Texas Closing Statement With The

Description

How to fill out Texas Closing Statement?

Regardless of whether for corporate objectives or personal matters, everyone must confront legal issues at some stage in their lives. Finalizing legal paperwork necessitates meticulous focus, starting from selecting the suitable form example. For example, if you select an incorrect version of the Texas Closing Statement With The, it will be dismissed upon submission. Thus, it is vital to obtain a trustworthy source of legal documents such as US Legal Forms.

If you are looking to acquire a Texas Closing Statement With The example, adhere to these straightforward steps: Retrieve the template you require using the search bar or catalog browsing. Review the form's description to ensure it aligns with your circumstances, state, and area. Click on the form's preview to examine it. If it is the wrong form, return to the search tool to discover the Texas Closing Statement With The example you require. Download the file when it satisfies your requirements.

- If you possess a US Legal Forms account, simply click Log in to access previously stored documents in My documents.

- In case you do not have an account yet, you can download the form by clicking Buy now.

- Select the suitable pricing option.

- Fill out the profile registration form.

- Choose your payment method: utilize a credit card or PayPal account.

- Select the document format you desire and download the Texas Closing Statement With The.

- Once downloaded, you can complete the form using editing software or print it and fill it out manually.

- With an extensive US Legal Forms catalog available, you do not have to waste time searching for the correct example online.

- Utilize the library's straightforward navigation to find the appropriate template for any situation.

Form popularity

FAQ

The 2% rule in Texas refers to the guideline that limits the amount of property taxes a homeowner can increase in a year to 2% of the previous year's value. This regulation helps homeowners manage their budget and avoid sudden spikes in property tax bills. When reviewing your Texas closing statement with the applicable tax information, it’s essential to understand how this rule impacts your overall costs. For assistance with property tax documents, US Legal Forms offers valuable resources to help you navigate these regulations.

The 3-day rule for closing disclosures in Texas requires lenders to provide borrowers with a closing disclosure at least three business days before the closing date. This document outlines the final terms and costs of the mortgage, allowing you to review the details carefully. Understanding the Texas closing statement with the closing disclosure helps ensure that you are informed about your financial obligations. If you have questions, platforms like US Legal Forms can guide you through the process.

To find your Texas closing statement with the necessary information, check with your real estate agent or closing attorney. They usually provide this document at the closing meeting. Additionally, if you used an online platform like USLegalForms, you can easily access your closing statement through your account. This convenience allows you to review important details anytime.

