10 Day Repossession Letter Sample Texas Withdrawal

Description

How to fill out Texas Letters?

Bureaucracy requires exactness and correctness.

If you do not engage in completing documents like the 10 Day Repossession Letter Sample Texas Withdrawal regularly, it may lead to some confusion.

Choosing the right sample from the beginning will ensure that your document submission proceeds smoothly and avoid any issues of re-submitting a file or performing the same task from the start.

If you are not a subscribed user, discovering the required sample may involve a few extra steps: Locate the template using the search box, verify that the 10 Day Repossession Letter Sample Texas Withdrawal you've found is applicable to your state or area, view the preview or read the description containing the details on the template's application. If the outcome aligns with your search, click the Buy Now button, choose the suitable option from the offered subscription plans, Log In to your account or sign up for a new one, complete the transaction via credit card or PayPal, and save the form in your preferred format. Acquiring the correct and updated samples for your documentation takes just a few minutes with an account at US Legal Forms. Sidestep bureaucratic issues and simplify your paperwork processes.

- You can effortlessly locate the appropriate sample for your documents in US Legal Forms.

- US Legal Forms is the largest online collection of forms, housing over 85 thousand samples for various fields.

- You can obtain the latest and most pertinent version of the 10 Day Repossession Letter Sample Texas Withdrawal by simply searching for it on the site.

- Locate, store, and save templates in your account or review the description to confirm that you possess the correct one.

- With an account at US Legal Forms, accessing, organizing, and browsing through the templates you save for quick retrieval is straightforward.

- While on the website, click the Log In button to Log In.

- Then, navigate to the My documents section, where your document list is maintained.

- Peruse the descriptions of the forms and bookmark the ones you need at any time.

