Tx Tenant Eviction Without Lease Agreement

Description

How to fill out Texas Landlord Tenant Eviction / Unlawful Detainer Forms Package?

Finding a reliable source to obtain the most up-to-date and pertinent legal forms is a significant part of managing bureaucracy.

Selecting the appropriate legal documents requires accuracy and meticulousness, which is why it's vital to obtain samples of Tx Tenant Eviction Without Lease Agreement exclusively from trustworthy providers, such as US Legal Forms. An incorrect template will squander your time and prolong your current situation.

Once you have the form on your device, you can edit it using the editor or print it and complete it by hand. Eliminate the stress associated with your legal documentation. Browse through the extensive US Legal Forms database to discover legal templates, verify their suitability for your circumstances, and download them instantly.

- Utilize the library navigation or search function to find your template.

- Review the form's details to determine if it meets the specifications of your state and locality.

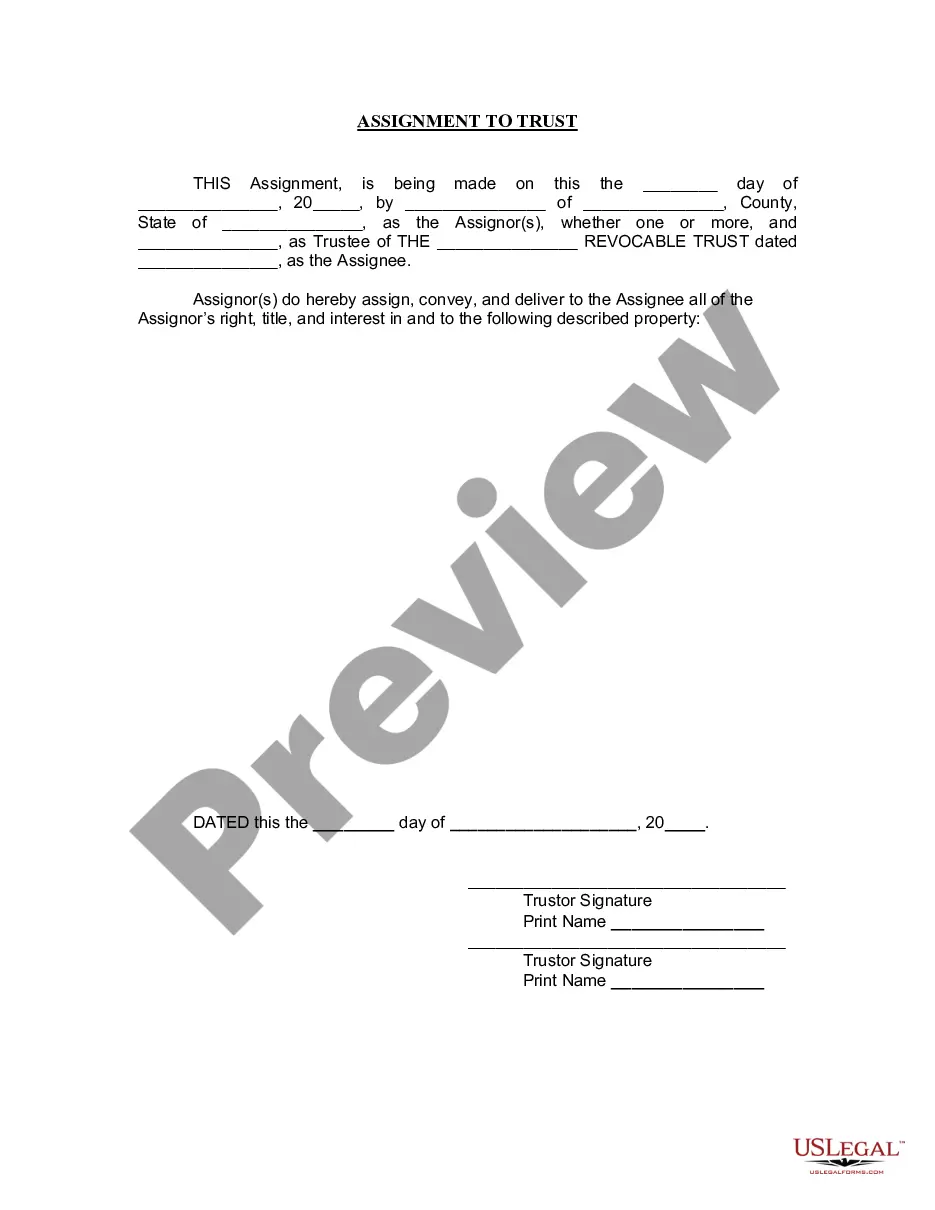

- Open the form preview, if available, to confirm that the template is indeed what you are looking for.

- Return to the search and seek the correct document if the Tx Tenant Eviction Without Lease Agreement doesn't align with your requirements.

- Once you are confident in the form's applicability, download it.

- If you're an authorized user, click Log in to verify your identity and access your chosen forms in My documents.

- If you haven't registered yet, click Buy now to purchase the template.

- Choose the pricing plan that best suits your needs.

- Continue to the registration process to finalize your purchase.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading the Tx Tenant Eviction Without Lease Agreement.

Form popularity

FAQ

Create a General Partnership in Massachusetts Determine if you should start a general partnership. Choose a business name. File a DBA name (if needed) Draft and sign partnership agreement. Obtain licenses, permits, and clearances. Get an Employer Identification Number (EIN) Get Massachusetts state tax identification numbers.

To update your Massachusetts LLC's Certificate of Organization, you'll need to file an Certificate of Amendment form with the Massachusetts Secretary of the Commonwealth, Corporations Division. You can file your Certificate of Amendment for $100.

To revive a Massachusetts LLC, you'll need to file all missing annual reports and the Application for Reinstatement Following Administrative Dissolution with the Massachusetts Secretary of the Commonwealth. You'll also have to fix the issues that led to your Massachusetts LLC's dissolution.

LLC vs. A limited liability company (LLC) is formed by filing articles of organization with your state's secretary of state and paying the appropriate filing fee. LLCs must have at least one member. A limited liability partnership (LLP) is a general partnership with limited liability protection for the partners.

Filing requirements for Partnerships Partnership must issue Schedules 3K-1 to individual partners. Copies of Schedules 3K-1 must be submitted to the Department of Revenue with Form 3. The state forms to file are the Form 3 and Schedule 3K-1. The federal forms to file are Form 1065 or 1065B & Schedules K-1.

A partnership may be created without formalities, much like a sole proprietorship. Two people merely need to agree to own and conduct a business together to create a partnership. Partners each have unlimited liability for the obligations of the business.

Follow our steps to create your general partnership. Step 1: Choose a business name. Your general partnership needs a name. ... Step 2: Draft and sign a partnership agreement. ... Step 3: Get an EIN. ... Step 4: Secure licenses and permits. ... Step 5: Open a bank account.

You don't have to file any formation paperwork with the state to start a General Partnership. Only formal business structures (like LLCs or Corporations) have to file formation documents with the state.