Application For Writ Of Garnishment Form Texas

Description

How to fill out Texas Writ Of Garnishment?

Drafting legal documents from scratch can often be daunting. Certain scenarios might involve hours of research and hundreds of dollars invested. If you’re searching for an easier and more cost-effective way of preparing Application For Writ Of Garnishment Form Texas or any other documents without jumping through hoops, US Legal Forms is always at your disposal.

Our online catalog of over 85,000 up-to-date legal forms addresses virtually every element of your financial, legal, and personal matters. With just a few clicks, you can instantly access state- and county-compliant templates diligently prepared for you by our legal professionals.

Use our website whenever you need a trustworthy and reliable services through which you can easily find and download the Application For Writ Of Garnishment Form Texas. If you’re not new to our website and have previously set up an account with us, simply log in to your account, locate the template and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No worries. It takes little to no time to set it up and navigate the catalog. But before jumping straight to downloading Application For Writ Of Garnishment Form Texas, follow these tips:

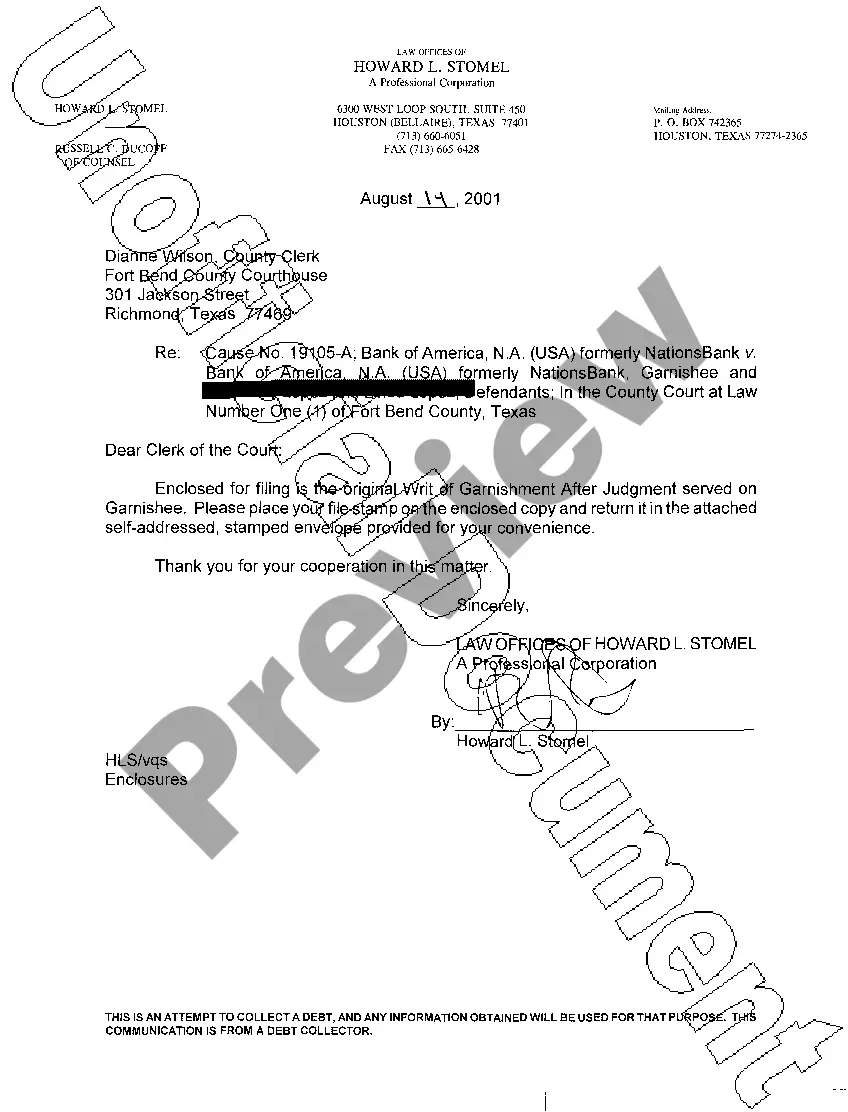

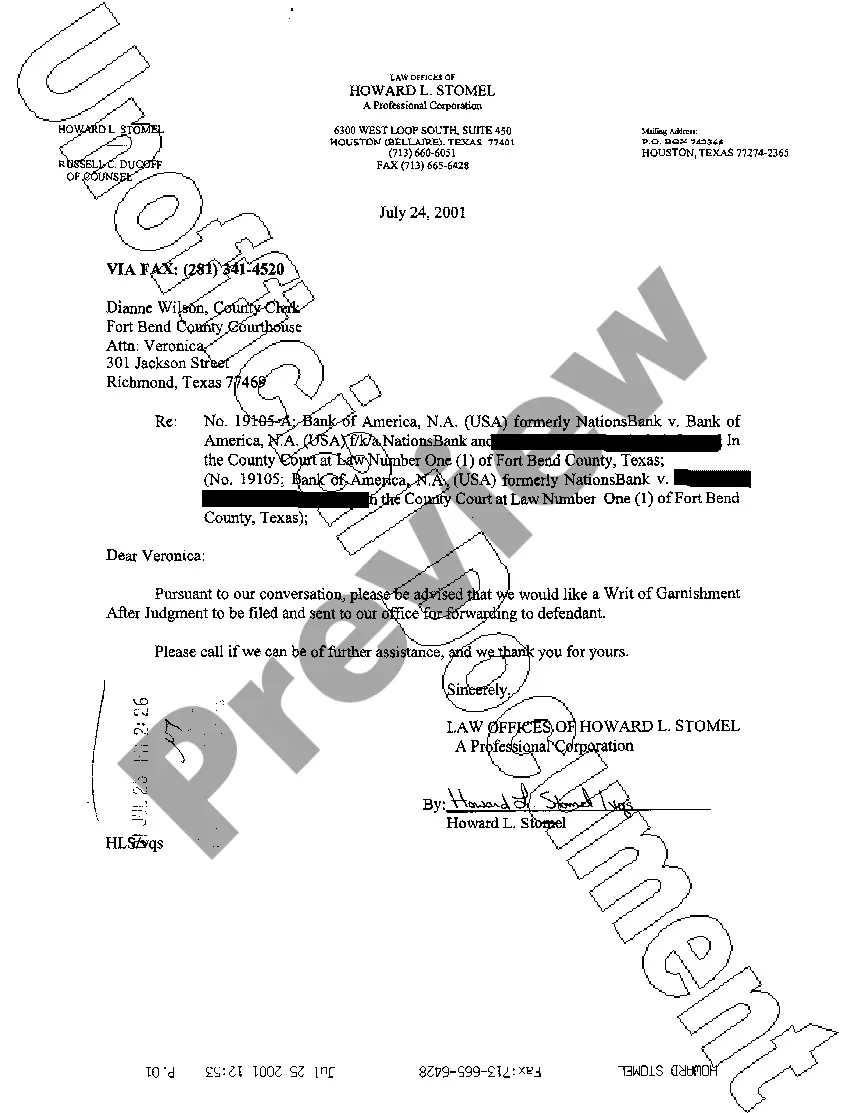

- Review the document preview and descriptions to ensure that you are on the the document you are looking for.

- Check if template you choose conforms with the regulations and laws of your state and county.

- Choose the right subscription option to get the Application For Writ Of Garnishment Form Texas.

- Download the file. Then fill out, certify, and print it out.

US Legal Forms has a good reputation and over 25 years of experience. Join us today and transform form execution into something simple and streamlined!

