Texas Rent Pay For

Description

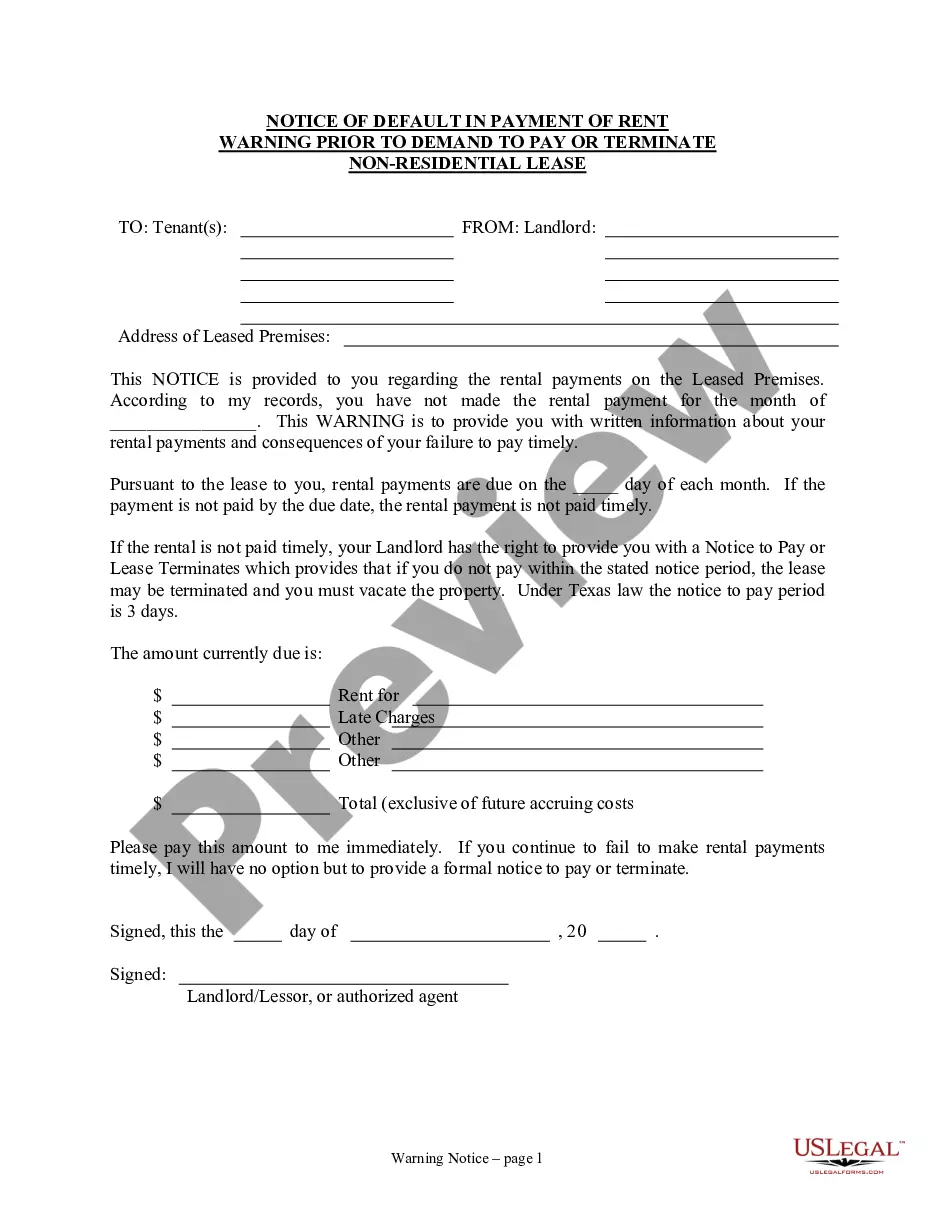

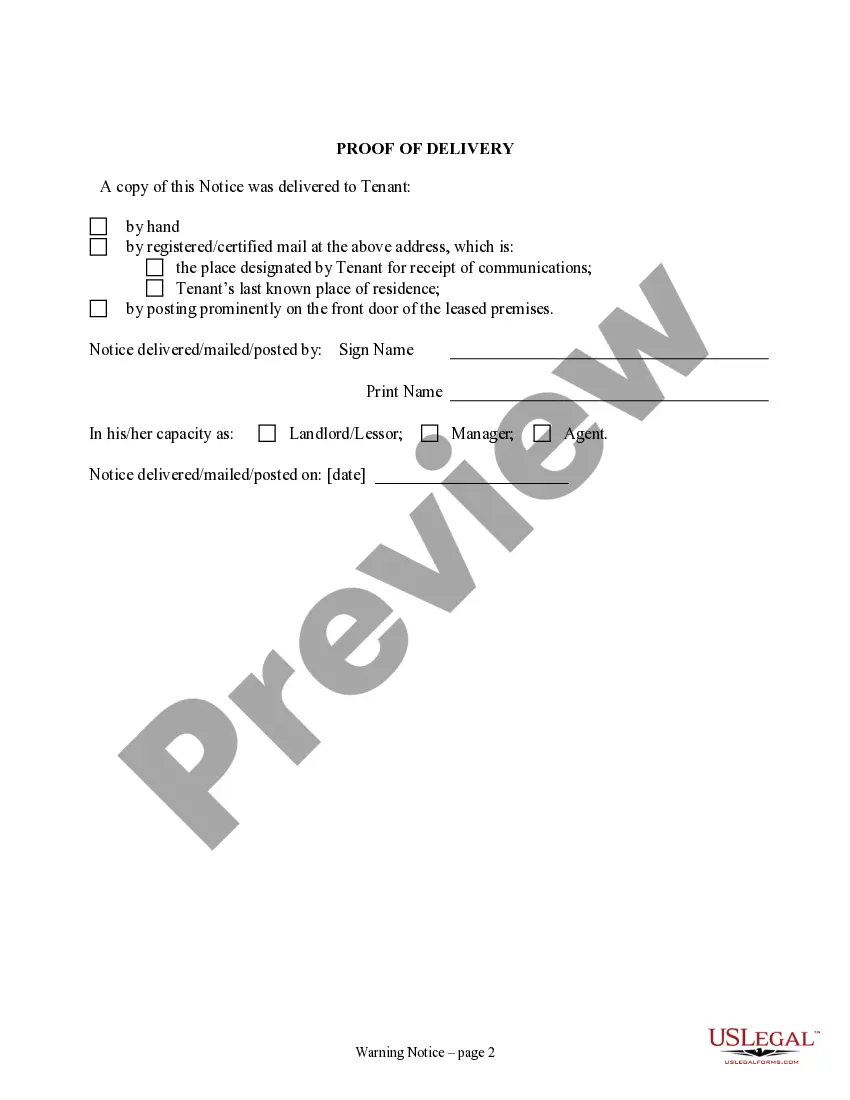

How to fill out Texas Notice Of Default In Payment Of Rent As Warning Prior To Demand To Pay Or Terminate For Nonresidential Or Commercial Property?

The Texas Rent Payment Template you see on this page is a reusable legal document created by expert attorneys in compliance with federal and local statutes and guidelines.

For over 25 years, US Legal Forms has offered individuals, businesses, and legal practitioners with more than 85,000 authenticated, state-specific documents for any commercial and personal need. It’s the fastest, easiest, and most reliable method to acquire the forms you require, as the service ensures the highest level of data protection and malware prevention.

Enroll in US Legal Forms to have verified legal templates for all of life’s situations available to you.

- Search for the document you require and examine it.

- Browse through the sample you searched and preview it or review the form description to verify it meets your needs. If it doesn’t, utilize the search feature to find the suitable one. Click Buy Now when you have found the template you need.

- Register and Log In.

- Select the pricing option that best fits your needs and set up an account. Use PayPal or a credit card for a swift payment. If you already have an account, Log In and check your subscription to proceed.

- Obtain the editable template.

- Choose the format you desire for your Texas Rent Payment Template (PDF, Word, RTF) and save the document on your device.

- Complete and sign the document.

- Print the template to fill it out manually. Alternatively, use an online versatile PDF editor to swiftly and accurately complete and sign your form with a valid signature.

- Re-download your documentation as needed.

- Utilize the same document again whenever necessary. Access the My documents tab in your profile to re-download any previously obtained documents.

Form popularity

FAQ

Income limits for housing assistance in Texas can vary depending on family size and program type. Generally, households must earn less than 80% of the area median income to qualify for assistance. It’s crucial to review specific limits that apply to your region or program of interest. For comprehensive guidance on income limits and application assistance, US Legal Forms can prove to be a valuable resource.

