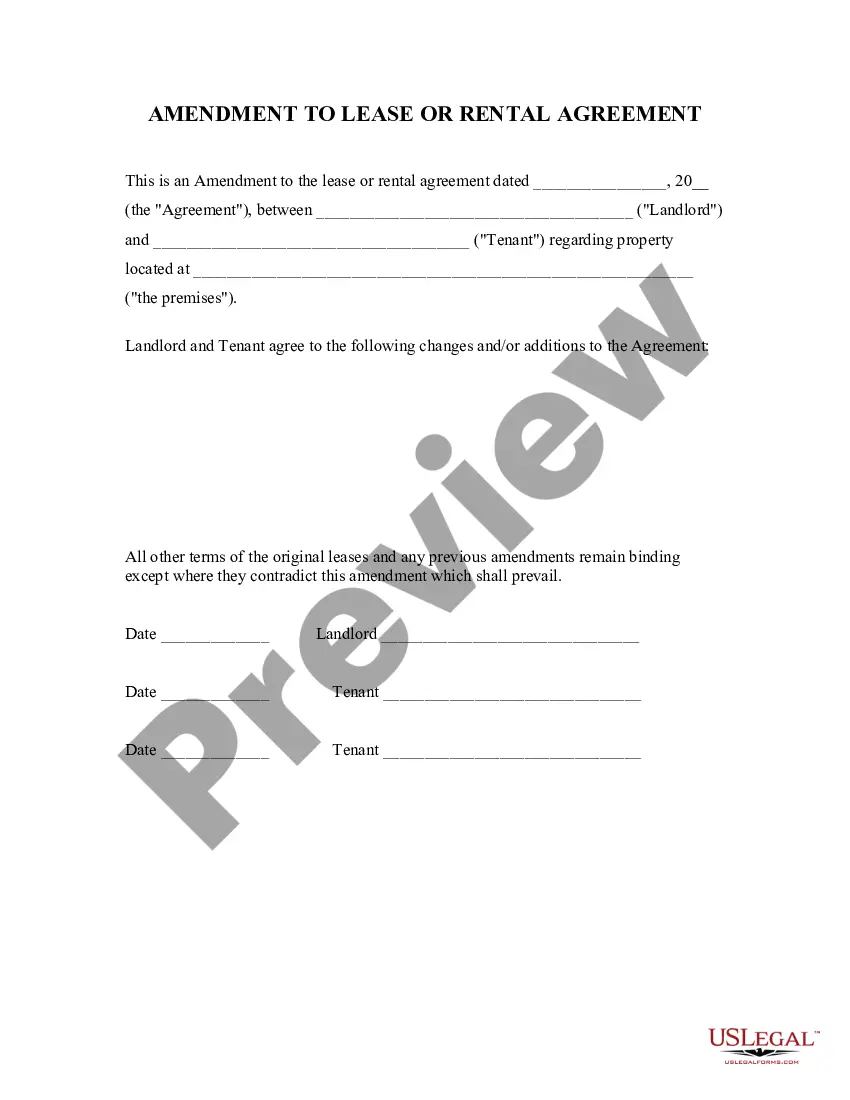

This Amendment to Lease or Rental Agreement form is used to record an agreed change to the terms of the rental agreement. Landlord and Tenant both sign the form, and the Amendment to Lease or Rental Agreement should detail what changes are being agreed upon. It is always wise to get these agreements in writing, because if it is only a spoken agreement, and there is a dispute later, the original written agreement will probably prevail over any subsequent oral agreement.

Rental Protheus

Description

How to fill out Texas Amendment To Lease Or Rental Agreement?

- Log in to your account if you're a returning user to access your documents. Ensure your subscription is active to download the required templates.

- If you're new, start by previewing form descriptions to find the correct legal document that fits your specific needs and complies with local regulations.

- Utilize the Search tab to find alternative templates if necessary, ensuring you choose the most suitable document.

- Select the form you want, then click the Buy Now button. Choose a subscription plan that best serves your requirements and create an account to unlock the library.

- Complete your purchase using your credit card or PayPal to finalize your subscription.

- Finally, download your selected document to your device and access it anytime via the My Forms menu in your profile.

Using Rental Protheus simplifies the document acquisition process and helps you generate legally sound, editable forms with ease. By following these steps, you'll take full advantage of the robust capabilities offered.

Ready to streamline your legal document needs? Start using Rental Protheus today and experience the benefits of US Legal Forms!

Form popularity

FAQ

To fill out a rental verification form, include the tenant's history, payment record, and any lease-related details. Rental protheus offers customizable templates to streamline this task, ensuring you capture all necessary information accurately. This efficient approach helps maintain a professional relationship with tenants and prospective landlords.

Filling out an apartment inspection form involves checking for issues such as cleanliness, safety hazards, and any damages before tenants move in or out. Rental protheus provides templates that guide you through the inspection process step by step. You can easily document your findings and keep records organized.

You do not have to file Form 4562 every year for your rental property unless you're claiming depreciation on new assets. Rental protheus can assist you in identifying when it is necessary to file this form. By analyzing your property’s financial situation, our platform ensures you remain compliant without unnecessary filings.

Rental properties are generally reported on Schedule E, especially if you rent them out part-time or full-time. However, if you are in the business of renting properties, you might consider Schedule C. Rental protheus guides you in determining the right schedule for your specific rental situation, making compliance simpler.

To prepare for taxes on your rental property, you will need to gather documentation such as your rental income, expense receipts, and any related mortgage information. Using rental protheus can help you organize these documents and ensure you capture all deductions. This comprehensive approach can result in significant savings come tax time.

For rental properties, you typically need to fill out Form 1040 Schedule E to report your rental income and expenses. Rental protheus can simplify this process by providing you with easy access to all necessary forms and guidelines. You can efficiently manage your rental property paperwork through our user-friendly platform.

For foreigners, rental income generated in the US is subject to taxation, and you must report it to the IRS. Generally, this income is taxed at a flat rate of 30%, unless a tax treaty provides for a lower rate. Understanding these tax obligations can be complex, but Rental Protheus offers resources to help foreign property owners navigate US tax laws effectively.

Yes, rental income from overseas property is taxable in the United States. Even if the property is located outside the US, you must report the income on your US tax return. It's crucial to understand the foreign tax regulations that might apply as well, as you may be eligible for certain deductions or credits. Rental Protheus can help clarify the nuances of overseas rental income taxation.

Yes, you do need to declare foreign property to the IRS. The IRS requires US citizens and residents to report their foreign assets and income on specific forms. This includes reporting rental properties owned abroad, ensuring compliance with tax regulations. Utilizing Rental Protheus can guide you through the necessary reporting requirements for foreign property.

To show proof of rental income, you should maintain clear and organized records of all rental transactions. This includes rental agreements, bank statements, and payment receipts. Having these documents readily available will make it easier for you to verify your income when required, whether for tax purposes or mortgage applications. Rental Protheus offers templates that can help you keep your rental records in perfect order.