Certificate Of Trust For Successor Trustee

Description

How to fill out Texas Affidavit Of Succession Of Trustee?

Legal documentation management can be daunting, even for the most skilled professionals.

When you're seeking a Certificate of Trust for Successor Trustee and lack the time to thoroughly search for the correct and current version, the process can be stressful.

With US Legal Forms, you have the ability to.

Access regional or county-specific legal and corporate documents. US Legal Forms caters to all your requirements, from personal to business paperwork, all in a single platform.

If this is your first experience with US Legal Forms, create an account and enjoy unlimited access to all the benefits of the library. Here are the steps to follow after locating the form you need.

Verify that it is the right document by previewing it and reviewing its details.

Ensure that the template is validated in your state or county.

- Utilize advanced features to prepare and manage your Certificate of Trust for Successor Trustee.

- Tap into a wealth of articles, guidelines, manuals, and resources related to your circumstances and requirements.

- Conserve time and effort in finding the documents you need and use US Legal Forms' sophisticated search and Review tool to locate and download the Certificate of Trust for Successor Trustee.

- If you possess a membership, Log In to the US Legal Forms account, look for the form, and download it.

- Check your My documents tab to see the documents you have previously saved and manage your folders as desired.

Select Buy Now when you are ready.

Choose a subscription option.

Select the file type you need, and Download, fill out, sign, print, and send your documents.

Leverage the US Legal Forms online library, supported by 25 years of expertise and reliability. Streamline your daily document management into a straightforward and user-friendly experience today.

- A powerful online form repository can be a transformative solution for anyone looking to handle these circumstances efficiently.

- US Legal Forms stands as a leader in digital legal documentation, boasting over 85,000 state-specific legal forms available at your convenience.

Form popularity

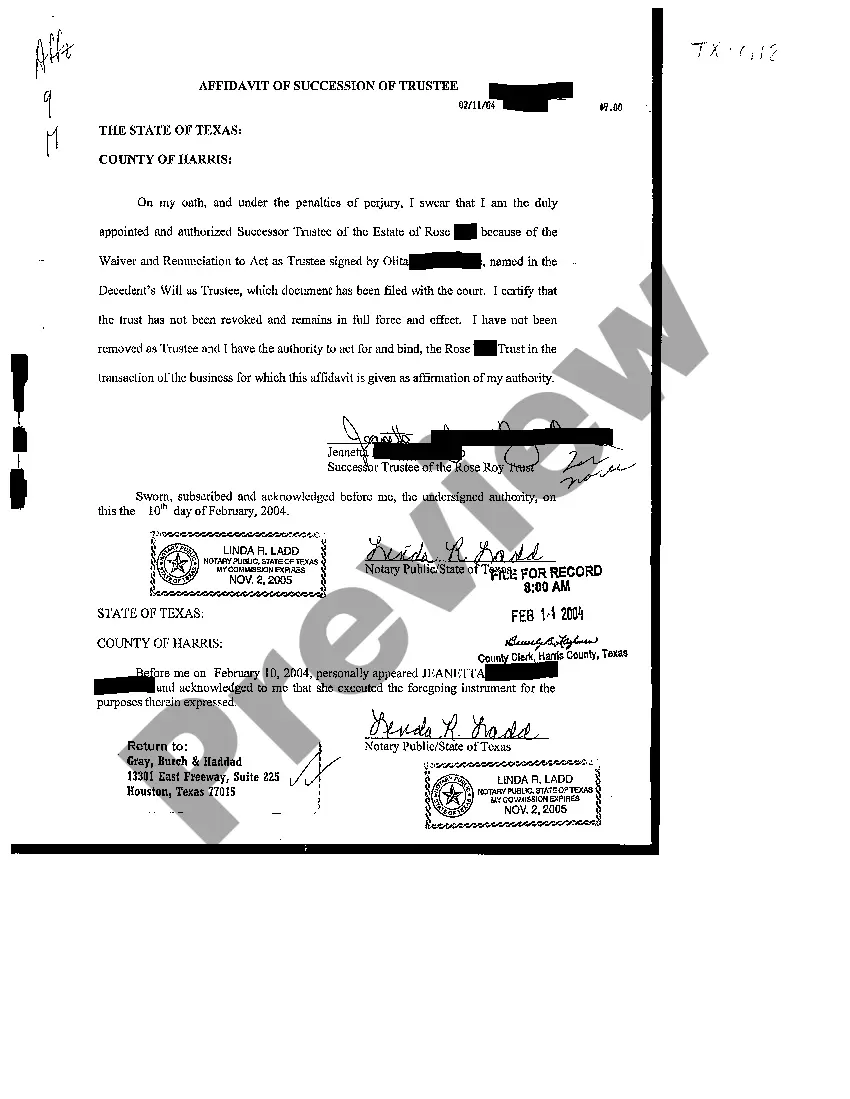

FAQ

A certificate of trust existence and authority shall contain all of the following information: (a) The title of the trust. (b) The date of the trust agreement and any amendments to the trust agreement. (c) The name of the settlor or grantor and the settlor's or grantor's address.

There are three ways to get a certificate of trust made: With a lawyer. An estate planning attorney can draft a certificate of trust for you to accompany your trust. With estate planning software. ... With a state-specific form from a financial institution or notary public.

As long as you are confident that your trust is validly formed in ance with state law, recording is not required nor necessary. However, for extra peace of mind, you may choose to record your Certificate of Trust with the county clerk's office in order to protect it from unauthorized changes or access.

A trustee, who can either be the trustor or another responsible party, may be appointed while the trustor is still alive; a successor trustee is charged with administering a trust after the trustor or the appointed trustee (if they are different from the trustor) becomes incapacitated or dies.