Sr 22 Financial Responsibility Insurance Certificate For California

Description

How to fill out Texas Financial Responsibility Insurance Certificate?

Legal papers managing might be mind-boggling, even for the most skilled specialists. When you are looking for a Sr 22 Financial Responsibility Insurance Certificate For California and do not get the time to commit searching for the correct and up-to-date version, the operations might be demanding. A strong web form catalogue can be a gamechanger for anyone who wants to deal with these situations effectively. US Legal Forms is a market leader in web legal forms, with more than 85,000 state-specific legal forms available to you whenever you want.

With US Legal Forms, you can:

- Access state- or county-specific legal and organization forms. US Legal Forms handles any requirements you may have, from personal to organization documents, in one location.

- Use innovative resources to complete and manage your Sr 22 Financial Responsibility Insurance Certificate For California

- Access a useful resource base of articles, guides and handbooks and materials connected to your situation and needs

Save time and effort searching for the documents you will need, and employ US Legal Forms’ advanced search and Review tool to discover Sr 22 Financial Responsibility Insurance Certificate For California and download it. If you have a monthly subscription, log in for your US Legal Forms profile, search for the form, and download it. Take a look at My Forms tab to find out the documents you previously downloaded and also to manage your folders as you see fit.

If it is the first time with US Legal Forms, register an account and acquire unlimited usage of all advantages of the library. Listed below are the steps for taking after downloading the form you want:

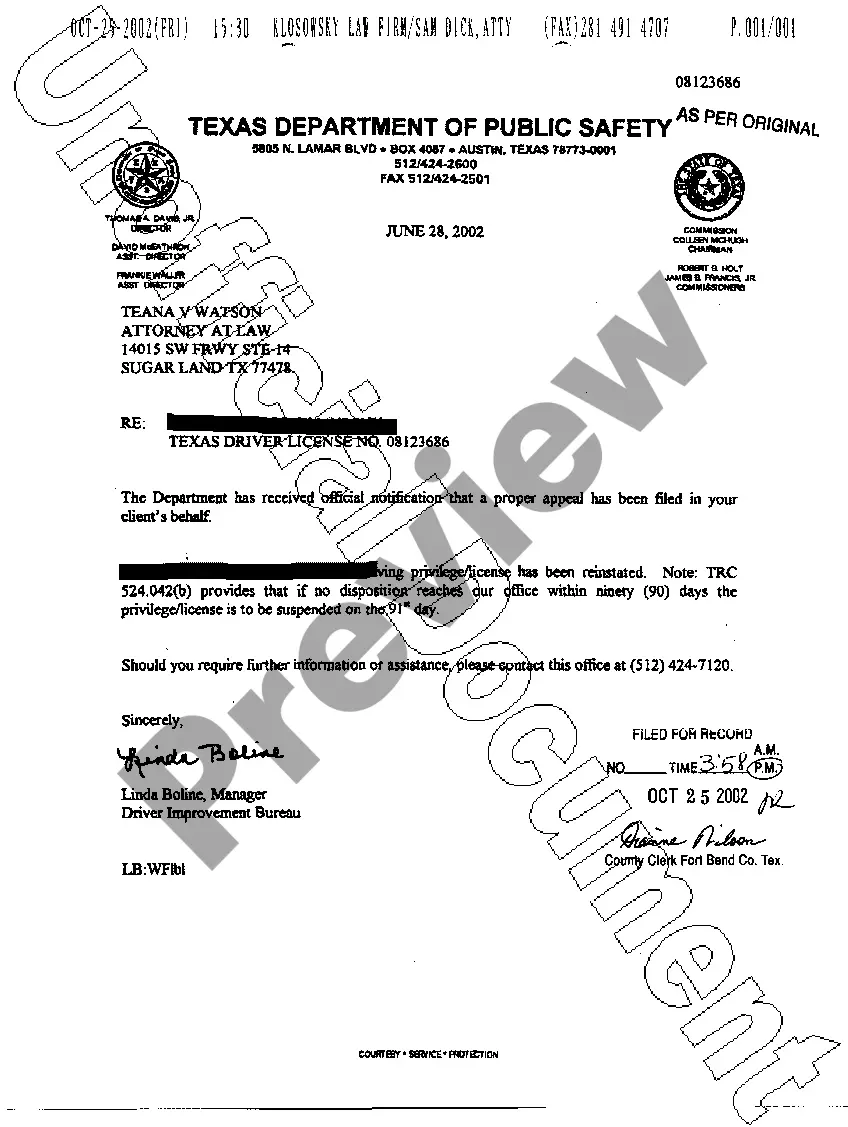

- Verify this is the right form by previewing it and looking at its description.

- Be sure that the sample is accepted in your state or county.

- Choose Buy Now once you are ready.

- Choose a subscription plan.

- Pick the formatting you want, and Download, complete, sign, print and deliver your papers.

Take advantage of the US Legal Forms web catalogue, backed with 25 years of experience and reliability. Change your everyday papers administration in to a smooth and easy-to-use process today.

Form popularity

FAQ

How to get an SR-22 in California. Filing an SR-22 isn't something you do on your own. California requires insurers to electronically report insurance information to the DMV. If you need an SR-22, ask your insurer to file one on your behalf ? if it will. Some insurance companies don't file SR-22s.

You may be requested to submit additional insurance information to DMV, such as: A document or identification card from your insurance company. A DMV authorization letter, if you are a cash depositor or are self-insured. California Proof of Insurance Certificate (SR 22) form for broad coverage or owner's policy.

They'll refer you to one of these options. Online. See your registration suspension status, submit your proof of insurance and reinstatement fee, and submit/remove an Affidavit of Non-Use (ANU). ... Email. Email a scanned copy of your proof of insurance to VehicleFRProgram@dmv.ca.gov. Kiosks. ... Mail. ... Phone.

Simply put, a California SR22 is a form (provided by your car insurance company) that verifies you have met this state's requirement for auto liability insurance. Upon issuance, your insurance company will forward a copy to the California Department of Motor Vehicles (DMV).

Your insurance company will notify the DMV that you have the SR22 on file. The SR22 is usually required for three years, but it can be longer or shorter, depending on your situation.