Georgia 10 Day Repossession Letter For Auto Accident Settlement

Description

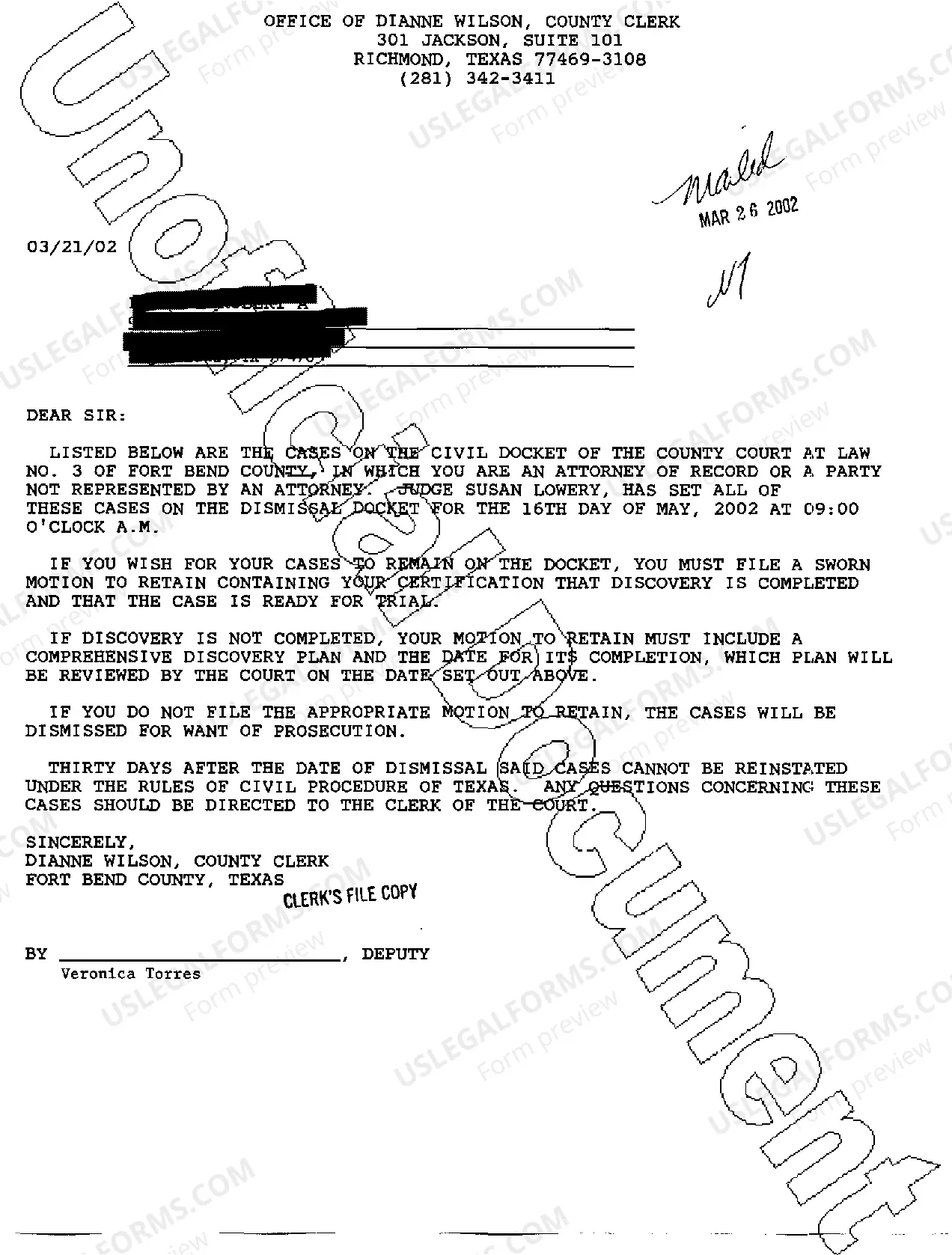

How to fill out Texas Letters?