Form popularity

FAQ

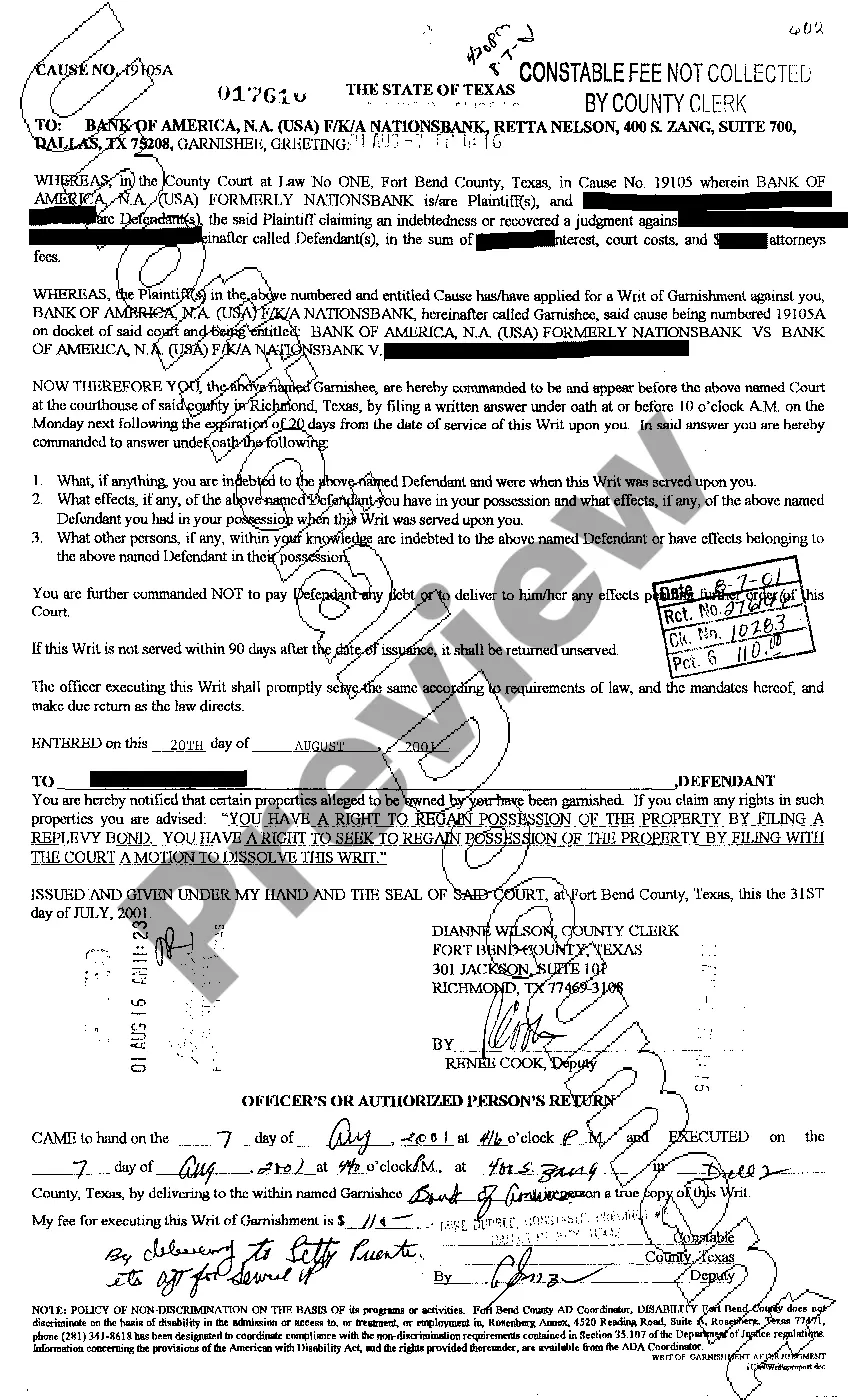

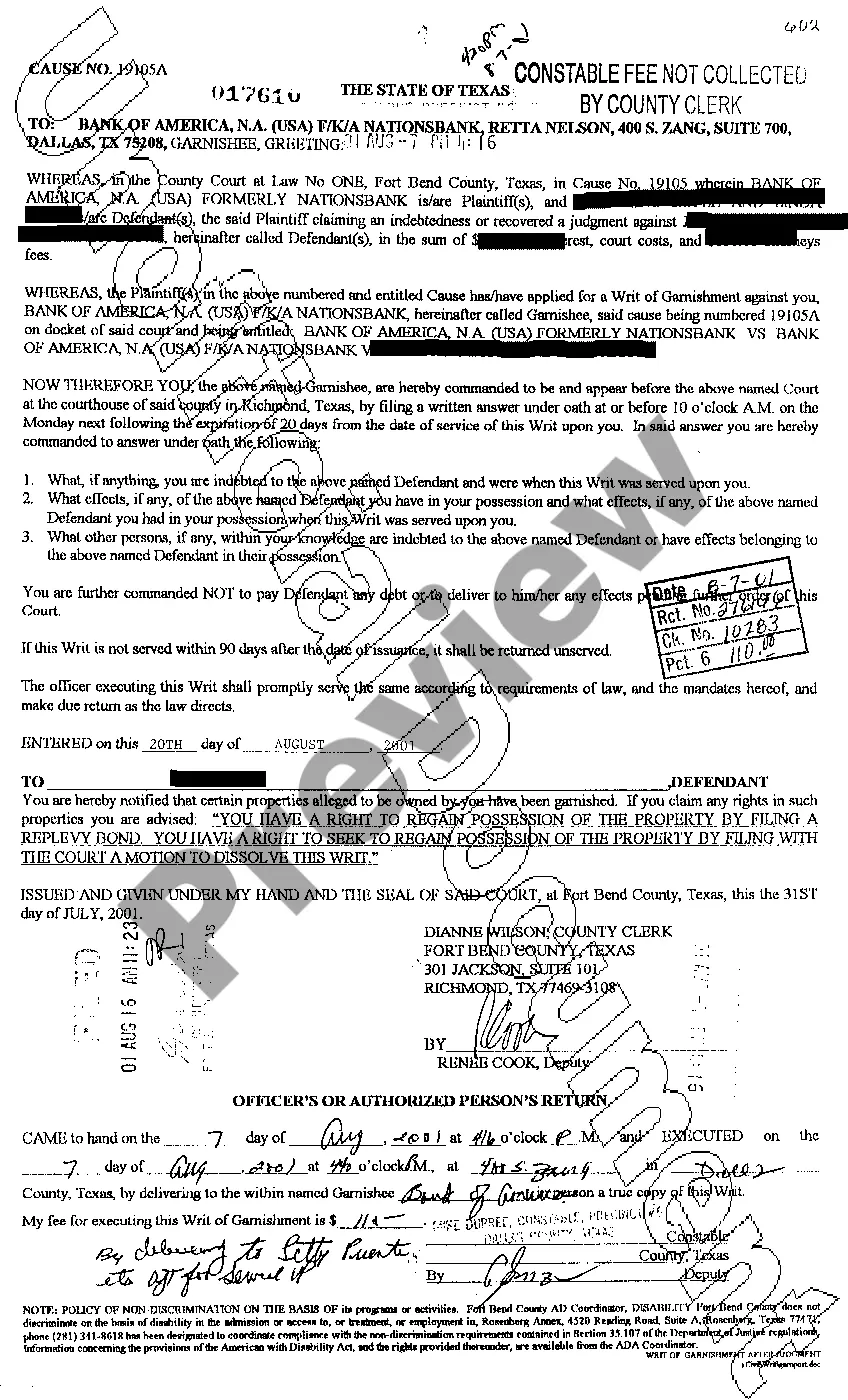

In order to file a Writ of Garnishment, the creditor must have an existing final judgment against the debtor and then must file for the writ in the court which rendered the original judgment against the debtor. It is the third party, the bank or financial institution, which receives the Writ of Garnishment. Tex.

If you want to stop wage garnishment once and for all, filing for bankruptcy is your best option in Texas. As soon as your DebtStoppers lawyer files your petition, the court will grant you an automatic stay that forbids any creditor from garnishing your wages.

In Texas, wage garnishment is prohibited by the Texas Constitution except for a few kinds of debt: child support, spousal support, student loans, or unpaid taxes. A debt collector cannot garnish your wages for ordinary debts. However, Texas does allow for a bank account to be frozen.

30 days after obtaining a final judgment, a creditor can request a Writ of Execution from the clerk of the court. The creditor or the creditor's attorney will fill out a Writ of Execution form available at any county courthouse.

Typically, a creditor must have filed a lawsuit against the debtor and won a judgment. After winning the judgment, the creditor will file a separate court case against a third party (also called a "garnishee") who has your money and ask the court to issue a writ of garnishment.