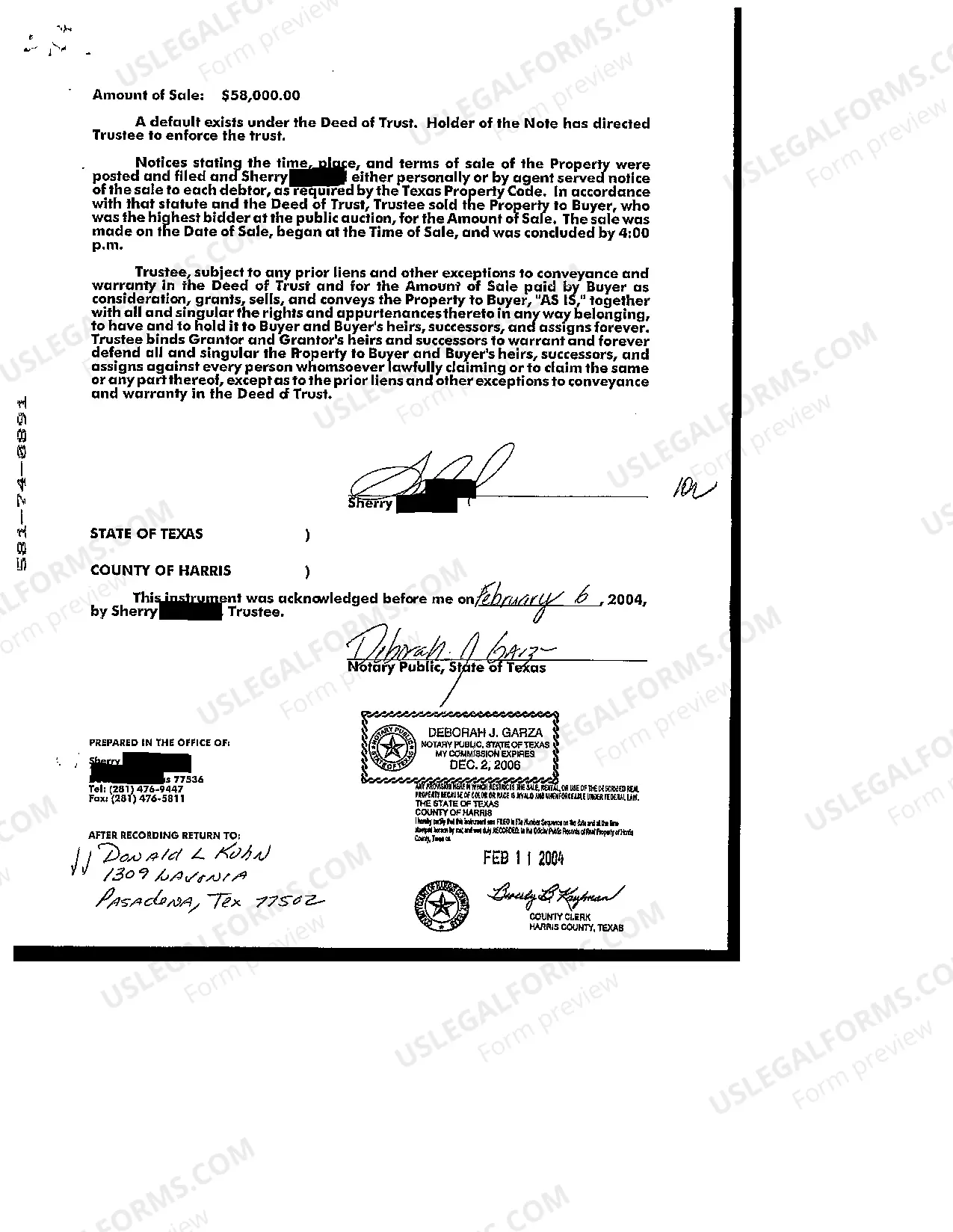

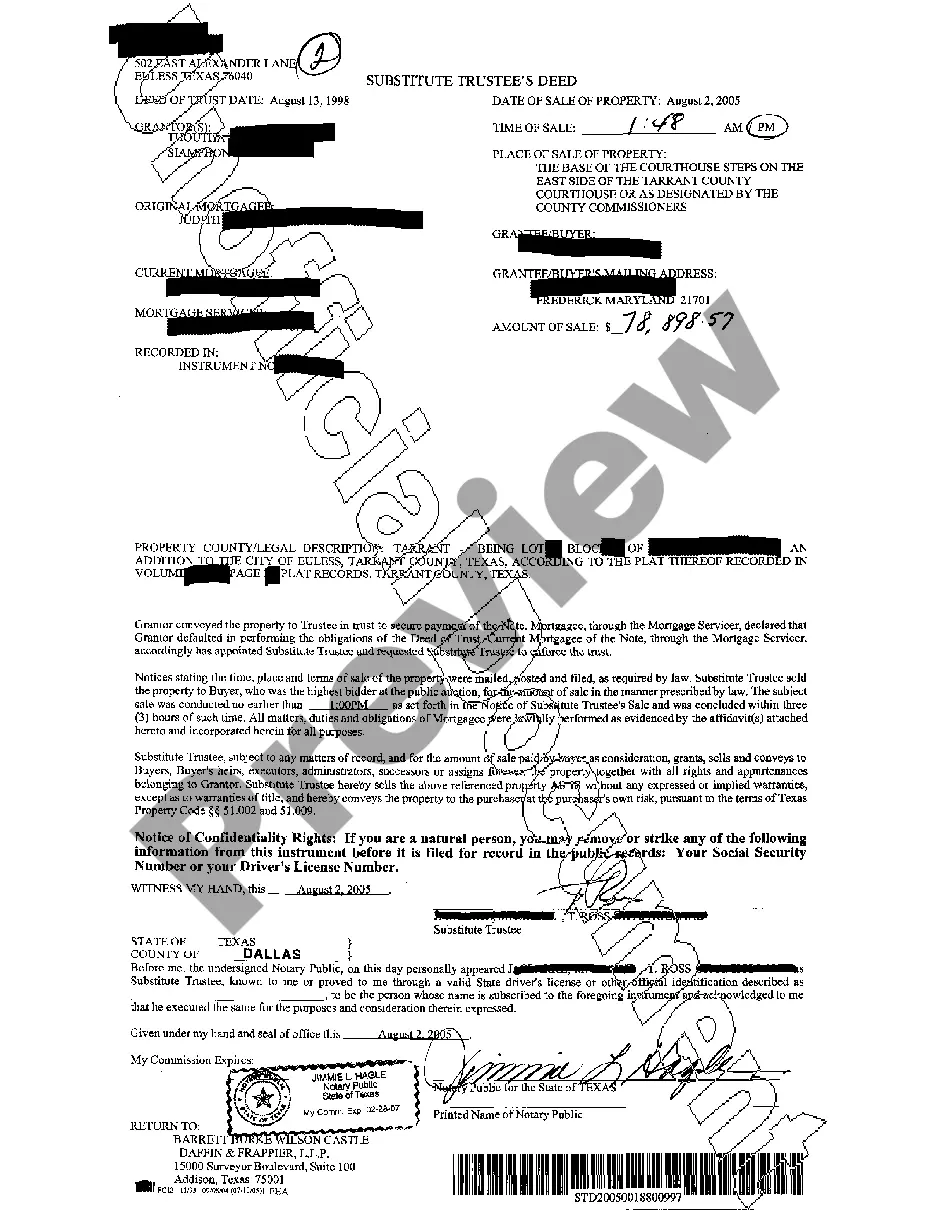

Trustee Deed Of Trust

Description

How to fill out Texas Trustee's Deed?

It’s clear that you cannot become a legal expert right away, nor can you swiftly learn how to draft a Trustee Deed Of Trust without possessing a specialized skill set.

Compiling legal documents is a lengthy task that demands specific education and expertise. So why not entrust the crafting of the Trustee Deed Of Trust to the professionals.

With US Legal Forms, featuring one of the largest legal template collections, you can find anything from court papers to in-office communication formats.

You can access your documents from the My documents section at any time. If you are a current customer, you can just Log In, and locate and download the template from the same section.

Regardless of the reason for your documentation—whether financial, legal, or personal—our website has you supported. Try US Legal Forms today!

- Access the document you need through the search bar located at the top of the page.

- Preview it (if this option is available) and read the accompanying description to ascertain if the Trustee Deed Of Trust is what you’re looking for.

- If you require a different form, restart your search.

- Sign up for a complimentary account and choose a subscription plan to acquire the template.

- Click Buy now. Once payment is completed, you can download the Trustee Deed Of Trust, complete it, print it, and mail it to the required individuals or organizations.

Form popularity

FAQ

The terms 'trust deed' and 'trustee deed' often create confusion, but they have specific meanings. A trust deed generally refers to the agreement between the investor and the trustee, which outlines how the property is held in trust. Conversely, a trustee deed reflects the actual conveyance of property from the trustee to the new owner, emphasizing the transfer of title.