It’s clear that you cannot instantly become a legal expert, nor can you swiftly create a Georgia 10 Day Repossession Letter For Auto Accident Settlement without possessing a specialized skill set.

Compiling legal documents is a lengthy endeavor necessitating specific training and expertise. Therefore, why not entrust the drafting of the Georgia 10 Day Repossession Letter For Auto Accident Settlement to the experts.

With US Legal Forms, which boasts one of the most comprehensive legal document collections, you can locate everything from court documents to templates for office correspondence. We recognize the importance of compliance with federal and local regulations. That’s why all templates on our website are location-specific and current.

Select Buy now. After the payment is finalized, you can download the Georgia 10 Day Repossession Letter For Auto Accident Settlement, complete it, print it, and dispatch it to the intended recipients or organizations.

You can regain access to your forms from the My documents tab anytime. If you are a returning customer, you can simply Log In and locate and download the template from the same tab.

- Begin your journey on our platform and acquire the document you require within moments.

- Find the document you seek by utilizing the search feature at the top of the page.

- Examine it (if this option is available) and read the accompanying description to ascertain whether the Georgia 10 Day Repossession Letter For Auto Accident Settlement is what you are looking for.

- Start a new search if you are in need of a different template.

- Sign up for a complimentary account and select a subscription plan to acquire the form.

Form popularity

FAQ

The repossession statute in Georgia governs the legal requirements for reclaiming vehicles. Under this law, lenders may take possession of a vehicle after sending a Georgia 10 day repossession letter for auto accident settlement, provided the borrower has defaulted. This statute also outlines the necessary steps lenders must follow to ensure the process is legal and fair. Understanding these laws can help you navigate any potential repossession situation effectively.

The timeline for car repossession in Georgia can vary, but it usually happens fairly quickly if payments are missed. Once a borrower defaults, lenders may issue a Georgia 10 day repossession letter for auto accident settlement to initiate the process. This letter typically gives the borrower a short window to catch up on payments before repossession occurs. Therefore, staying informed about your payment obligations can help you avoid unexpected repossession.

To settle repossession debt, start by evaluating the total amount owed and gather all relevant documentation. Open a line of communication with your lender to discuss possible settlement options, which may include renegotiating payment terms. This process can be enhanced by considering the steps outlined in a Georgia 10 day repossession letter for auto accident settlement, which provides a structured approach to addressing your situation.

Creating a repossession letter involves drafting a clear and concise document that outlines the details of the repossession. Be sure to include the reasons, dates, and relevant information. Utilizing resources like uslegalforms can help you generate a Georgia 10 day repossession letter for auto accident settlement, ensuring all necessary legal aspects are covered.

Writing a voluntary repossession letter requires clarity and sincerity. Start by stating your intention to return the vehicle and provide necessary information, such as the vehicle identification number and your contact details. By referencing a Georgia 10 day repossession letter for auto accident settlement, you can enhance the effectiveness of your communication and ensure a smoother resolution.

To write a repossession letter, you should include essential details such as the account number, the reason for repossession, and a clear statement of intent. Additionally, specify a time frame for when the vehicle should be returned. For a more streamlined process, consider using a prepared template that reflects a Georgia 10 day repossession letter for auto accident settlement.

In Georgia, repossession is allowed without a court order as long as it is done without breaching the peace. Once a car is repossessed, the lender must send you a Georgia 10 day repossession letter for auto accident settlement. This letter serves as notification about your rights and options regarding the repossessed vehicle. Familiarizing yourself with these rules can empower you to navigate the situation effectively.

A repossession letter usually contains specific information about your overdue car payments and the lender's intent to reclaim the vehicle. It may reference the Georgia 10 day repossession letter for auto accident settlement, detailing your rights and obligations. This letter often explains how you can prevent repossession by making your payments on time. Understanding what the letter entails can help you respond correctly.

In Georgia, lenders typically initiate the repossession process after you miss two to three payments. This means that if you are 30 to 60 days behind, you may receive a Georgia 10 day repossession letter for auto accident settlement. It is crucial to communicate with your lender early if you experience difficulties with payments. Prompt action can help you avoid the stress of repossession.