Trustee In Deed Of Trust Texas

Description

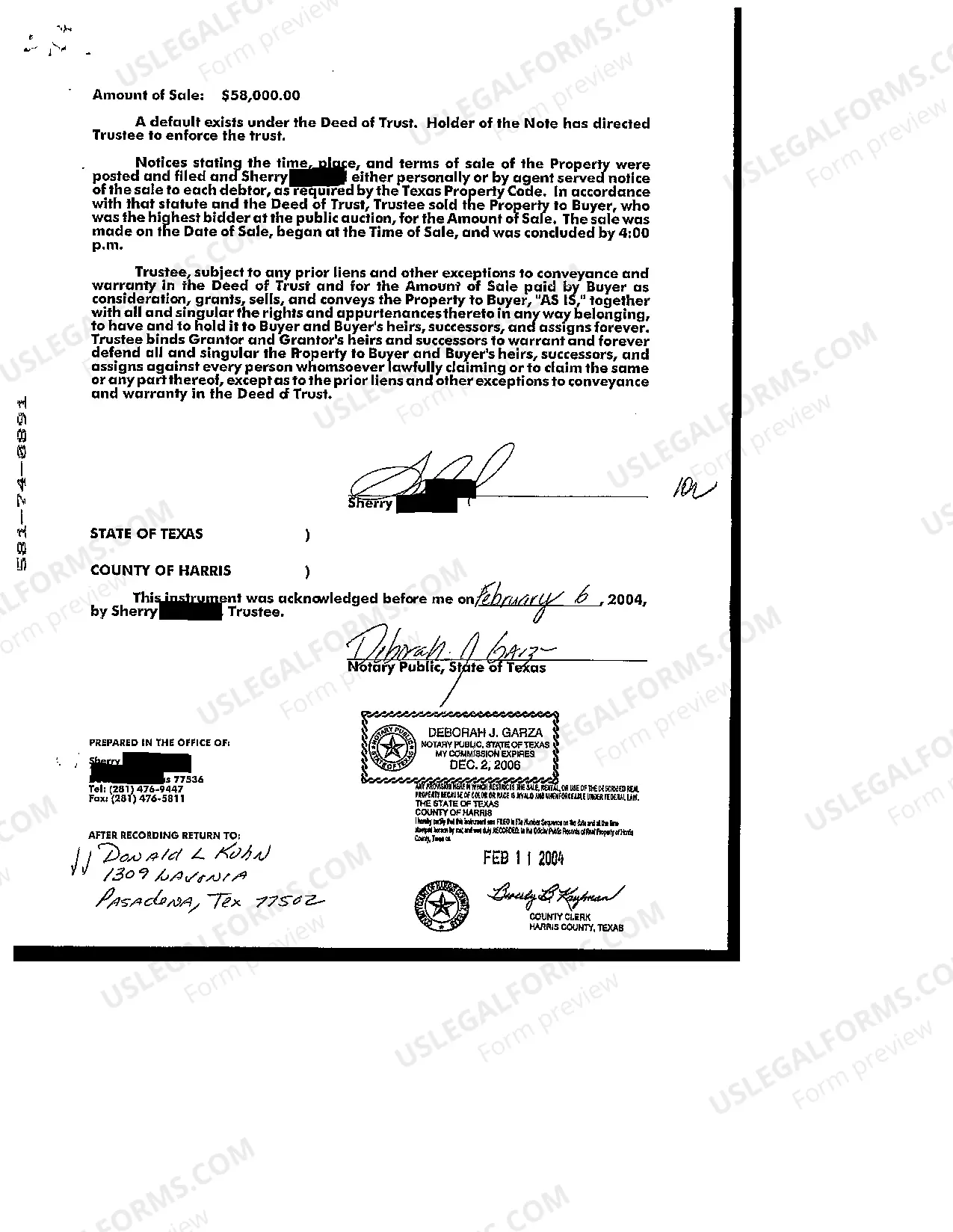

