Requirements For Dba In Texas

Description

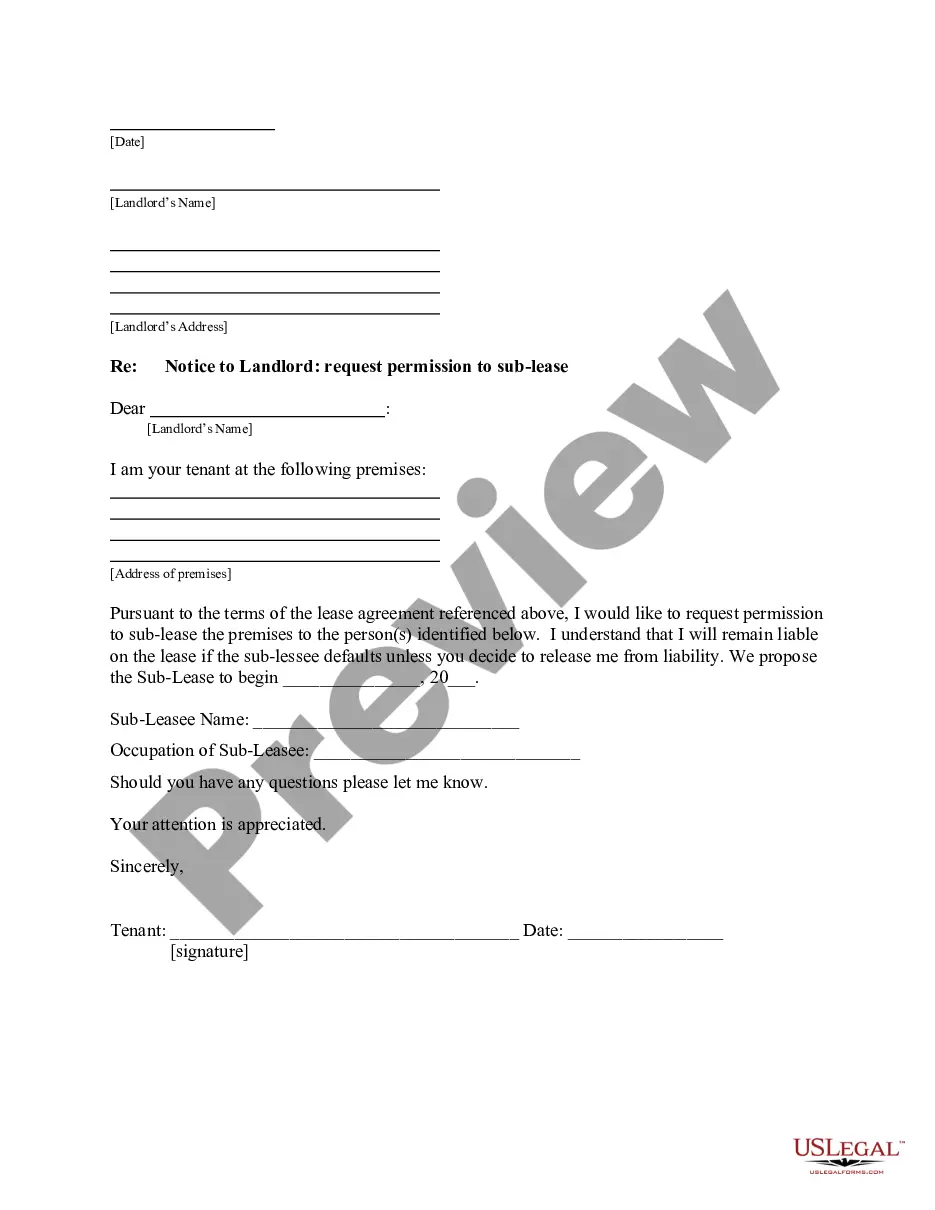

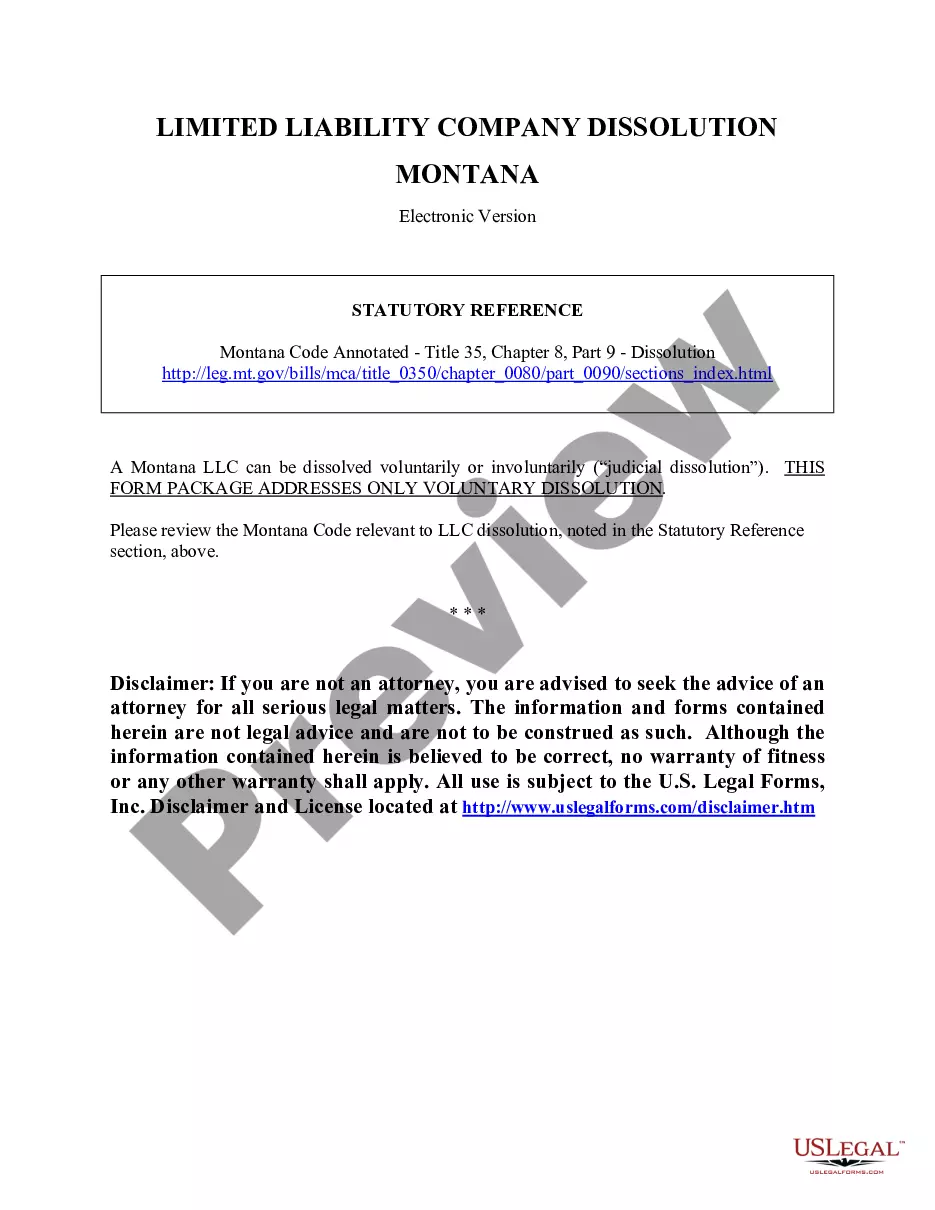

How to fill out Texas Assumed Name Certificate?

Whether for business purposes or for individual matters, everybody has to deal with legal situations at some point in their life. Filling out legal paperwork needs careful attention, beginning from choosing the correct form sample. For example, when you pick a wrong version of the Requirements For Dba In Texas, it will be declined when you send it. It is therefore important to have a reliable source of legal papers like US Legal Forms.

If you have to obtain a Requirements For Dba In Texas sample, follow these easy steps:

- Get the template you need using the search field or catalog navigation.

- Look through the form’s description to make sure it matches your situation, state, and county.

- Click on the form’s preview to examine it.

- If it is the wrong form, get back to the search function to find the Requirements For Dba In Texas sample you require.

- Download the file if it meets your needs.

- If you have a US Legal Forms account, click Log in to access previously saved documents in My Forms.

- In the event you don’t have an account yet, you can obtain the form by clicking Buy now.

- Choose the correct pricing option.

- Complete the account registration form.

- Select your payment method: use a bank card or PayPal account.

- Choose the file format you want and download the Requirements For Dba In Texas.

