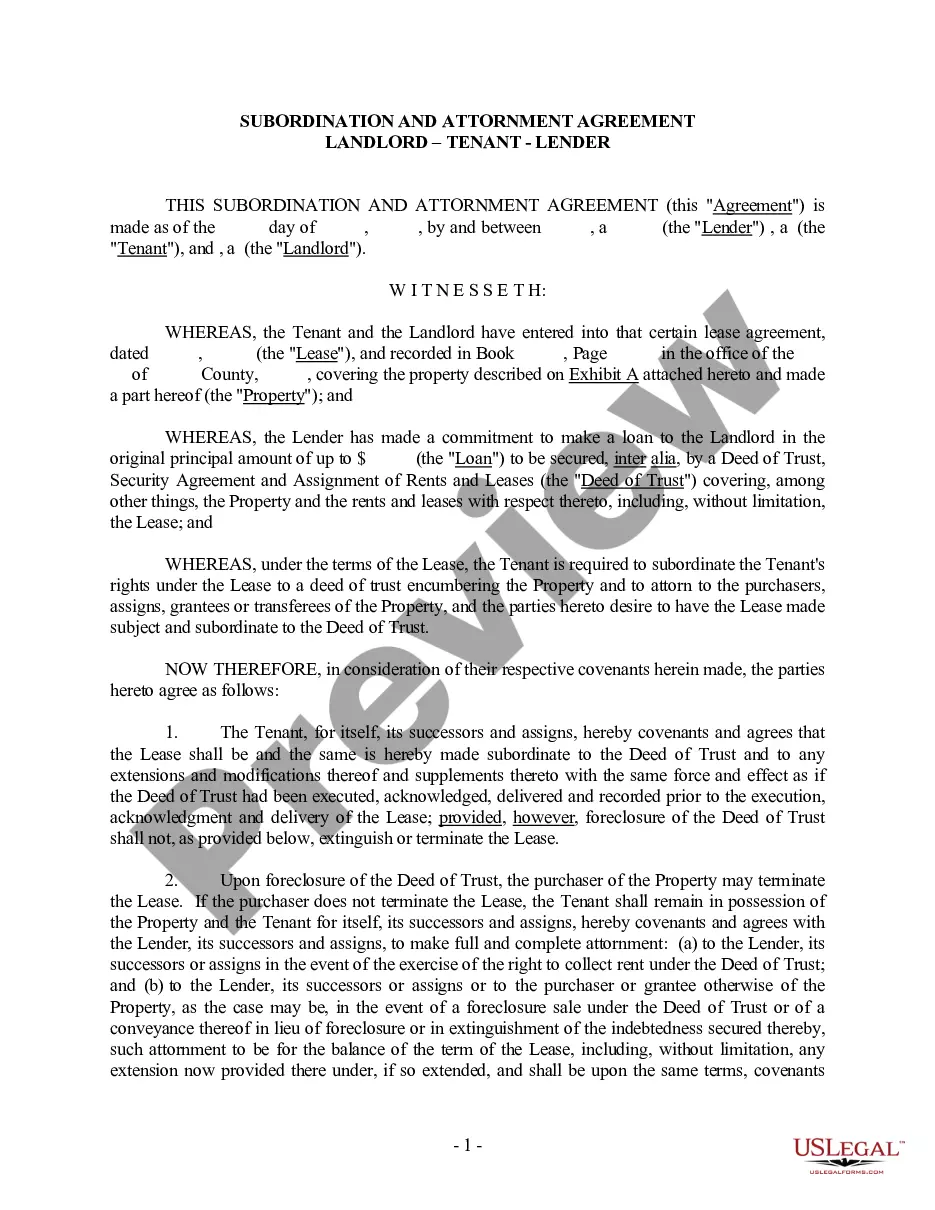

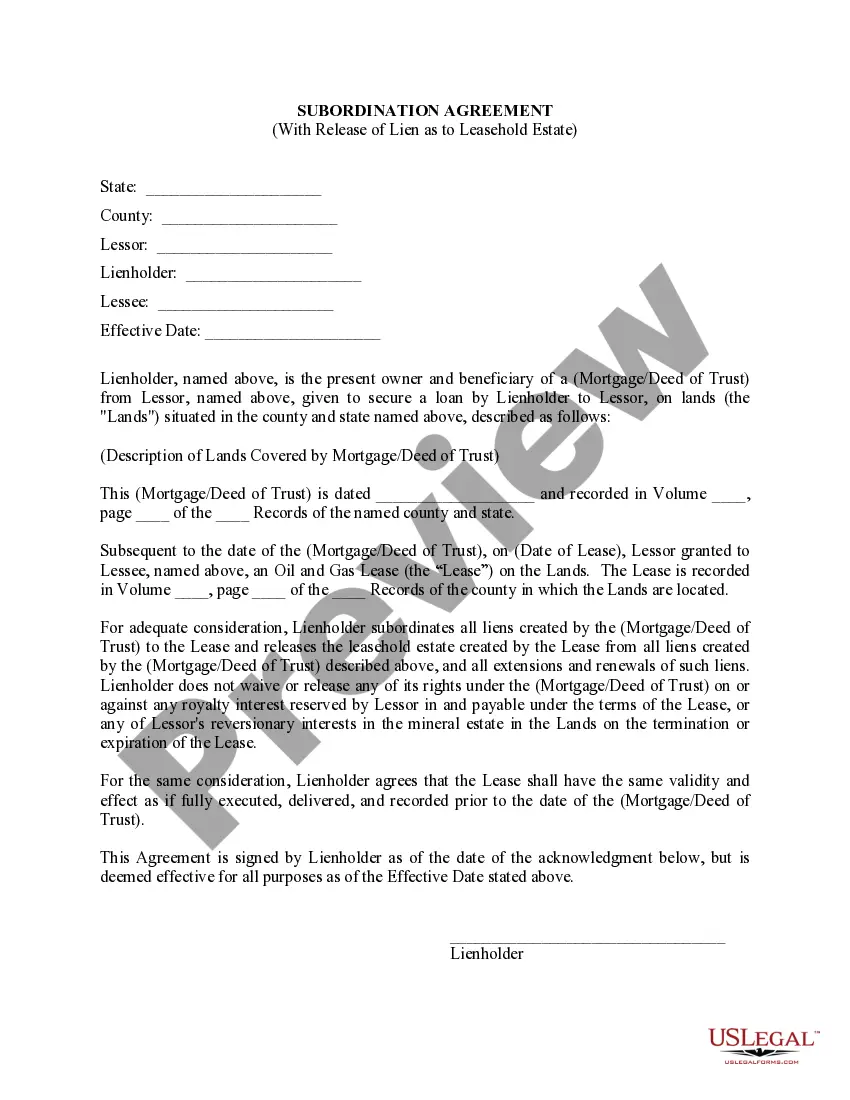

Subordination Agreement Texas Format

Description

How to fill out Texas Lease Subordination Agreement?

The Subordination Agreement Texas Format you see on this page is a reusable formal template drafted by professional lawyers in line with federal and regional laws. For more than 25 years, US Legal Forms has provided individuals, organizations, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the fastest, simplest and most trustworthy way to obtain the paperwork you need, as the service guarantees the highest level of data security and anti-malware protection.

Acquiring this Subordination Agreement Texas Format will take you just a few simple steps:

- Browse for the document you need and review it. Look through the file you searched and preview it or check the form description to ensure it suits your requirements. If it does not, use the search bar to get the right one. Click Buy Now once you have found the template you need.

- Sign up and log in. Select the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to continue.

- Get the fillable template. Choose the format you want for your Subordination Agreement Texas Format (PDF, DOCX, RTF) and save the sample on your device.

- Complete and sign the document. Print out the template to complete it manually. Alternatively, utilize an online multi-functional PDF editor to quickly and precisely fill out and sign your form with a legally-binding] {electronic signature.