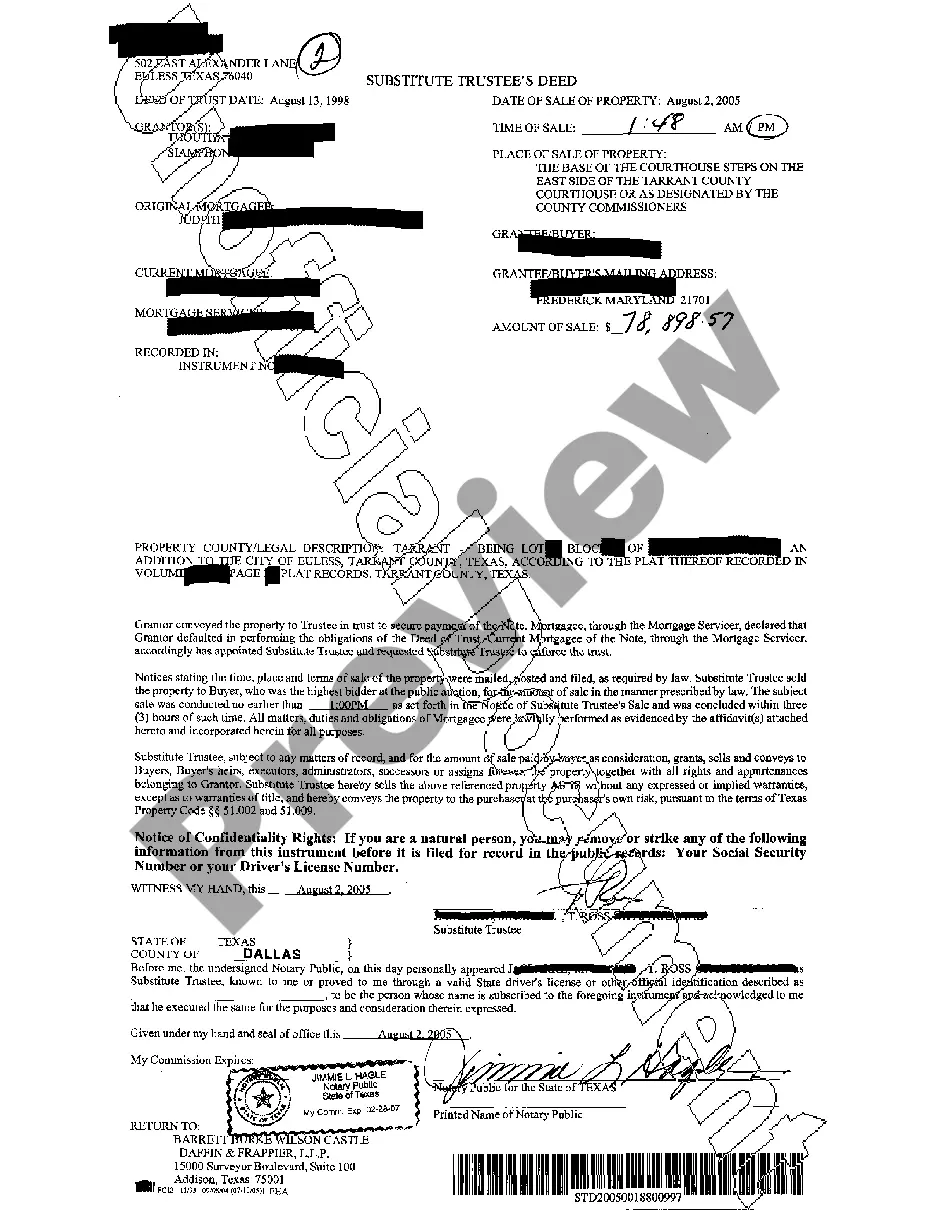

How to fill out Texas Trustee's Deed?