Form popularity

FAQ

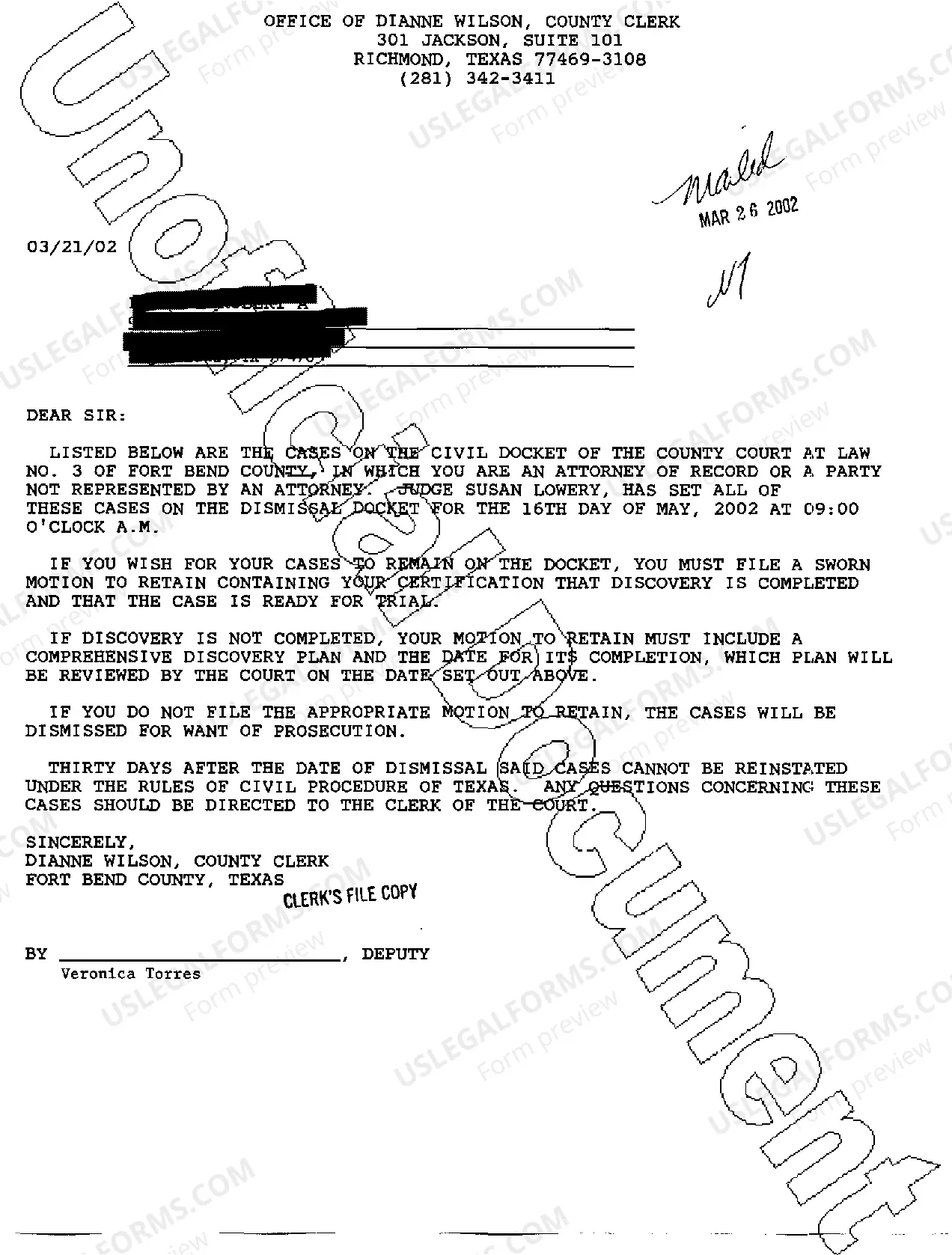

A 10-day letter in family court in Texas serves as a formal notice regarding repossession. When a debtor fails to make payments, this letter outlines the intent to reclaim property, providing a clear timeframe for the debtor to respond. The 10 day repossession letter sample texas withdrawal is essential for ensuring that all legal steps are followed properly within the designated period. Using a reliable resource like USLegalForms can help you draft an accurate and effective 10-day letter tailored to your situation.

Yes, lenders typically send a letter before repossession, often referred to as a demand letter. This letter notifies borrowers about their overdue payments and warns them about the potential repossession of their asset. It is crucial to address any outstanding issues highlighted in this letter promptly. For a clear understanding and examples, check out the 10 day repossession letter sample Texas withdrawal available on US Legal Forms.

Writing a repossession letter involves outlining the reasons for the repossession, including outstanding debts and relevant account information. Be direct and professional in your tone, and include a deadline for the borrower to respond. This clarity can help expedite the process and prevent misunderstandings. For those looking for guidance, US Legal Forms can provide valuable resources, including a 10 day repossession letter sample Texas withdrawal.

To write a voluntary repossession letter, you should clearly state your intention to return the item and provide relevant details about the asset, including the account number. Make sure to specify the date you plan to return the asset, as well as any outstanding balance that needs addressing. Using a proper format ensures that your communication is clear and effective. US Legal Forms offers templates to assist you in crafting a suitable voluntary repossession letter.

A 10 day demand letter Texas is a formal notice sent to borrowers, informing them of overdue payments and impending repossession actions. This letter serves as a warning that the lender intends to reclaim the asset unless the debt is settled within ten days. By understanding this process, you can better prepare yourself if you find yourself in a similar situation. For a comprehensive guide, including a 10 day repossession letter sample Texas withdrawal, visit US Legal Forms.

A 10 day demand letter in Texas is a specific written notice that informs the debtor of their obligation to settle their outstanding debt promptly. It acts as a warning before legal actions, such as repossession, take place. By using a 10 day repossession letter sample texas withdrawal, you can create a clear and effective letter that complies with Texas laws. This proactive approach can help you resolve issues efficiently and maintain control over the situation.

A 10-day demand is a formal request for payment that requires the recipient to settle their debt within ten days. This demand often serves as a precursor to further legal action, such as repossession or filing a lawsuit. Utilizing a 10 day repossession letter sample texas withdrawal can streamline the process and ensure compliance with legal standards. Understandably, it's an essential step in protecting your financial interests.

To write a demand letter in Texas, start by clearly stating your intention. Include important details such as the amount owed and any relevant circumstances surrounding the debt. Reference the 10 day repossession letter sample texas withdrawal, if applicable, to guide your tone and structure. Finally, send your letter through a means that provides proof of delivery.

A 10-day demand letter Texas is a formal document aimed at prompting a quick response from the recipient regarding an outstanding issue or obligation. This letter clearly outlines the demands and includes a 10-day response timeframe, making it critical for resolving disputes efficiently. To assist in crafting an effective letter, you may consider using platforms like US Legal Forms, which provide templates catered to Texas laws.

The 10-day letter of demand process involves drafting a letter that specifies your demands and provides a 10-day window for the other party to comply. This is a critical step before pursuing legal action, as it establishes your intent to resolve the matter amicably. Following this process shows good faith and can potentially avert more serious legal disputes.