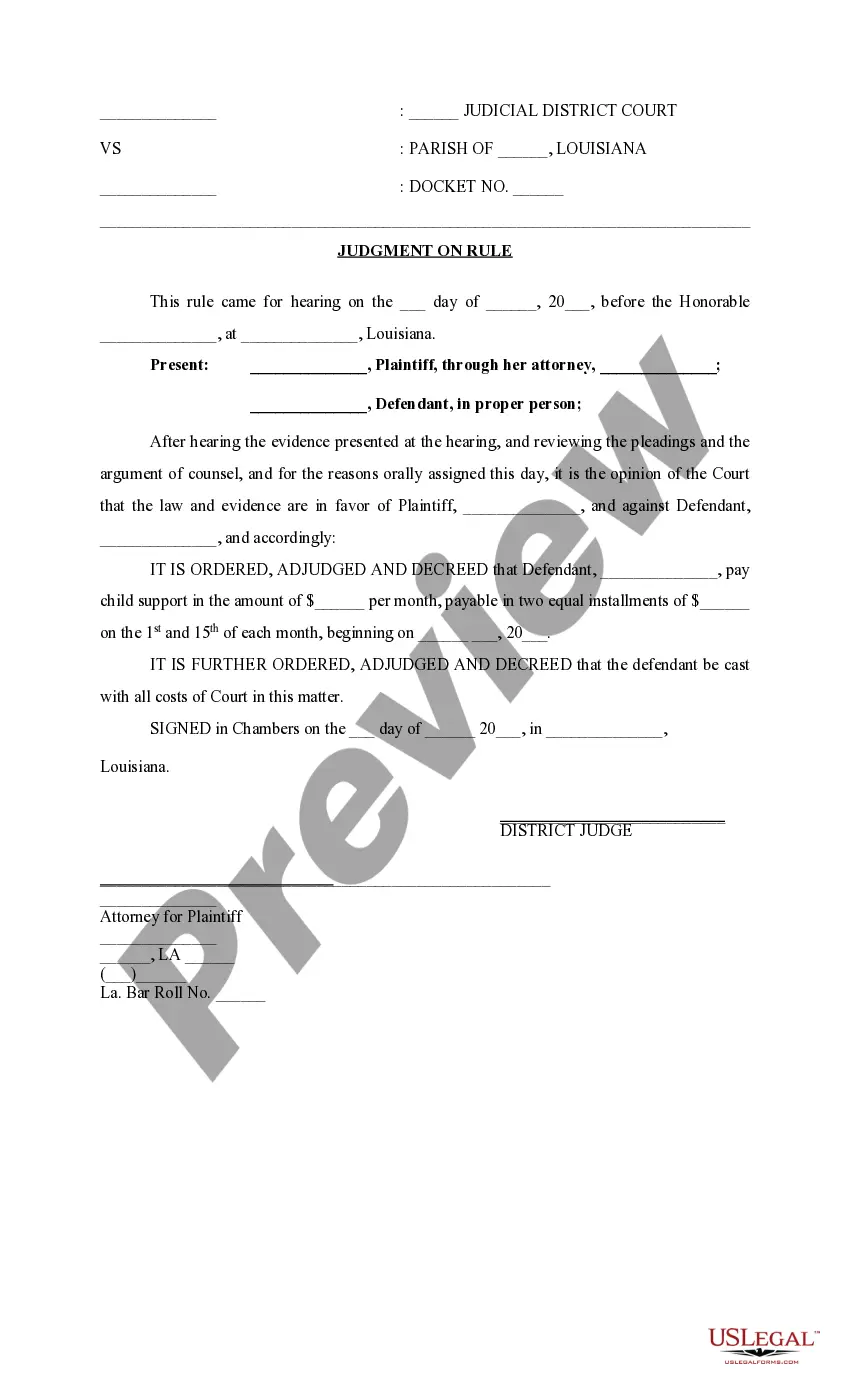

A settlement statement is a document that outlines the financial details of a real estate transaction. It includes all the costs associated with the sale, such as closing costs, fees, and any credits or debits. In Texas, the closing statement is crucial as it provides transparency and ensures both parties understand their financial obligations. By using resources like US Legal Forms, you can easily access templates and guides to help you prepare a Texas closing statement with the necessary details.

How to read the top of the settlement statement File No./Escrow No. Think of the escrow number like a bank account number ? it's a series of digits specific to a single transaction between a buyer and seller. Date & Time: ... Officer/Escrow Officer: ... Settlement Location: ... Property Address: ... Buyer: ... Seller: ... Lender:

The closing statement should also detail the purchase price of the home, deposits paid by the buyer, and seller credits. Prorated amounts. If a buyer or seller is paying prorated amounts toward property taxes or homeowners association (HOA) fees, then these also would be included on the closing statement. Loan costs.

How To Read A Settlement Statement From Your Real Estate Closing YouTube Start of suggested clip End of suggested clip This first page also includes your principal. And interest payment for your loan. Including anyMoreThis first page also includes your principal. And interest payment for your loan. Including any escrows. So you'll see principal and interest underneath it'll say estimated escrows.

The closing statement is the attorney's final statement to the jury before deliberation begins. The attorney reiterates the important arguments, summarizes what the evidence has and has not shown, and requests jury to consider the evidence and apply the law in his or her client's favor.

The closing statement, also called a closing disclosure or settlement statement, is essentially a comprehensive list of every expense that either the buyer and seller must pay to complete the purchase of a home (or whatever the property is).