3 Day Notice To Vacate Texas Example

Description

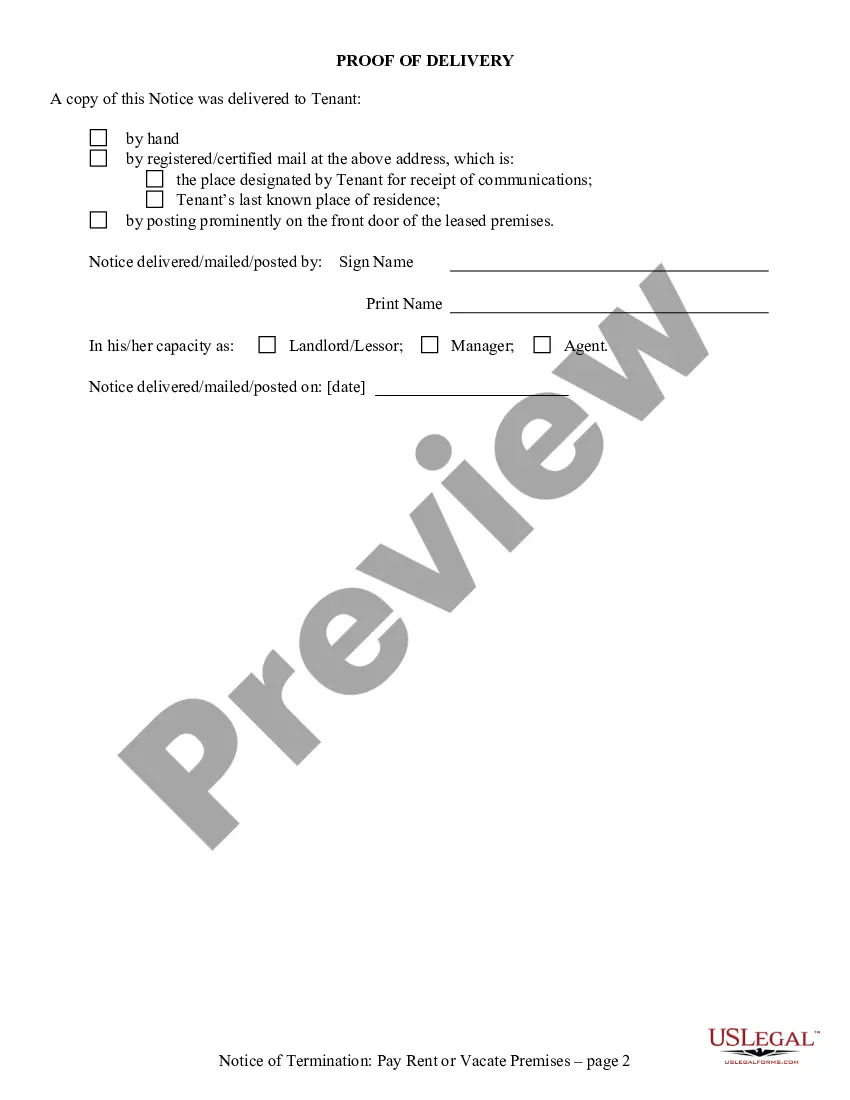

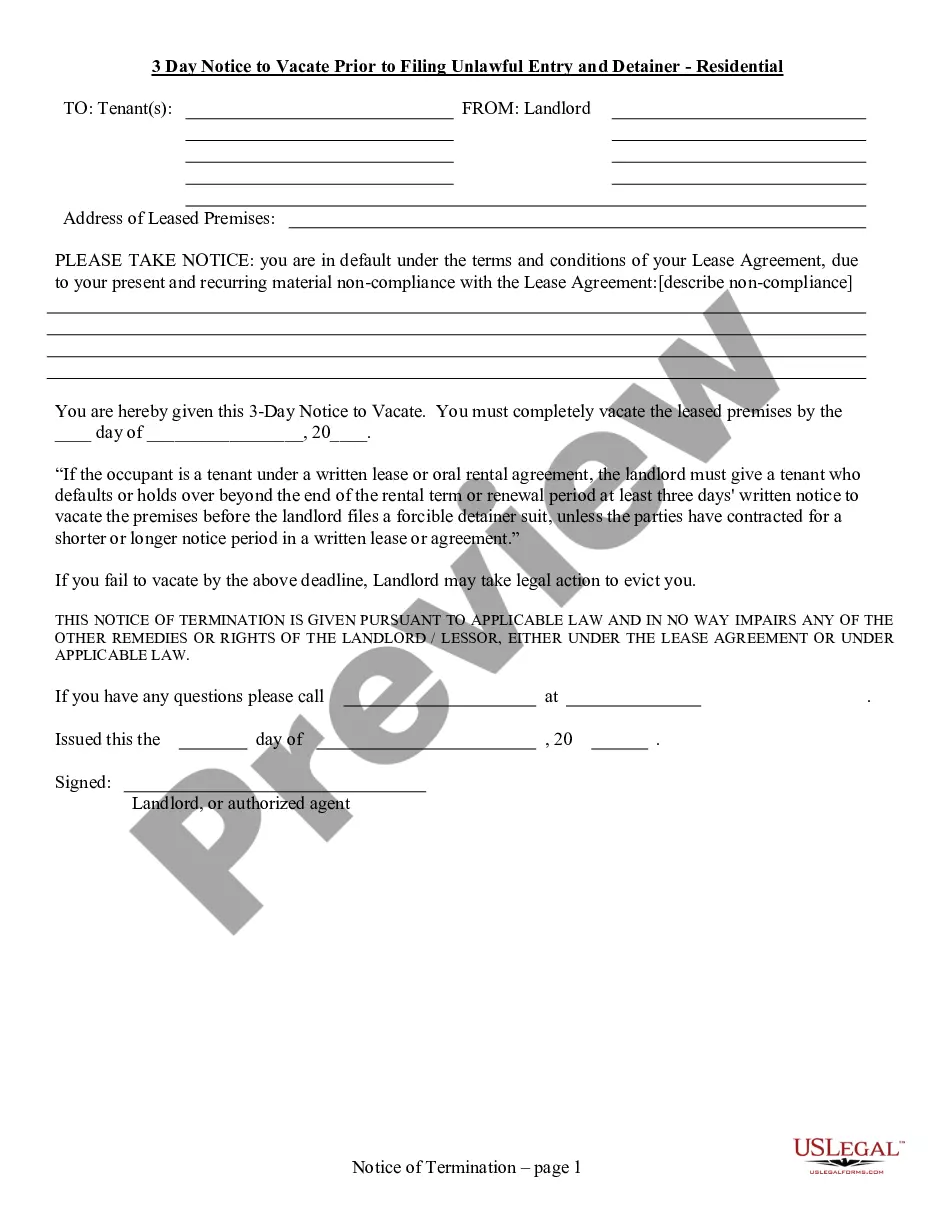

How to fill out Texas 3 Day Notice To Pay Rent Or Vacate (Prior To Filing Unlawful Entry And Detainer) - Residential?

Whether for commercial reasons or personal matters, everyone must navigate legal situations at some point in their lives.

Completing legal documents requires meticulous care, beginning with choosing the correct template.

Once it is downloaded, you can fill out the form using editing software or print it and complete it by hand.

- For example, if you select an incorrect version of a 3 Day Notice To Vacate Texas Example, it will be denied once submitted.

- Thus, it is crucial to have a reliable source of legal documents like US Legal Forms.

- If you need to acquire a 3 Day Notice To Vacate Texas Example template, follow these straightforward steps.

- Obtain the sample you require using the search bar or catalog browsing.

- Review the form’s details to verify it fits your circumstances, state, and area.

- Click on the form’s preview to inspect it.

- If it is the wrong form, return to the search functionality to find the 3 Day Notice To Vacate Texas Example sample you need.

- Download the file if it aligns with your criteria.

- If you already possess a US Legal Forms account, just click Log in to access previously saved documents in My documents.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Select the appropriate pricing choice.

- Complete the account registration form.

- Choose your payment option: utilize a credit card or PayPal account.

- Select the document format you prefer and download the 3 Day Notice To Vacate Texas Example.

Form popularity

FAQ

How to File an Oregon Notice of Right to Lien Name of the property owner and complete mailing address of the property. Your full name and address. Name of the person who hired you to contribute to the construction project. Date you mailed the Right to Lien / Intent to Lien form.

