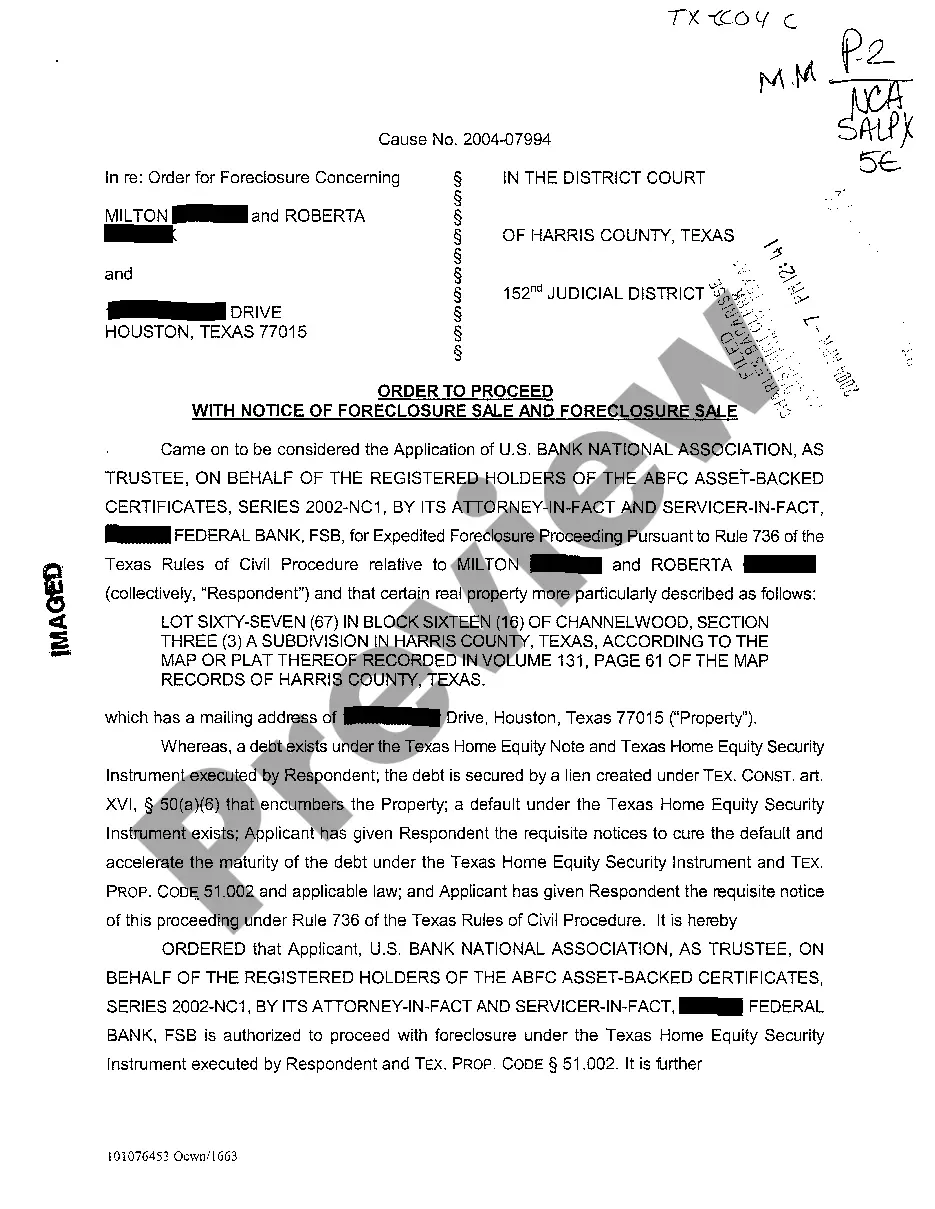

Texas Foreclosure Notice Form

Description

How to fill out Texas Order To Proceed With Notice Of Foreclosure?