- Download your papers again. Make use of the same document again anytime needed. Open the My Forms tab in your profile to redownload any previously purchased forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s scenarios at your disposal.

Form popularity

FAQ

The Subordinated Lender hereby agrees that all Subordinated Obligations (as defined below) and all of his right, title and interest in and to the Subordinated Obligations shall be subordinate and junior in right of payment to the Senior Lender Loan and all rights of Senior Lender in respect of the Senior Lender Loan, ...

A subordination agreement prioritizes debts, ranking one behind another for purposes of collecting repayment from a debtor in the event of foreclosure or bankruptcy. A second-in-line creditor collects only when and if the priority creditor has been fully paid.

Subordination agreements are prepared by your lender. The process occurs internally if you only have one lender. When your mortgage and home equity line or loan have different lenders, both financial institutions work together to draft the necessary paperwork.

Lender and Tenant do hereby covenant and agree that the Lease with all rights, options, liens and charges created thereby, is and shall continue to be subject and subordinate in all respects to the lien created by the First Lien Mortgage, including any renewals, modifications, consolidations, replacements and ...

A subordination agreement prioritizes debts, ranking one behind another for purposes of collecting repayment from a debtor in the event of foreclosure or bankruptcy. A second-in-line creditor collects only when and if the priority creditor has been fully paid.