Dba In Texas Without Llc

Description

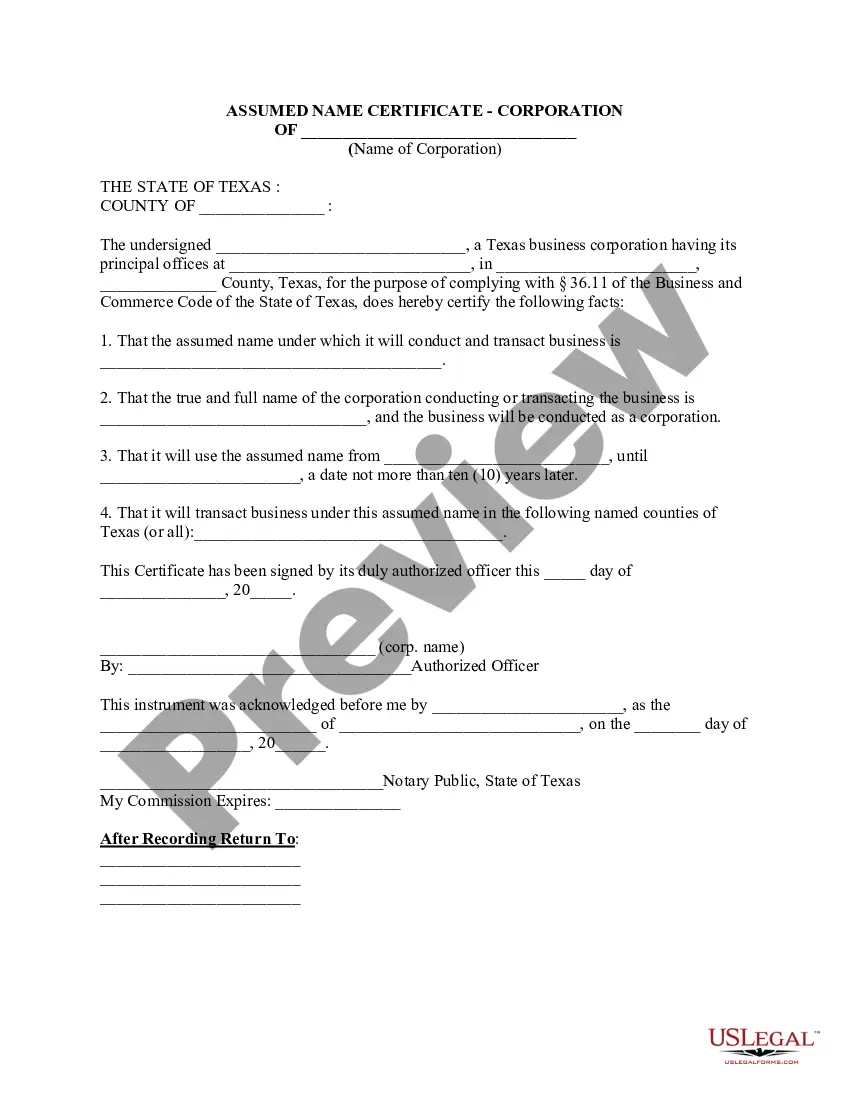

How to fill out Texas Assumed Name Certificate?

Creating legal documents from the ground up can frequently feel somewhat daunting.

Certain situations may require extensive research and significant financial investment.

If you're looking for a simpler and more cost-effective method of preparing Dba In Texas Without Llc or any other forms without unnecessary complications, US Legal Forms is always available to assist you.

Our online database of over 85,000 current legal forms encompasses nearly every facet of your financial, legal, and personal matters.

Before diving straight into downloading Dba In Texas Without Llc, follow these suggestions: Review the document preview and details to confirm you have the correct document. Ensure the template you choose adheres to the laws and regulations of your state and county. Select the most appropriate subscription option to acquire the Dba In Texas Without Llc. Download the form, then complete, certify, and print it. US Legal Forms boasts an impeccable reputation and over 25 years of experience. Join us today and simplify the form-filling process!

- With just a few clicks, you can quickly obtain state- and county-compliant templates carefully crafted for you by our legal specialists.

- Utilize our platform whenever you require a dependable service through which you can effortlessly locate and download the Dba In Texas Without Llc.

- If you're a returning visitor and have already established an account with us, simply sign in to your account, find the form, and download it or access it again anytime in the My documents section.

- Not signed up yet? No worries. It takes minimal time to register and browse the collection.

Form popularity

FAQ

No, a DBA does not need to include 'LLC' in its name, especially if you are registering a DBA in Texas without forming an LLC. A DBA allows you to choose a name that reflects your business without implying a formal corporate structure. This flexibility can benefit your marketing and branding strategies. Using uslegalforms, you can easily navigate the naming requirements for your DBA.

You do not necessarily need an EIN for a DBA in Texas if you plan to operate as a sole proprietorship without hiring employees. However, obtaining an EIN can provide benefits, such as separating your personal and business finances. When you file for a DBA in Texas without an LLC, consider the future growth of your business and your financial needs. Using uslegalforms can help simplify the process of understanding EIN requirements.

Yes, you can use a DBA as an alternative to an LLC in Texas, but there are important distinctions. A DBA provides a business name that is separate from your personal name or the legal name of your business, but it does not offer personal liability protection. If you are looking for security and tax advantages, consider forming an LLC. For assistance with managing your business structure, UsLegalForms offers resources that can help clarify your options while exploring DBA in Texas without LLC.

Getting a DBA approved in Texas typically takes about 1 to 3 weeks, depending on various factors like your county’s processing speed. After you submit the application, the county clerk will review it for any errors. You can check the status online for quick updates. If you want to streamline this process, consider using platforms like UsLegalForms, which can help you navigate your DBA in Texas without LLC efficiently.

No, an LLC is not required to obtain a DBA in Texas. Sole proprietors and partnerships can also apply for a DBA to operate under a unique name. This makes it a practical option for many entrepreneurs looking to establish their business identity while keeping their operation simple and straightforward.

The legal requirements for a DBA in Texas include choosing a name that is not already in use by another business. You must also file an Assumed Name Certificate with the appropriate county clerk’s office. This process is designed to ensure transparency and prevents confusion among consumers when you decide to pursue a DBA in Texas without LLC.

Yes, you can obtain a DBA in Texas without forming an LLC. A DBA, or 'Doing Business As,' allows you to operate under a name that is different from your legal business name. This flexibility makes it easier for sole proprietors and partnerships to establish a brand identity without needing the formal structure of an LLC.