Georgia 10 Day Repossession Letter With Credit Card

Description

How to fill out Texas Letters?

Dealing with legal documents and processes can be a lengthy addition to your schedule.

Georgia 10 Day Repossession Letter With Credit Card and similar forms usually require you to search for them and maneuver through the completion process efficiently.

Therefore, whether you are managing financial, legal, or personal issues, possessing a comprehensive and accessible online repository of forms readily available will be extremely beneficial.

US Legal Forms is the leading online service for legal templates, providing over 85,000 state-specific forms along with a variety of resources to help you complete your documentation with ease.

Is this your first time using US Legal Forms? Register and create a free account in just a few minutes to gain access to the form library and the Georgia 10 Day Repossession Letter With Credit Card. After that, follow the steps below to fill out your form.

- Explore the library of pertinent documents accessible to you with just a single click.

- US Legal Forms offers state and county-specific forms at any time for quick downloading.

- Protect your document management processes with top-quality support that allows you to create any form in minutes without any extra or hidden fees.

- Simply Log In to your account, locate Georgia 10 Day Repossession Letter With Credit Card, and download it immediately from the My documents section.

- You can also retrieve previously downloaded forms.

Form popularity

FAQ

In Louisiana, the law allows creditors to repossess vehicles if payments are missed, typically requiring a notice before repossession. While the primary focus is on direct communication with the debtor, understanding state-specific terms can be beneficial. If you want to stay informed and prepared, you may find useful resources on how to draft a Georgia 10 day repossession letter with credit card to protect your interests.

When crafting a repossession letter, begin with your contact information, followed by the date. Clearly outline the facts, including any overdue payment details and state the consequences, like potential repossession. To ensure correctness, consider using templates from UsLegalForms, which provide guidance on creating an effective Georgia 10 day repossession letter with credit card.

To write a letter for car repossession, start by including your name, address, and contact details at the top. Next, clearly state the purpose of the letter, mentioning the vehicle details and the relevant account information. It's important to include a clear request for the return of the vehicle while mentioning the terms associated with your Georgia 10 day repossession letter with credit card.

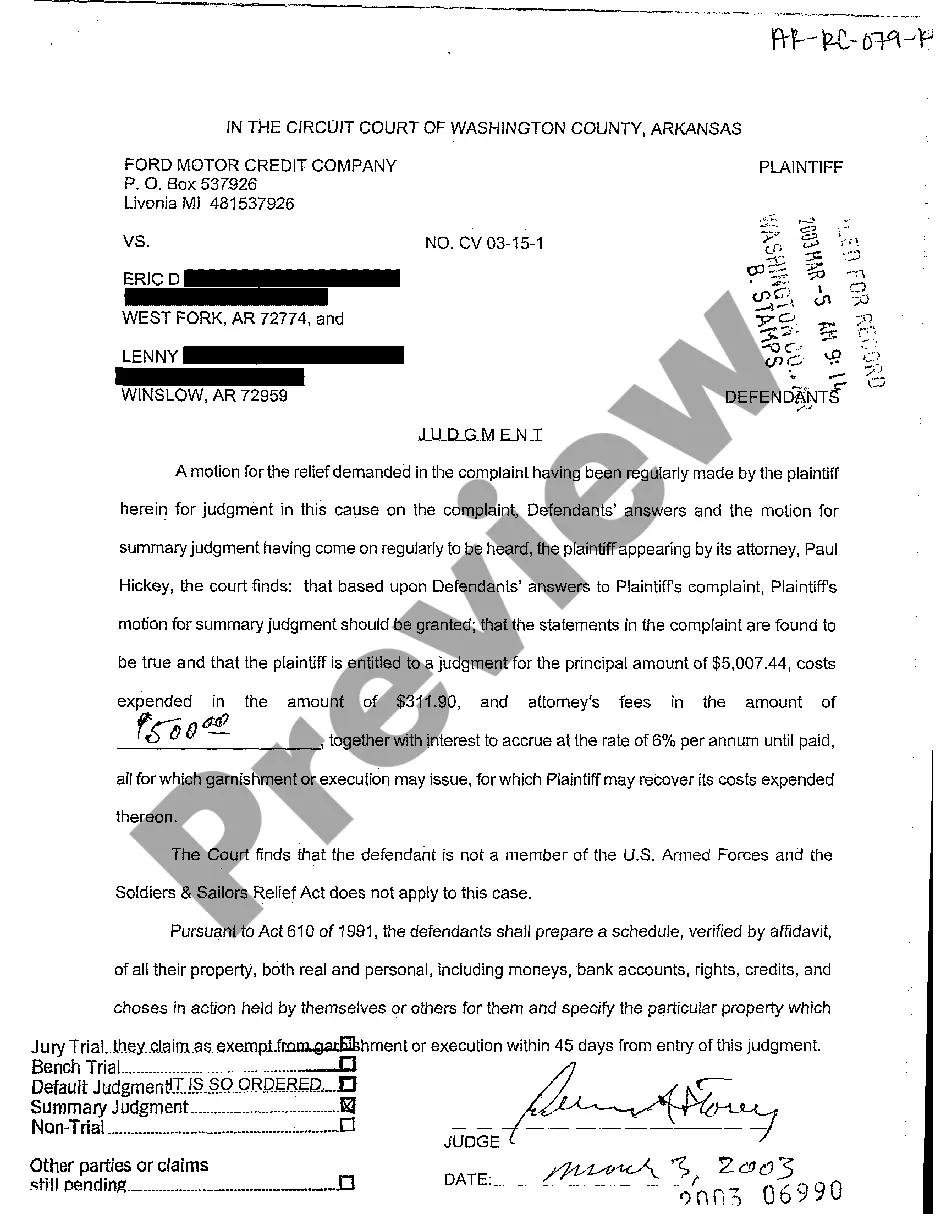

Generally, your car cannot be repossessed solely for credit card debt since car repossession is tied to auto loans. However, if a court judgment is issued for unpaid debts, creditors can sometimes place liens on your assets, which could affect your vehicle. Always seek professional guidance if you're concerned about your financial obligations. For information on handling these situations, a Georgia 10 day repossession letter with credit card details may provide clarity and direct you towards appropriate resources.