In Oregon, construction liens generally need to be recorded within 75 days from the date the project was substantially completed, or 75 days from the date that the lien claimant stopped providing labor, material, equipment, or services, whichever hap- pened first.

Section 87.035 - Perfecting lien; filing claim of lien; contents of claim (1) Every person claiming a lien created under ORS 87.010(1) or (2) shall perfect the lien not later than 75 days after the person has ceased to provide labor, rent equipment or furnish materials or 75 days after completion of construction, ...

Common Types of Liens in Oregon Tax Liens. Judgment Liens. Mortgage Liens. Mechanics' Liens.

Statute of Limitation on Tax Collection However, the statute of 10 years limitation on judgment liens begins to run on a tax lien as soon as the tax warrant is filed pursuant to ORS 314.430. Such lien may be renewed by court order without loss of priority.

Ann. §§ 87.001 through 87.093 constitute Oregon's construction lien law (the Lien Law). The Lien Law gives suppliers of labor, material, professional services, and rental equipment a means of securing their right to be paid for their contribution to, or work on, a construction project.

In Oregon, construction liens generally need to be recorded within 75 days from the date the project was substantially completed, or 75 days from the date that the lien claimant stopped providing labor, material, equipment, or services, whichever hap- pened first.

How to File a Mechanic's Lien in Oregon ? Step-By-Step Guide Step 1: Determine if you have the right to file a lien. Step 2: Send notice of right to lien. Step 3: Prepare the lien document. Step 4: File the lien. Step 5: Send notice of lien. Step 6: Secure payment. Step 7: Release the lien.