Third Party Financing With Carvana

Description

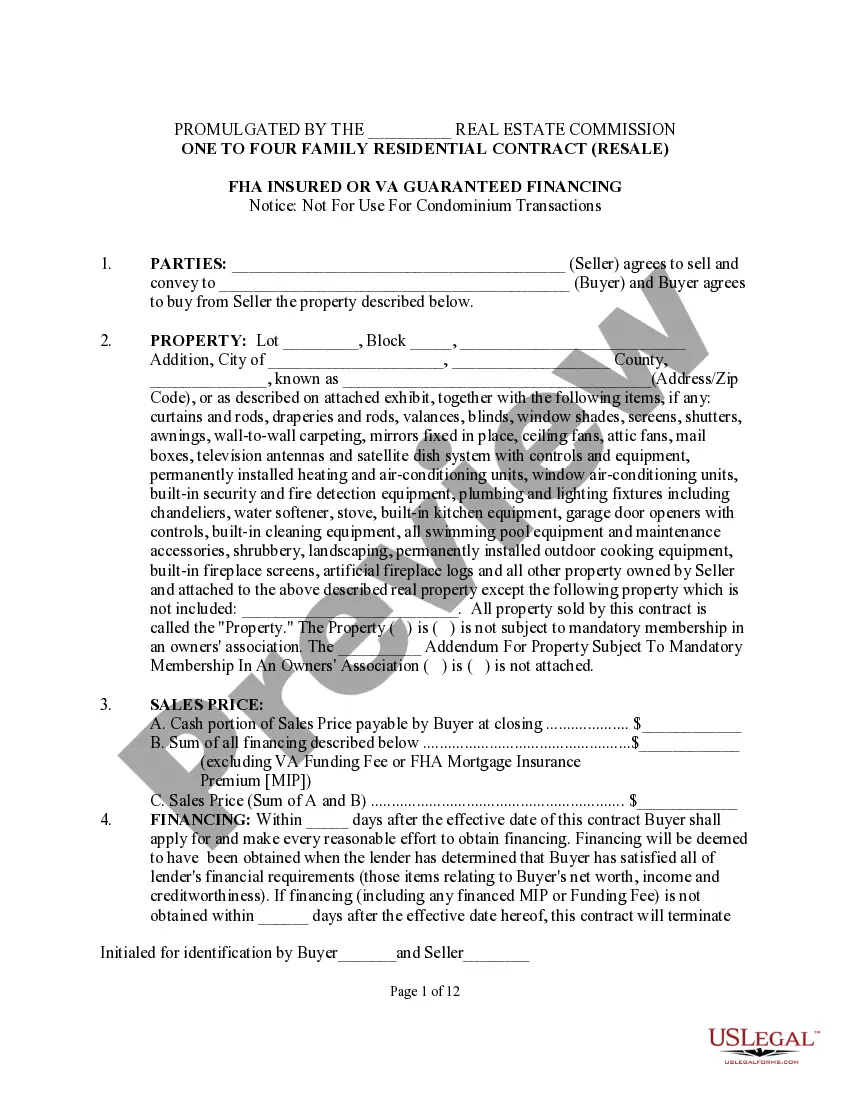

How to fill out Texas One To Four Family Residential Contract - Resale - All Cash, Assumption, Third Party Conventional Or Seller Financing?

- Start by logging in to your account if you're an existing user. Ensure your subscription is up to date and click the Download button for your desired form template.

- For first-time users, select the appropriate form by reviewing the preview mode and form description to confirm it meets your needs and jurisdiction requirements.

- If the available templates don't meet your criteria, utilize the Search tab to explore other options until you find the suitable one.

- Once you’ve found the right document, click on the Buy Now button to select your preferred subscription plan. Make sure to create an account to access the document library.

- Complete your purchase by entering your credit card information or selecting your PayPal account to finalize the subscription.

- Download your form directly to your device, and you can always access it later from the My Forms menu in your profile.

US Legal Forms offers a robust collection of over 85,000 legal forms, providing more options than competitors at similar costs. Plus, you can easily fill out and edit these forms according to your specific needs.

In addition to the extensive library, US Legal Forms connects you with premium experts to ensure that your documents are not only complete but also legally sound. Don’t hesitate—explore the benefits of using US Legal Forms today!

Form popularity

FAQ

Yes, you can utilize your own finance company with Carvana. This is a common choice for customers who prefer third party financing with Carvana. Ensure that your finance company is acceptable to Carvana for a smooth transaction.

Carvana generally aims to provide financing options for a wide range of customers. However, approval for financing depends on factors such as credit history and income. If you are considering third party financing with Carvana, reviewing your financial situation can help improve your chances of approval.

One downside to Carvana is that its inventory can be limited compared to traditional dealerships. Additionally, while third party financing with Carvana can be beneficial, it often may involve higher interest rates than other options. Always evaluate your choices thoroughly. Researching your financing options can ensure that you make the best decision for your financial situation.

Absolutely, you can finance through someone else with Carvana. This option falls under third party financing with Carvana and can be a helpful solution if you plan to buy a car for someone else. Just ensure that all necessary information is gathered and that you both understand the financing terms. It can be a straightforward process with the right preparation.

Carvana partners with a variety of finance companies to provide its customers with flexible financing options. They collaborate with lenders that offer competitive rates and diverse terms. By using third party financing with Carvana, you can explore various lenders to find one that fits your needs. This network allows Carvana to offer a detailed financing process tailored to your circumstances.

Yes, you can use third party financing with Carvana. When you choose to finance your vehicle through an external lender, Carvana will work with you to ensure a smooth transaction. This option gives you the flexibility to secure financing with terms that suit your financial situation. Utilizing third party financing with Carvana can also help you find competitive rates.

The lienholder on your title is most commonly Bridgecrest if you financed your vehicle through Carvana. This is identified on your vehicle title as the entity that has a security interest in your car. If you have questions about your title or wish to use third party financing with Carvana, reviewing your title can provide clarity.

In most scenarios, Bridgecrest serves as the lienholder when you finance a vehicle purchased through Carvana. Carvana facilitates the transaction, but your financial agreement usually designates Bridgecrest to manage your lien. This setup is important to keep in mind if you are exploring third party financing with Carvana.

The lienholder for Carvana typically depends on the financing arrangement you select. In many cases, Bridgecrest holds the title as the lienholder when you finance your vehicle through Carvana. Understanding the role of the lienholder is essential, especially when you’re considering third party financing with Carvana.