Lease Guarantor Near Me

Description

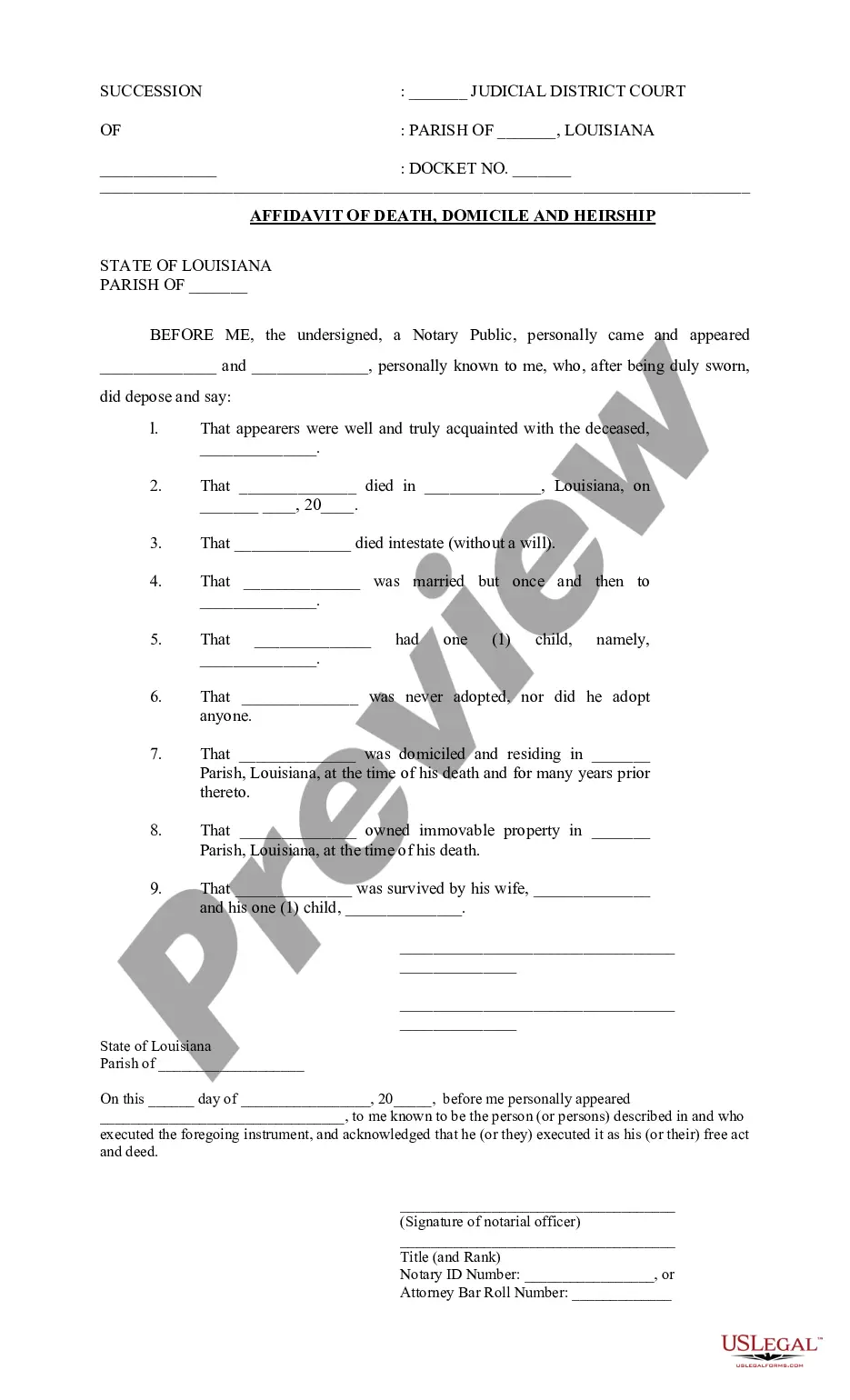

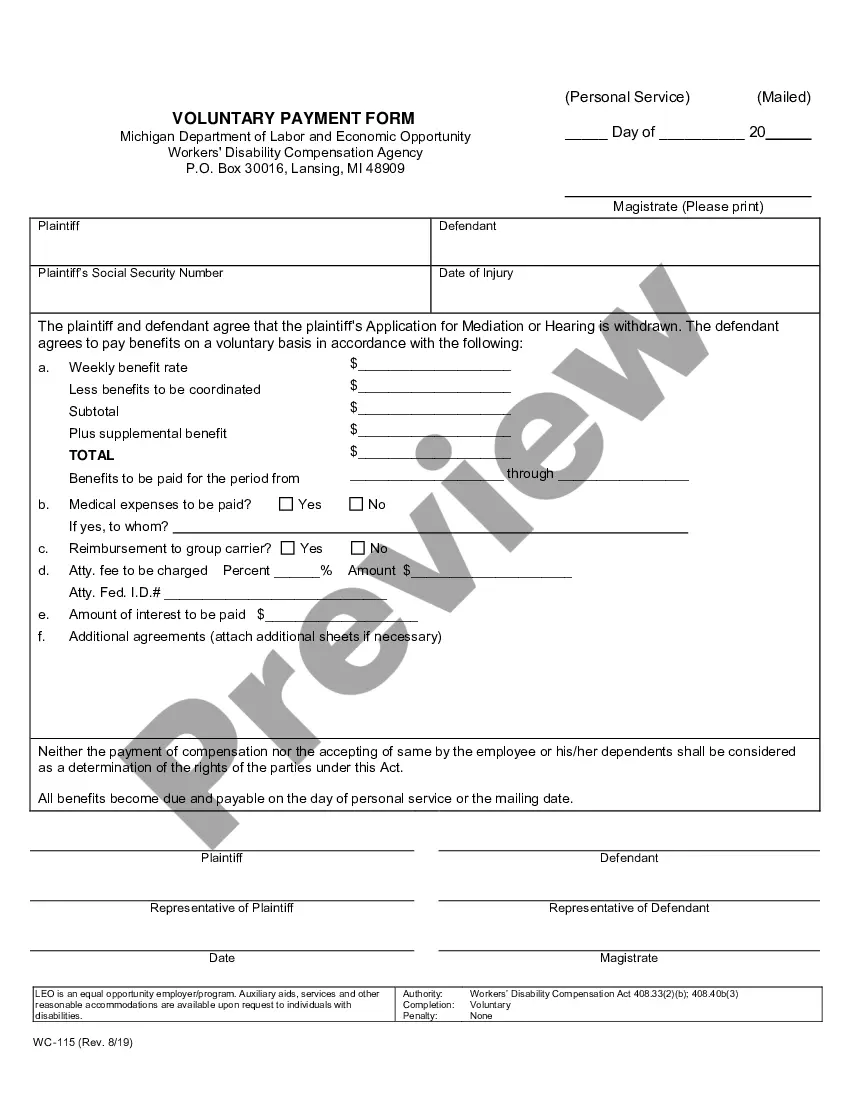

How to fill out Texas Guaranty Attachment To Lease For Guarantor Or Cosigner?

Creating legal documents from the ground up can frequently be daunting.

Certain situations may require extensive research and significant financial investment.

If you're looking for a simpler and more economical method of preparing Lease Guarantor Near Me or any other documents without unnecessary hurdles, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal forms covers nearly every aspect of your financial, legal, and personal matters.

Review the form preview and descriptions to confirm that you are on the correct form. Ensure the form you select meets the criteria of your state and county. Select the appropriate subscription plan to acquire the Lease Guarantor Near Me. Download the form, then complete, sign, and print it. US Legal Forms has a strong reputation and over 25 years of experience. Join us now and make form completion a seamless and straightforward process!

- With just a few clicks, you can swiftly obtain state- and county-specific forms meticulously assembled for you by our legal experts.

- Utilize our platform whenever you need dependable and trustworthy services to quickly find and download the Lease Guarantor Near Me.

- If you are familiar with our services and have previously set up an account with us, simply Log In to your account, select the form, and download it or re-download it anytime from the My documents section.

- Not registered yet? No problem. Registering takes minimal time and allows you to browse the catalog.

- Before proceeding to download Lease Guarantor Near Me, adhere to these suggestions.

Form popularity

FAQ

Help from your local council or a local charity It may be worth contacting your local council to see if they can help you. They may be able to: help you pay rent in advance and a deposit; or. offer you a guarantor service.

The primary difference between a co-signer and a guarantor is how soon each individual becomes responsible for the borrower's debt. A co-signer is responsible for every payment that a borrower misses. However, a guarantor only assumes responsibility if the borrower falls into total default.

Guarantors are typically needed if you have a thin credit file, poor credit, or are considered low income. It's very normal to need a guarantor when applying for a flat if you are: Moving into your own flat for the first time, or otherwise have no credit or low credit. Unemployed, and sometimes if you're self employed.

Ask someone with whom you have a strong relationship and who trusts you. Your guarantor must be willing to sign the lease agreement and go through the screening process. You'll want to know if they pay their bills on time. It's essential to know they are responsible before you ask them to be a guarantor.

Before you become a guarantor, the lender will carry out a credit check on you. However, this is normally a 'soft' credit search. Soft credit searches aren't visible to other companies and won't affect your credit score. If the borrower keeps up their repayments your credit score won't be affected.