Holographic Codicil To Formal Will

Description

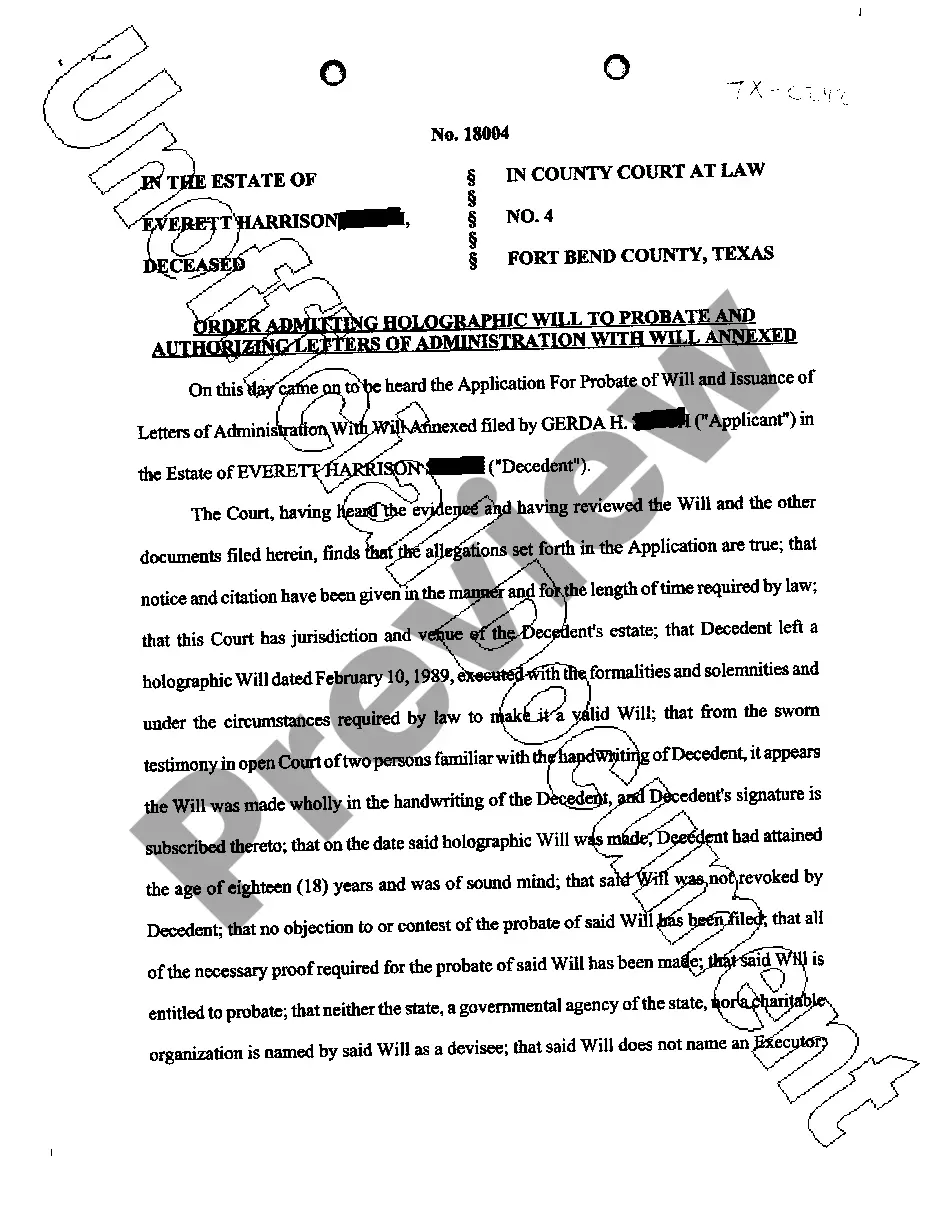

How to fill out Texas Order Admitting Holographic Will To Probate And Authorizing Letters Of Administration With Will Annexed?

Locating a reliable source for the latest and suitable legal templates is part of the challenge in dealing with red tape.

Selecting the correct legal documents requires accuracy and thoroughness, which is why obtaining samples of Holographic Codicil To Formal Will only from trustworthy providers, such as US Legal Forms, is crucial.

After securing the document on your device, you can modify it with an editor or print it out to fill in manually. Remove the complexity associated with your legal documentation. Delve into the extensive US Legal Forms collection, where you can discover legal templates, assess their applicability to your situation, and download them immediately.

- Utilize the library navigation or search feature to find your template.

- Review the document's details to ensure it meets the standards of your state and locality.

- Examine the form preview, if available, to confirm the document is indeed what you seek.

- If the Holographic Codicil To Formal Will does not meet your needs, continue searching for the appropriate document.

- If you are confident in the form's applicability, download it.

- As a registered user, click Log in to verify and access your chosen forms in My documents.

- If you haven't set up an account, click Buy now to acquire the template.

- Select a pricing plan that fits your preferences.

- Move on to the signup process to finalize your transaction.

- Complete your purchase by selecting a payment option (credit card or PayPal).

- Determine the format for downloading Holographic Codicil To Formal Will.

Form popularity

FAQ

The 7-in-7 rule explained Collectors are permitted to place a call to the consumer about a particular debt seven (7) times within a period of seven (7) consecutive days, so long as no contact is made with the consumer in any of the attempts.

Harassment of the debtor by the creditor ? More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor.

This myth is incorrect, debt does not disappear after 7 years in Canada. This common misconception is likely derived from the fact that most debts drop off your credit report after 7 years. However, this doesn't mean your debt disappears. It just disappears from your credit report.

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising. But if you are otherwise using credit responsibly, your score may rebound to its starting point within three months to six years.

How to Request Debt Verification. To request verification, send a letter to the collection agency stating that you dispute the validity of the debt and that you want documentation verifying the debt. Also, request the name and address of the original creditor.

Legally, a debt collector has to send you a debt verification letter within five days of their first contact with you. And if not, you should ask for one.

Don't provide personal or sensitive financial information Never give out or confirm personal or sensitive financial information ? such as your bank account, credit card, or full Social Security number ? unless you know the company or person you are talking with is a real debt collector.

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase ?please cease and desist all calls and contact with me immediately? to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.