Limited Liability Company With Example

Description

How to fill out Texas Dissolution Package To Dissolve Limited Liability Company LLC?

- Log into your US Legal Forms account if you're already a member and download your desired LLC template by clicking the Download button. Remember to check your subscription status.

- If it's your first time, start by reviewing the form's preview and description to ensure it aligns with your local jurisdiction requirements.

- If you encounter inconsistencies with your document choice, utilize the Search tab to find the correct template tailored to your needs.

- Purchase your chosen document by clicking the Buy Now button and selecting a suitable subscription plan. You'll need to create an account to access all features.

- Complete your payment using a credit card or PayPal. This grants you access to the extensive library and resources available.

- Finally, download your form and save it on your device. You can always access it again via the My Forms menu in your account.

US Legal Forms empowers users with a robust collection of legal documents at a competitive value. By providing access to premium experts, it ensures that your forms are completed correctly and are legally sound.

Take the first step in forming your limited liability company today by visiting US Legal Forms and accessing their extensive library.

Form popularity

FAQ

To create an LLC by yourself, you will need to choose a name that complies with state regulations and file the Articles of Organization with your state’s business division. It’s essential to draft an operating agreement, even if it’s not required, as this document outlines how your limited liability company will operate. You can use platforms like uslegalforms to simplify the process and ensure all legal requirements are met with ease.

An example of a limited company is 'JKL Cleaners Ltd.' This entity type limits the financial liability of its shareholders. Unlike a limited liability company with example, a limited company can also be privately held and offers similar protections, making it an attractive option for many business owners.

A limited liability company is a business structure that combines elements of both partnerships and corporations. It shields its owners, known as members, from personal liability for business debts. An example of this is 'PQR Landscaping, LLC,' which enjoys this protection while allowing for flexible management and profit distribution among its members.

Limited liability is a legal structure where a business owner's personal assets are protected from the company’s debts and liabilities. For instance, if 'LMN Retail, LLC' incurs financial troubles, the owner's personal property stays safe from creditors. Using a limited liability company with example not only protects personal assets but also encourages entrepreneurs to take business risks with lesser personal repercussions.

An example of an LLC can be 'XYZ Tech Solutions, LLC.' This company might focus on providing innovative technology services. The flexibility and protection provided by a limited liability company with example, such as this one, allows all members to benefit from limited personal liability, giving them peace of mind as they operate their business.

To write an LLC example, start by outlining the basic structure, which includes the name of the company, the purpose of the business, and the members involved. You can illustrate this with an example such as 'ABC Consultants, LLC,' which specifies the consulting services it offers. The operating agreement should also be included in your example, detailing how profits and responsibilities are divided among members.

Yes, you can file your limited liability company with example independently, and many people choose to do so. However, it's important to ensure that you follow all legal requirements for your state to avoid future issues. For added convenience and accuracy, consider using a service like USLegalForms for assistance with the filing process.

Failing to file taxes for your limited liability company with example can lead to serious consequences. You may incur penalties, interest, and your LLC could lose its good standing with the state. It's crucial to stay on top of tax obligations to maintain the benefits of your LLC and avoid complications.

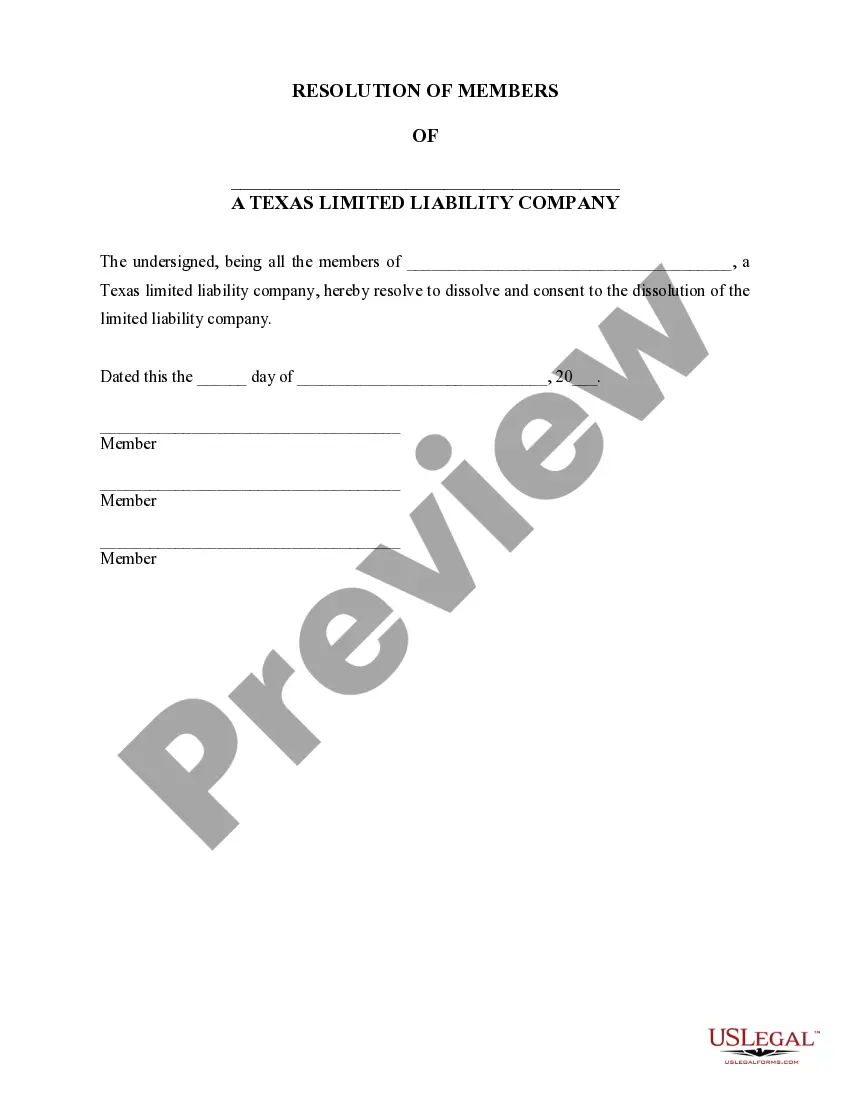

Writing a limited liability company with example typically involves drafting and filing your Articles of Organization with your state. This document outlines essential details such as the LLC's name, address, and the names of its members. USLegalForms can assist you in creating this document to ensure compliance with state requirements.

A single owner limited liability company with example treats itself as a disregarded entity for tax purposes. This means that the business income is reported on your personal tax return using Schedule C. Fortunately, this simplifies the tax process, and you can still enjoy the liability protection that an LLC provides.