A trustee's deed is a legal document that conveys property from a trustee to a beneficiary or buyer. This type of deed is crucial in real estate transactions, as it outlines the transfer of ownership in a transparent manner. When discussing a trustee deed of trust, it is important to understand that this deed serves as evidence of the trust's authority to manage the property. Therefore, using platforms like US Legal Forms can help you create a reliable and legally compliant trustee's deed, ensuring smooth property transactions.

You can find a copy of a trust deed through your local county recorder's office or land registry office. Many states also provide online databases where you can search for the trustee deed of trust by entering property details. Additionally, platforms like US Legal Forms offer easy access to various legal documents, including trust deeds, ensuring you have the right information at your fingertips.

What's the distinction between a trustee and a beneficiary in a trust? A beneficiary stands to benefit from the trust's assets, while a trustee is responsible for managing those assets in line with the trust creator's intentions.

This Deed of Trust (the ?Trust Deed?) sets out the terms and conditions upon which: [Settlor Name] (the ?Settlor?), of [Settlor Address], settles that property set out in Schedule A (the ?Property?) upon [Trustee Name] (the ?Trustee?), being a Company duly registered under the laws of [state] with registered number [ ...

A simple example would be the situation in which one member of a family advances money to another and asks the second member to hold the money or to invest it for him. A more complicated example of an implied trust would be the situation in which one party provides money to another for the purchase of property.

Ing to the term of a trust instrument, it can be defined into different types. For example: Inter Vivo trust is created when the settlor is alive. Testamentary trust is usually created through the terms of a settlor's will and goes into effect after the death of the settlor.

Trust Deed Disadvantages You will be unable to obtain credit. ... They are not appropriate for secured obligations. ... They can cause issues for business owners. ... Your trustee has the authority to claim new assets.