Texas Llc Formation

Description

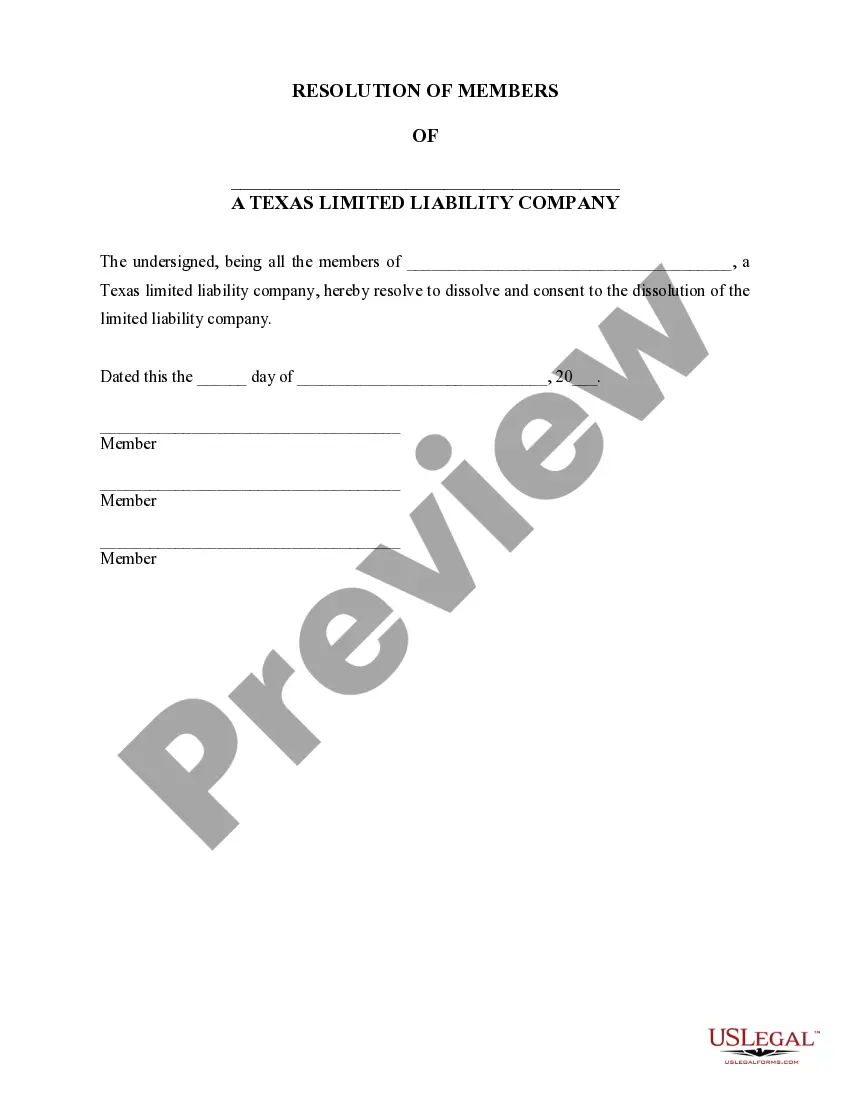

How to fill out Texas Dissolution Package To Dissolve Limited Liability Company LLC?

- If you are a returning user, log in to your account and download the necessary form template by clicking the Download button. Confirm that your subscription is still active; if not, renew it according to your plan.

- For first-time users, start by exploring the Preview mode and description of the form. Make sure you select the appropriate document that aligns with your needs and complies with local jurisdiction requirements.

- If you need to find a different template, utilize the Search tab to locate the form that best fits your situation.

- Once you have identified the correct form, proceed by clicking the Buy Now button and select your desired subscription plan, ensuring you create an account for access to the full library.

- Complete your purchase by entering your credit card details or utilizing your PayPal account to finalize the subscription.

- Finally, download your form and save it on your device. You can also access it at any time through the My Forms section in your profile.

US Legal Forms stands out with over 85,000 available legal forms and packages, providing more choices than competitors at a similar cost. Whether you are an individual or an attorney, you’ll find our platform easy and efficient.

Start your Texas LLC formation today with US Legal Forms and enjoy seamless access to expert assistance for completing your documents accurately. Don't hesitate—visit us now and take the first step towards your business success!

Form popularity

FAQ

Starting an LLC in Texas can be straightforward, even for beginners. First, select a catchy name that reflects your business and check its availability. Then, file your Certificate of Formation through uslegalforms, which simplifies the filing process with clear instructions. Lastly, set up an operating agreement to clarify how your LLC will run, and ensure you meet all local licensing requirements. With these steps, you can confidently navigate your Texas LLC formation.

To set up an LLC in Texas by yourself, start by choosing a unique name for your business that complies with Texas naming rules. Next, file the Certificate of Formation with the Texas Secretary of State, which can be done online through a user-friendly platform like uslegalforms. After that, create an operating agreement to outline the management structure and member roles, even if it’s not required by Texas law. Finally, obtain any necessary licenses and permits to ensure your Texas LLC formation is complete and compliant.

It's advisable to form your LLC in Texas before obtaining an EIN. Once your LLC is approved, you can then apply for an EIN, which is essential for opening a business bank account and handling taxes. Prioritizing your Texas LLC formation first establishes your legal business entity, thereby simplifying the EIN application process. Using a service like uslegalforms ensures that you can efficiently manage both tasks.

The fastest way to form an LLC in Texas is by filing online directly with the Secretary of State. This method accelerates the approval process compared to mailing forms. Additionally, using a service like uslegalforms can help streamline the necessary paperwork and ensure that your Texas LLC formation adheres to all legal requirements. This way, you can focus on your business without delays.

You can form an LLC in Texas relatively quickly, often within a few days. If you file online through the Texas Secretary of State, you may receive approval in as little as 24 hours. However, processing times may vary based on the workload of the office. For a smooth experience, consider using a reliable service like uslegalforms, which simplifies the Texas LLC formation process.

The permits you need for an LLC in Texas largely depend on your specific business activities and local regulations. Common permits involve zoning permits, health permits, or professional licenses, which vary based on the industry. Before you begin operations, it's crucial to research the specific permits required for your LLC. Utilizing the uslegalforms platform can provide guidance on identifying and obtaining the necessary permits for your Texas LLC formation.

Yes, even if you have an LLC in Texas, you may still need a business license depending on the type of business you plan to operate and your local jurisdiction. While Texas does not require a general state business license, particular professions and activities might necessitate specific licenses and permits. It’s essential to check with local regulations to ensure compliance. Using the uslegalforms platform can help streamline this process, ensuring that you acquire all necessary business licenses for your Texas LLC formation.

To set up an LLC in Texas, begin by choosing a unique name for your business that complies with state regulations. Next, file a Certificate of Formation with the Texas Secretary of State, which typically requires details like your LLC's name, duration, and registered agent information. After submitting this form, you’ll need to obtain an Employer Identification Number (EIN) from the IRS. For assistance throughout this process, consider using the uslegalforms platform, which can guide you through Texas LLC formation.