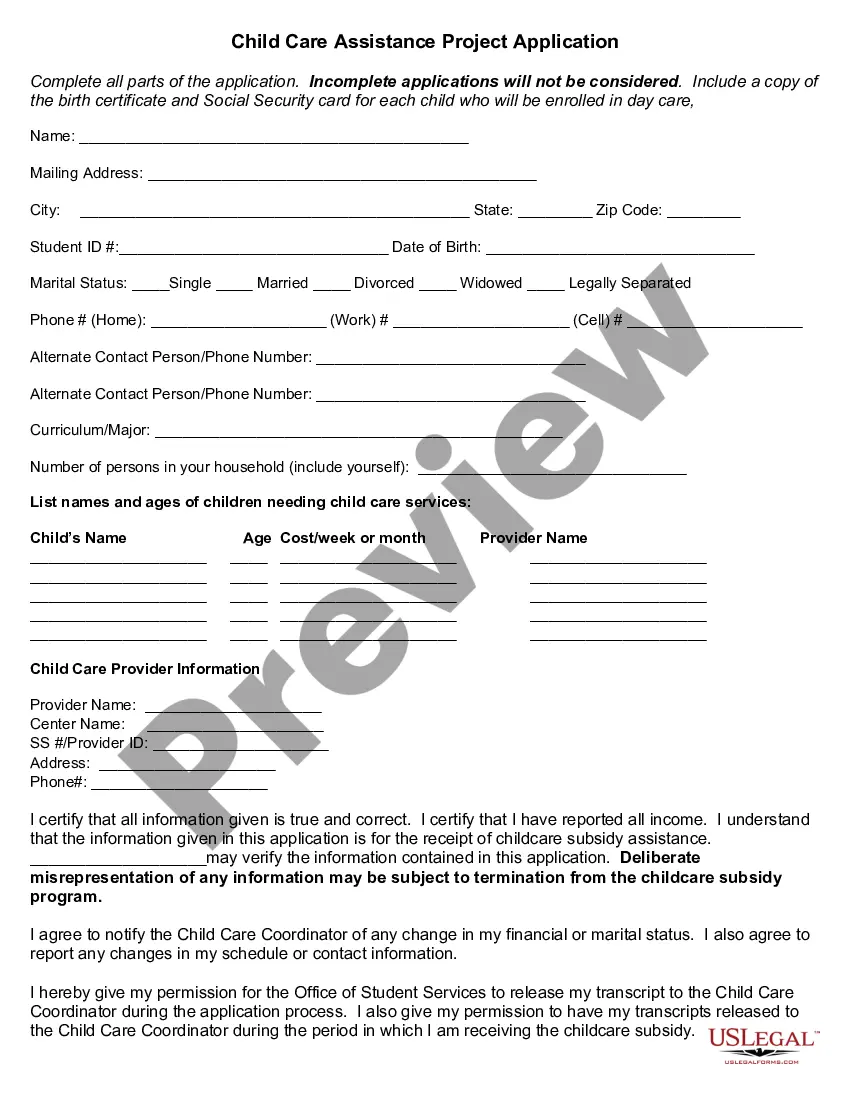

Properly formulated official documents serve as a crucial safeguard against complications and legal disputes, yet acquiring them without the assistance of an attorney may require time.

Whether you are looking to swiftly locate a current Texas Foreclosure Notice Form or other templates for employment, family, or business matters, US Legal Forms is always available to assist.

The process becomes even simpler for existing subscribers of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button beside the selected document. Furthermore, you can access the Texas Foreclosure Notice Form anytime, as all documents ever acquired on the platform can be found in the My documents section of your profile. Conserve time and money on drafting formal documents. Explore US Legal Forms today!

- Verify that the form is appropriate for your situation and locality by reviewing the description and sample.

- Search for an additional template (if necessary) using the Search bar located in the header.

- Press Buy Now once you find the right template.

- Choose the pricing option, Log In to your account, or create a new one.

- Select your preferred payment method to purchase the subscription plan (using a credit card or PayPal).

- Choose the PDF or DOCX format for your Texas Foreclosure Notice Form.

- Click Download, then print the template to complete it manually or upload it to an online editor.

Form popularity

FAQ

In a foreclosure, the homeowner typically suffers the most, facing financial distress and the loss of their property. The impact of a Texas foreclosure notice form can extend beyond losing a home; it often affects credit scores, emotional well-being, and family stability. Moreover, communities can also be affected, as foreclosures can decrease local property values and strain local resources. It's essential to seek help early to mitigate these impacts.

To get a foreclosure dismissed, you must present a valid defense against the foreclosure, which can sometimes involve filing a motion in court. Reviewing the Texas foreclosure notice form is crucial, as it outlines the lender's claims against you. Seeking assistance from an attorney can strengthen your case and increase your chances of dismissal. Additionally, negotiating with your lender may also lead to favorable outcomes.

The foreclosure process in Texas typically begins with your lender sending a Texas foreclosure notice form after you miss payments. This notice must be sent at least 20 days before the scheduled foreclosure sale. Following this, the lender will file a notice of sale, and the property will be auctioned if payments are not made. Understanding these steps can help you take proactive measures to protect your home.

To respond to a foreclosure notice, you should gather all relevant documents and review the terms outlined in the Texas foreclosure notice form. This information can help you determine your options, such as negotiating with your lender or filing a dispute. Consider contacting a housing counselor who can guide you through the process and help you understand your rights under Texas law.

In Texas, foreclosure sales are typically conducted by a trustee appointed by the lender. These sales usually take place on the first Tuesday of the month at the county courthouse. It is essential for homeowners facing foreclosure to be aware of this process. Using a Texas foreclosure notice form may provide clarity on your situation and help you prepare for any upcoming foreclosure sales.

A notice of default in Texas is a formal document issued by the lender when a borrower fails to meet their mortgage obligations. This notice indicates the start of the foreclosure process and provides critical details about the debt and required actions. Securing a Texas foreclosure notice form can help you understand this document and respond appropriately to avoid potential foreclosure.

Typically, missing one mortgage payment puts you at risk of default, but foreclosure usually begins after you are at least 90 to 120 days behind. Each lender may have different policies, so it's vital to stay informed. If you're facing financial trouble, you should consider obtaining a Texas foreclosure notice form to help you engage with your lender effectively.

Being 120 days delinquent means you have not made your mortgage payment for four consecutive months. This status triggers additional lender actions, including the potential for foreclosure. It's crucial to address this situation proactively, and obtaining a Texas foreclosure notice form may assist in communicating with your lender regarding possible solutions.

In Texas, the 120 day rule indicates that a lender cannot pursue foreclosure until the borrower has been at least 120 days delinquent on their mortgage payments. This rule provides borrowers an extended period to catch up on payments or negotiate a solution. To navigate this process, utilizing a Texas foreclosure notice form can help clarify your rights and obligations.

The 37 day foreclosure rule refers to a specific timeline within Texas foreclosure proceedings. After a borrower defaults on their mortgage, the lender must wait at least 37 days before filing a foreclosure notice. Understanding this rule is essential, as it allows you time to consider your options, including requesting a Texas foreclosure notice form to formalize communication with your lender.