- Once it is saved, you can fill out the form by using editing applications or print it and finish it manually.

With a large US Legal Forms catalog at hand, you don’t need to spend time looking for the right template across the internet. Use the library’s easy navigation to find the right form for any occasion.

Form popularity

FAQ

If you don't, Texas's Business & Commerce Code (sections 71.201, 71.202, 71.203) states that your business could be subject to civil and criminal penalties.

How Much Does a Texas DBA Cost? The filing fee for an assumed name certificate with the secretary of state of Texas is $25. You may pay this fee by personal check, money order or a LegalEase debit card. You may also pay online using a credit card but may be subject to a 2.7 percent fee for paying with credit card.

The certificate expires at the end of the stated term or 10 years from the date of filing. If the registrant decides to continue using the same assumed name, a new assumed name certificate must be filed prior to the expiration of the current certificate.

Forms needed to file a DBA in Texas Texas Comptroller of Public Accounts website. Texas Secretary of State. Texas County Clerks Database. Form 02-07 Assumed Name Registration for 1-2 Owners. Form 02-07A Assumed Name Registration for 4-13 Owners. Form 02-07B Assumed Name Registration for 14 or More Owners.

In most cases, no. You do need a DBA if you are using a business name other than your legal business name, or if you haven't registered your business and operate as a sole proprietorship or partnership.