Creating legal documents from the ground up can occasionally be overwhelming.

Certain situations may require extensive research and a significant financial investment.

If you’re looking for a more straightforward and economical method to prepare Trustee In Deed Of Trust Texas or any other forms without unnecessary complications, US Legal Forms is readily available.

Our online collection of over 85,000 current legal forms covers nearly every aspect of your financial, legal, and personal matters.

However, before you proceed to download Trustee In Deed Of Trust Texas, please consider these guidelines: Review the document preview and descriptions to ensure you have the correct form. Verify if the form you select adheres to the regulations and laws of your state and county. Choose the appropriate subscription plan to acquire the Trustee In Deed Of Trust Texas. Download the form, then complete, sign, and print it. US Legal Forms boasts an impeccable reputation and over 25 years of experience. Join us today and simplify your form completion process!

- With just a few clicks, you can easily access state- and county-compliant forms crafted specifically for you by our legal experts.

- Utilize our website whenever you require a dependable and trustworthy service through which you can swiftly locate and download the Trustee In Deed Of Trust Texas.

- If you’re already familiar with our services and have previously created an account, simply Log In to your account, find the form, and download it or re-download it anytime later in the My documents section.

- Don't have an account? No worries. Establishing it takes just a few minutes and helps you navigate the catalog.

Form popularity

FAQ

In the context of a deed of trust, trustees should be formally appointed, often through a written deed. This appointment establishes the trustee in deed of trust Texas and grants them the authority to act on behalf of the lender and borrower. Properly documenting the appointment helps avoid legal complications and ensures that the trustee understands their responsibilities. You can find templates and resources on US Legal Forms to assist in this process.

Yes, a primary beneficiary can serve as a trustee in a deed of trust in Texas provided they meet other eligibility requirements. This can create a seamless management structure, as the beneficiary has a vested interest in the trust’s performance. However, be mindful of potential conflicts of interest. For clarity on managing these roles, consider exploring the resources available at US Legal Forms.

Certain individuals cannot be appointed as a trustee in Texas. Generally, minors and those who are legally declared incompetent are not eligible. Additionally, individuals with conflicting interests or a history of bankruptcy may also be disqualified. It’s important to ensure the selected trustee meets all legal criteria, and you can utilize US Legal Forms for further information on this matter.

In Texas, eligible trustees include individuals, organizations, and legal entities. They must be capable of fulfilling fiduciary duties under the law. While most people can serve as a trustee, it’s crucial to select someone trustworthy and reliable. Platforms like US Legal Forms provide resources to help you determine the most suitable trustee for your deed of trust.

In Texas, any adult who is legally competent can serve as a trustee on a deed of trust. This includes individuals and certain entities, such as banks or trust companies. However, it is essential that the trustee understands their responsibilities, as they hold a crucial role in managing the trust. To ensure you select a qualified trustee, consider reliable resources like US Legal Forms for guidance.

A trust's beneficiaries are usually known, loved, and trusted by the trustmaker, so it makes sense to select one of the beneficiaries as trustee.

The Deed of Trust must be in writing, signed by the property owner, and filed in the County Clerk property records. The Deed of Trust should describe the loan amount, name a Trustee, and describe the collateral securing the loan. A correct legal description of the property is essential for a valid Deed of Trust.

The Trustee, usually chosen by the lender, is the person who represents both the Grantor and the Grantee (Beneficiary) if there is a default under a Deed of Trust. When no specific trustee is required by the lender, someone willing and able to hold a foreclosure sale if necessary may be selected.

Generally, the trustee must be an attorney, title insurance company, trust company, bank, savings and loan, credit union, or other company specifically authorized by law to serve as a trustee. Other states have no limitations.

In Texas, a deed of trust, also known as a trust deed, is the commonly used instrument for the purpose of creating mortgage liens on real estate. A mortgage is an executed contract in which the legal or equitable owner of the real property pledges the title thereto as security for performance of an obligation.