Housing assistance in Texas primarily benefits low-income individuals and families. To qualify, applicants must meet income guidelines and demonstrate a need for financial support to secure stable housing. Special consideration is often given to vulnerable populations, including the elderly and disabled. For detailed eligibility criteria, it's helpful to consult resources like US Legal Forms.

Several factors may disqualify someone from receiving housing assistance in Texas. Issues such as prior evictions, criminal history, or substantial income can bar eligibility. Additionally, failure to provide necessary documentation or meet program requirements can lead to disqualification. Understanding these factors can help you prepare better, making platforms like US Legal Forms invaluable for ensuring adherence to application guidelines.

Yes, Texas continues to offer rent relief programs aimed at assisting those in need. The state has various resources to support individuals and families facing hardships. It’s advisable to visit official state websites or services like uslegalforms to navigate available options and apply effectively.

File a personal injury lawsuit: In Hawaii, you have two years from the date of the accident to file a lawsuit for compensation. Filing the suit may press the insurance company to make a better settlement offer before going to trial, which is the riskier option.

Filing fees generally are not more than $250. You may also need to pay a small fee for serving the defendant. If you win your case, you can usually have the defendants pay for your court costs. If you pay the filing fee, you can apply to have your fee waived.

To file a claim, you must do the following: Visit the Small Claims Court clerk at the main Small Claims Court for Honolulu at 1111 Alakea Street (corner of Alakea and Hotel Streets), Honolulu, Hawaii or call at (808) 538-5151. The place the dispute started. Have the sheriff serve the notice to each defendant.

The Small Claims Court hears your case if: The amount disputed doesn't exceed $5,000. Or, in a counterclaim, no more than $40,000 is requested. Claims up to $40,000 are heard by the Regular Claims Division.

How do I start my Small Claims or Commercial Small Claims case? You or someone else may start your case by filling out a Complaint Form (DC-283). The Complaint Form describes your claim to the Court. You may file by mail or you may file in person at one of the District Court courthouses.