Creating a Georgia 10 day repossession letter with credit card can be straightforward. Begin by including the debtor's name, address, and account details. Next, specify the reason for repossession and clearly state the amount owed. Finally, mention the deadline for repayment and the consequences of failure to act, ensuring you comply with Georgia law.

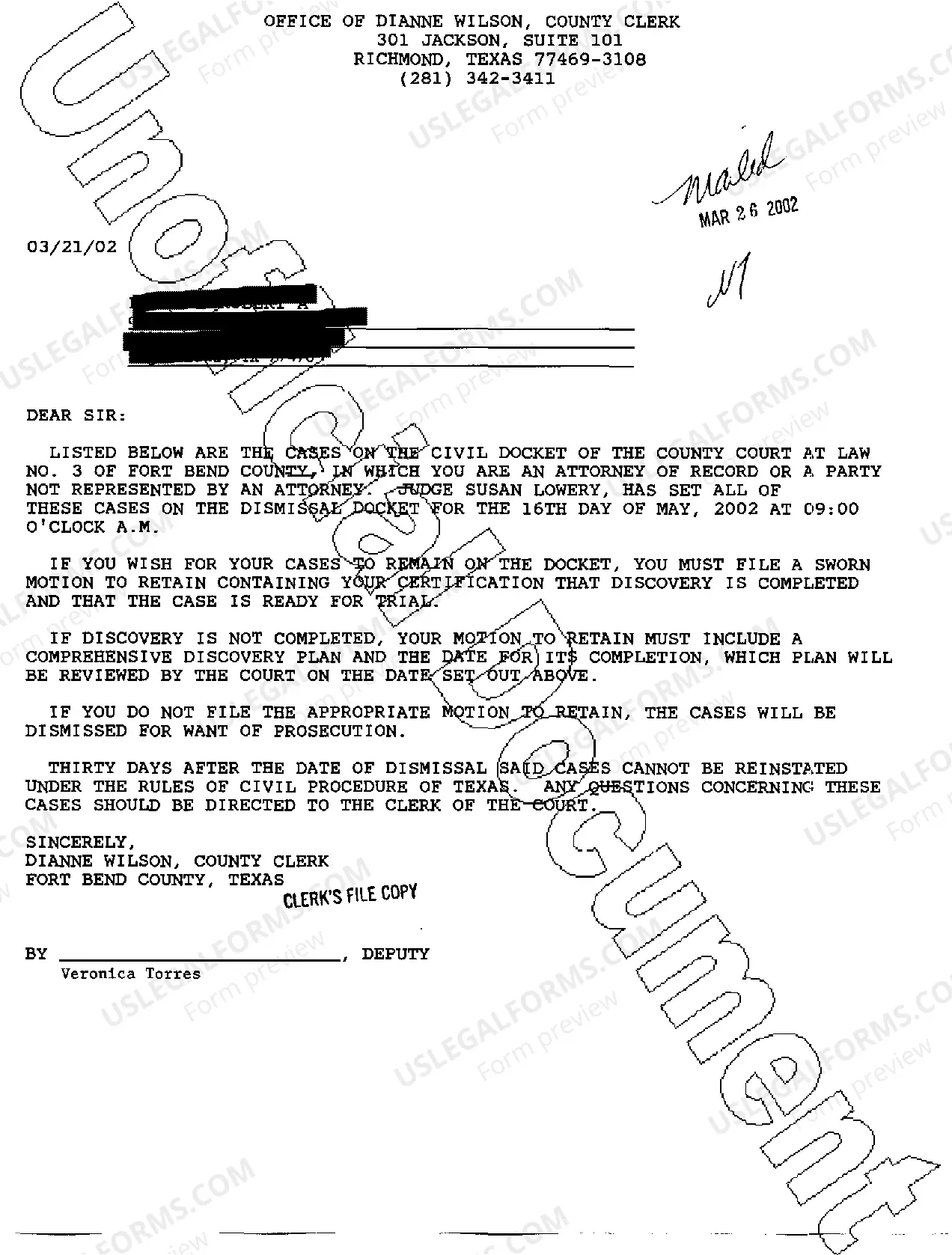

Once your auto vehicle is taken, the lender has to mail you a notice within 10 days explaining that your automobile has been repossessed. The notice will explain how you have to pay off the loan and repo fees if you want your car back. It will also tell you how long you have to get your car back.

How Many Payments Can You Miss Before Your Car is Repossessed? There is no set time limit on when your car can be repossessed if you have defaulted on your loan. Technically, when you are even one day late with your car payments you are in default of your loan agreement.

Under Georgia law (O.C.G.A. 10-1-36) that provides the rights of the buyer and seller after the repossession of a motor vehicle sold under a retail installment contract, you can redeem your car after repossession as long as you do so within ten days of the repossession.

The repo company cannot enter your home or garage to take the vehicle without your permission. They are allowed to go onto the property to get your car if it's parked somewhere such as the driveway or the carport. In Georgia, the repossession company is not allowed to breach the peace when repossessing your car.

If you have paid less than 60 percent of the car loan when the creditor takes back the car, the creditor is allowed to keep the car to pay off the debt. However, if you believe the car is worth more than you owe, you have 21 days to object in writing. If you object, the creditor must resell the vehicle.