mail. This document confirms your business's status and ensures it is in compliance with state regulations. Having the Certificate of Non Appearance Texas Withholding can help streamline this process.